Investor Insight

Pinnacle Silver and Gold presents a compelling investment opportunity in the precious metals sector as it continues to advance its existing projects and pursue new opportunities, offering investors an attractive entry point into the dynamic world of silver and gold exploration.

Overview

As an exploration company focused on silver and gold projects in the Americas, Pinnacle is strategically positioned to capitalize on the growing demand for these valuable resources. The company’s investment appeal stems from several key factors:

- A robust pipeline of projects at various stages of exploration and development

- Strategic focus on high-potential areas in North and South America

- Effective capital management practices

- Aggressive expansion strategy through strategic acquisitions

The company’s business strategy involves the acquisition of past-producing mines that can be put back into production quickly to generate cash flow. By focusing on high-grade, underground mines, Pinnacle can leverage low capex, a smaller operational footprint, easier and faster permitting process and protection against metal price volatility. At the same time, the company conducts brownfield exploration for resource expansion, increasing its potential for district-scale discovery.

Pinnacle’s emphasis on creating shareholder value is evident in its approach to project selection and development. The company’s portfolio is carefully curated to balance near-term production potential with long-term growth prospects, offering investors exposure to both immediate returns and future upside.

Company Highlights

- Pinnacle Silver and Gold is a Canada-based exploration and development company dedicated to building long-term shareholder value with its silver- and gold-focused assets in North and South America.

- The company has built an asset portfolio entirely within mining-friendly jurisdictions with clear legal requirements and regulations that provide confidence in the future of each project.

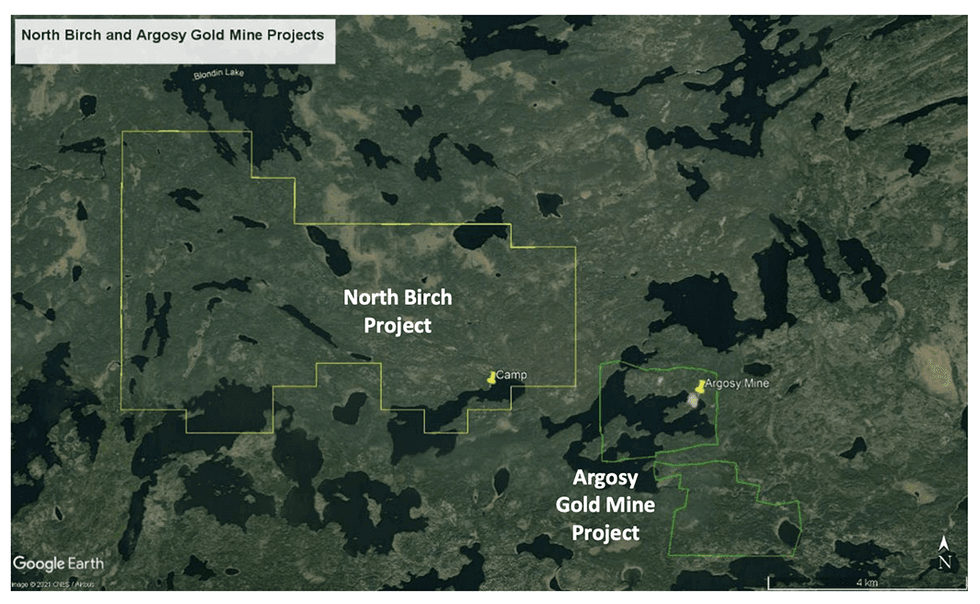

- Both the Argosy Gold Mine and North Birch Project are located in the Red Lake District in Northwestern Ontario, a region famous for gold production.

- The company is led by an impressive management team with decades of experience managing mining companies that operate in the Americas.

