(TheNewswire)

|

|||||||||

|

|||||||||

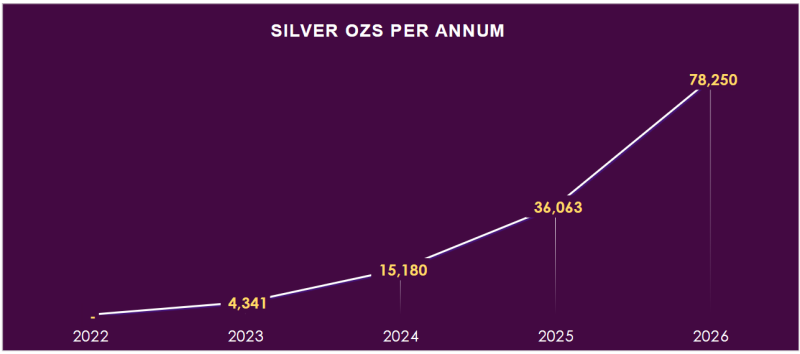

TORONTO, ON, January 10, 202 5 TheNewswire – Silver Crown Royalties Inc. (‘ Silver Crown ‘, ‘ SCRi ‘, the ‘ Corporation ‘, or the ‘ Company ‘) (CBOE:SCRI; OTCQX:SLCRF; FRA:QS0) wishes to provide an update on its 2024 progress and 2025 expectations. Based on minimum silver payment obligations, we anticipate receipt of cash payments on 15,180 ounces of silver for 2024 and 36,063 ounces of silver in 2025 on our royalty portfolio.

Click Image To View Full Size

Silver Crown Royalties Growth Profile

B acTech Environmental Corp. (‘BacTech’)– Bioleaching Facility in Tanquel, Ecuador

In the fourth quarter of 2024 we closed our first all-equity royalty purchase transaction on BacTech’s future bioleaching facility in Tenguel, Ecuador and issued C$1.0 million of units of the Company (‘ Units ‘) at a deemed price of C$10 per Unit at closing. Each Unit consists of one common share in the capital of the company and one warrant entitling the holder thereof to acquire another common share at a price of C$16.00 for a period of 36 months from closing. BacTech is advancing a bioleaching facility in Ecuador with the expectation of first production within the next two years. Upon full deployment of royalty payments (an additional C$3.0 million in common shares at a deemed price of at C$10.00 per common share) BacTech is to deliver 90% of silver produced or 35,000 ounces per year, for a minimum of ten years, whichever is higher.

BacTech continues to make positive advancements regarding its bioleaching initiatives. Early last year BacTech, in collaboration with MIRARCO Mining Innovation, commissioned a bioleaching pilot plant in Sudbury to test bioleaching processes on pyrrhotite tailings, targeting the recovery of nickel, cobalt, and other valuable by-products. The pilot plant has completed baseline campaigns to ensure operational readiness, with full-scale testing planned to commence shortly. BacTech continues to expand its search for historic mine tailings in northern Peru to potentially supply feed for the Ecuador project or establish a base for a new plant near Trujillo, in northern Peru.

Gold Mountain – Elk Gold Mine, British Columbia, Canada

At the end of the third quarter of 2024 Silver Crown received the C$124,299 minimum royalty payment from Elk Gold Mining Corp. pursuant to the terms of the royalty agreement dated May 11, 2023. Cash payments delivered to Silver Crown pursuant to the terms of the Royalty Agreement now total C$216,296.

Gold Mountain encountered various financial challenges that reflected ongoing operational issues, including commissioning difficulties and delays that impacted production levels at the Elk Mine. These challenges stemmed from grade control and sampling inefficiencies during ramp-up, resulting in lower-than-forecast ore production. To address these challenges, the Company implemented a series of financial restructuring initiatives, that included issuing additional common shares, converting secured debt, raising additional capital by way of a convertible debenture and restructured secured obligations to improve its financial position.

Winter operations commenced in late November of 2024, with a planned return to normal operations by late February. The first phase of infill drilling, focused on the east bench, has been completed, supported by Phase 1 financing for exploration drilling. Currently, mining is focused on the east face of Pit 1, targeting the 1300 series vein system at surface. Construction of a new crushing and ore sorting system is set to begin by the end of the month, with the sorting system expected to significantly improve grades.

Pilar Gold Inc. – PGDM Mine, Goiás, Brazil

The restart of commercial production at the PGDM Complex was delayed from Q3 2024 to Q1 2025. Accordingly, while Pilar de Goiás Desenvolvimento Mineral Ltda. has acknowledged its obligation to make minimum royalty payments during Q3 2024 and Q4 2024, it has defaulted on its obligation to make its minimum royalty payment in the amount of US$81,536.41 for the quarter ending September 30, 2024 in accordance with the terms of the amended and restated royalty agreement dated April 26, 2024 between Silver Crown and Pilar (the ‘ A&R Royalty Agreement ‘). The Company had previously agreed to forbear on enforcement action under the A&R Royalty Agreement pursuant to a letter forbearance agreement whereby Pilar agreed to release the C$100,000 contained in a segregated cash account to the Company and pay the balance of the Royalty Payment for the third quarter of 2024 and replenish the Segregated Cash Account no later than December 31, 2024. However, Pilar failed to pay the balance of the Royalty Payment for the third quarter of 2024 and failed to replenish the Segregated Cash Account on December 31, 2024.