Key Projects

Argosy Gold Mine Project

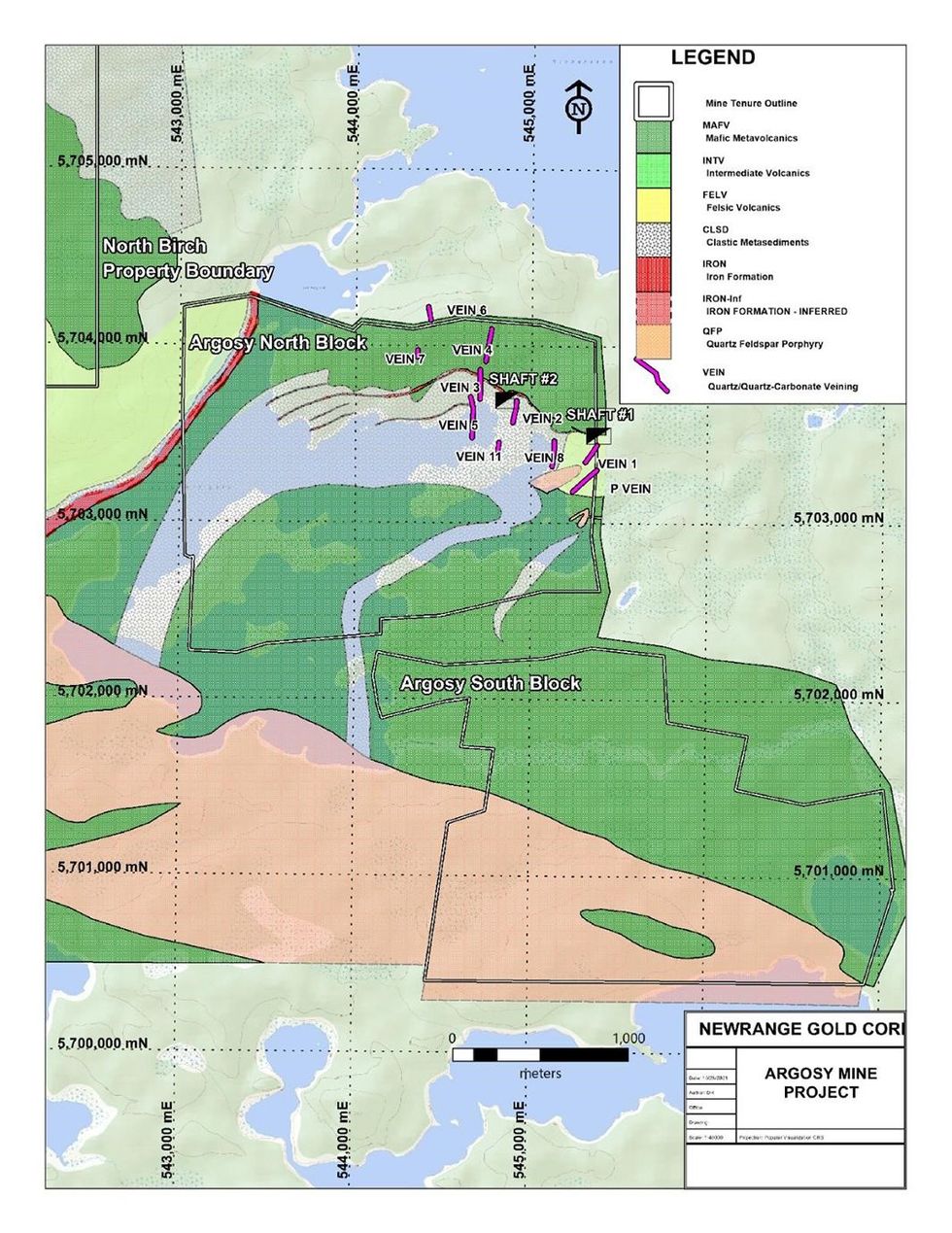

The 100 percent owned Argosy Gold Mine project is located in the northern part of the Birch-Uchi Greenstone Belt of the Superior Province of the Precambrian Shield, and just 10 km northwest of First Mining Gold’s Springpole deposit, which contains 4.7 million ounces of gold in the indicated category. The Birch-Uchi Belt lies between the prolific Red Lake and Pickle Lake Greenstone Belts and contains similar geology. Located 110 kilometres east-northeast of Red Lake, the property hosts the most significant past-producing gold mine in the Birch-Uchi Belt, with 101,875 oz of gold produced at 12.7 grams per ton (g/t) between 1931 and 1952.

Diamond drilling in October 2002 by a previous operator confirmed the extension of the gold mineralization below the old workings with intercepts of 11.75 g/t over 1.55 m and 14.39 g/t over 0.7 m on the Number 2 Vein, 100 m below the old mine development. Additional intercepts of 14.67 g/t over 1.7 m on the Number 3 Vein, and 12.02 g/t over 1.29 m on the Number 8 Vein highlight the potential to build resources on parallel, un-mined veins.

There is exceptional exploration potential on the property and the company is actively expanding its exploration efforts to delineate the full extent of the mineralization.

North Birch Gold Project

The 3,850 hectare, 100 percent owned North Birch gold project lies in the northwestern corner of the Birch-Uchi Greenstone Belt in the Red Lake mining division of northwestern Ontario, roughly 110 km northeast of the town of Red Lake. The Birch-Uchi Belt is considered to have similar geology to the Red Lake Belt but has seen less exploration and is about three times larger. The North Birch project covers a geological setting identified from airborne magnetic surveys and interpreted as a favorable environment for gold mineralization. The property covers an intensely folded and sheared iron formation similar in appearance to the one hosting Newmont Goldcorp’s Musselwhite Mine (past production, reserves and resources exceed 8 million ounces of gold), some 190 kilometers to the northeast. In addition, the stratigraphy underlying the bulk of both properties is interpreted as Cycle I volcanics, which are thought by some workers to be equivalent to the Balmer Assemblage, host of the prolific Campbell/Red Lake gold orebody (more than 20 million ounces of gold in past production and reserves) in the adjacent Red Lake Greenstone Belt.

Located about 4 km from the Argosy Gold Mine, North Birch has undergone minimal previous exploration, making it a largely grassroots prospect. The property covers an interpreted geological setting that is considered to be highly prospective for both iron formation hosted and high-grade quartz vein hosted gold mineralization.

Expansion into Mexico – El Potrero Gold-Silver Project

In a strategic move to diversify its portfolio, Pinnacle has signed a letter of intent for an option to acquire a high-grade El Potrero gold-silver project in the Sierra Madre Trend of Mexico. This expansion underscores the company’s commitment to growth and its ability to identify and secure promising opportunities in key mining jurisdictions.

El Potrero lies within 35 km of four operating mines, including the 4,000 tons-per-day (tpd) Ciénega mine by Fresnillo, Luca Mining’s 1,000 tpd Tahuehueto mine, and the 250 tpd Topia mine owned by Guanajuato Silver. The El Potrero property had undergone small-scale production from 1989 to 1990 and contains a 100 tpd plant that can be refurbished/rebuilt at relatively low cost.

The property hosts a 4 km strike length of a northwest-southeast trending epithermal vein system with high-grade gold and silver mineralization. The veins are brecciated and hosted in andesitic volcanics of the Tertiary Lower Volcanic Series near the contact with the overlying Upper Volcanic Series. Multiple small mines, accessible by adits into the side of the hill, exist along the system and some have been exploited in the 1980’s and possibly before. Vein widths are reported to be in the 0.5 to 10 meter range. Vein textures indicate the mines may be sitting fairly high in the epithermal system implying good potential to extend the mineralization to depth.

Under the terms of the agreement, Pinnacle will earn an initial 50 percent interest immediately upon commencing production. The goal would then be to generate sufficient cash flow with which to further develop the project and increase the company’s ownership to 100 percent subject to a 2 percent NSR. If successful, this approach would be less dilutive for shareholders than relying on the still challenging equity markets to finance the growth of the company.

Management Team

Robert Archer – President and CEO, Director

Robert Archer has more than 40 years’ experience in the mining industry, working throughout the Americas. After spending more than 15 years with major mining companies, Archer held several senior management positions in the junior mining sector and co-founded Great Panther Mining, a mid-tier precious metals producer, where he served as president and CEO from 2004 to 2017 and director until 2020. He joined Pinnacle as a director in March 2018 followed by his appointment as CEO in January 2019 and president in October 2021. Archer is a professional geologist and holds an Honours BSc from Laurentian University in Sudbury, Ontario.

David Cross – CFO

David Cross is a CPA and CGA with over 21 years’ experience in the junior sector with a focus on finance and corporate governance. He is currently a partner of Cross Davis and Company LLP Chartered Professional Accountant, which specializes in accounting and management services for private and publicly listed companies within the mining industry, and has recently been appointed CFO of Ashburton Ventures.

Colin Jones – Independent Director

Colin Jones is principal consultant for Orimco Resource Investment Advisors in Perth, Australia. He has almost 40 years’ experience as a mining, exploration and consulting geologist in a number of different geological environments on all continents. He has managed large exploration and due diligence projects, and has undertaken numerous bankable technical audits, technical valuations, independent expert reports and due diligence studies worldwide, most of which were on behalf of major international resource financing institutions and banks. Jones holds a Bachelor of Science (Earth Sciences) degree from Massey University, NZ.

David Salari – Independent Director

David Salari has worldwide experience in the design, construction and operation of extractive metallurgical plants. He is an engineer with more than 35 years of experience in the mining and mineral processing field. He is currently the president and CEO of DENM Engineering.

Ron Schmitz – Independent Director

Ron Schmitz is the principal and president of ASI Accounting Services, providing administrative, accounting and office services to public and private companies since July 1995. Schmitz has served as a director and/or chief financial officer of various public companies since 1997, and currently holds these positions with various public and private companies.