Silver Crown will work in good faith with Pilar to cure the ongoing default and provide a further update to the market as soon as possible.

PPX Mining Corp. – Igor 4 project, Peru

During the fourth quarter in 2024 Silver Crown announced the signing of a definitive royalty agreement for up to 15% of the cash equivalent of silver produced from the Igor 4 project in Peru for an aggregate of US$2.5 million in cash. The first tranche of US$1.0 million is to be paid on closing which is expected to occur in early 2025, with the second tranche of US$1.5 million to be paid within six months of Closing. The Royalty will be payable immediately based on current operations at the Project and, beginning on and from the earlier of October 1, 2025 and the startup of metallurgical operations at the 250 tpd CIL and flotation plant currently under construction, will provide for minimum deliveries of the cash equivalent of 14,062.5 ounces of silver per quarter up to a total of 225,000 ounces. Upon the closing of the second tranche, and upon the delivery of the cash equivalent of an aggregate of 225,000 ounces of silver to Silver Crown, the Royalty will automatically terminate. PPX intends to use the proceeds from the sale of the Royalty together with other sources of financing to complete the construction of the Beneficiation Plan.

Peter Bures, Silver Crown’s Chief Executive Officer commented, ‘We are very pleased to continue our collaboration with PPX and are excited about the opportunities the new year will bring. We have great faith in the company as skilled operators and are happy to support them in achieving their production milestones. We continue to be encouraged with progress at GMTN. Although we are disappointed by the non-payment of the PDGM royalty, we note the minimal impact (~C$14,000) to Silver Crown’s revenues to date as we have set up internal protection against such an eventuality. In the meantime, we have been able to identify numerous opportunities to grow our revenue and will continue to advance such opportunities.’

ABOUT Silver Crown Royalties INC.

Founded by industry veterans, SCRi is a publicly traded, silver royalty company. SCRi currently has four silver royalties of which three are revenue-generating. Its business model presents investors with precious metals exposure allowing for a natural hedge against currency devaluation while minimizing the negative impact of cost inflation associated with production. SCRi endeavors to minimize the economic impact on mining projects while maximizing returns for shareholders.

For further information, please contact:

Silver Crown Royalties Inc.

Peter Bures

Chairman and CEO

Telephone: (416) 481-1744

Email: pbures@silvercrownroyalties.com

FORWARD-LOOKING STATEMENTS

This release contains certain ‘forward looking statements’ and certain ‘forward-looking information’ as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as ‘may’, ‘will’, ‘should’, ‘expect’, ‘intend’, ‘estimate’, ‘anticipate’, ‘believe’, ‘continue’, ‘plans’ or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes. Forward-looking statements and information include but are not limited to statements with respect to SCRi’s ability to achieve its strategic objectives in the future and its ability to target additional operational silver-producing projects. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual actions, events or results to be materially different from those expressed or implied by such forward-looking information, including but not limited to: the impact of general business and economic conditions; the absence of control over mining operations from which SCRi will purchase gold and other metals or from which it will receive royalty payments and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined; accidents, equipment breakdowns, title matters, labor disputes or other unanticipated difficulties or interruptions in operations; SCRi’s ability to enter into definitive agreements and close proposed royalty transactions; the inherent uncertainties related to the valuations ascribed by SCRi to its royalty interests; problems inherent to the marketability of gold and other metals; the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; industry conditions, including fluctuations in the price of the primary commodities mined at such operations, fluctuations in foreign exchange rates and fluctuations in interest rates; government entities interpreting existing tax legislation or enacting new tax legislation in a way which adversely affects SCRi; stock market volatility; regulatory restrictions; liability, competition, the potential impact of epidemics, pandemics or other public health crises on SCRi’s business, operations and financial condition, loss of key employees. SCRi has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information. SCRi undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available.

This document does not constitute an offer to sell, or a solicitation of an offer to buy, securities of the Company in Canada, the United States or any other jurisdiction. Any such offer to sell or solicitation of an offer to buy the securities described herein will be made only pursuant to subscription documentation between the Company and prospective purchasers. Any such offering will be made in reliance upon exemptions from the prospectus and registration requirements under applicable securities laws, pursuant to a subscription agreement to be entered into by the Company and prospective investors. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements.

CBOE CANADA DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

Copyright (c) 2025 TheNewswire – All rights reserved.

News Provided by TheNewsWire via QuoteMedia