BP Silver Corp. (TSXV: BPAG) (‘BP Silver‘ or the ‘Company‘) announces assay results (‘Assays‘) from the first two drill holes of its eleven-hole Phase I drill program (the ‘Program‘) at the Cosuño Silver Project (‘Cosuño‘) in Bolivia. The Company expects to release assays from the remaining nine drill holes over the coming weeks. The Company also announces that Dr. Mark Cruise, has been appointed as the Company’s Executive Chair.

Dr. Stewart D. Redwood, Director and Qualifying Person stated, ‘Cosuño is a 10.5 square kilometer zone of alteration. The Program tested only four targets in the southern portion of Cosuño, selected as initial targets because they were outcropping. We expect there to be many more hidden targets as most of the area is covered by surficial overburden. We are literally scraping the surface with two short holes into this extensive system, and it is very significant that Cosuño’s lithocap is mineralized as lithocaps are usually barren.’

Dr. Redwood continued, ‘We expect Cosuño’s grades to increase when we drill deeper into and below the lithocap. Lithocaps are extensive zones of clay and silica alteration that form in the top part of Bolivian polymetallic vein systems and tin porphyries, similar to those which overlie porphyry copper deposits. The nearest neighbour to Cosuño, in a similar geological setting, the Pulacayo deposit, has a large lithocap that is barren and conceals a major vein that produced 640 million ounces of silver and 200,000 tons each of lead and zinc.’

Key Highlights from Cosuño’s Initial Results

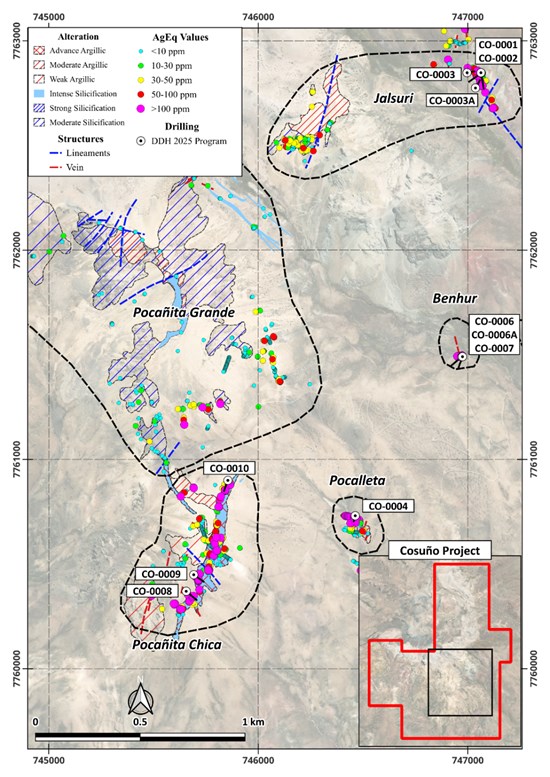

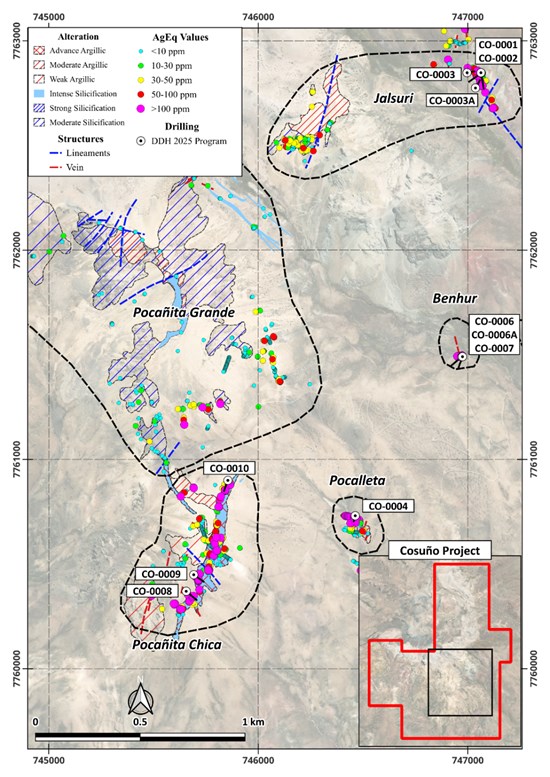

Assays released are from the first two drill holes, Hole CO-0001 and CO-0002, which tested one of four initial surface targets identified within the large ~10.5km2 Cosuño hydrothermal system (Table 1 & Figure 1). The assays demonstrate that silver and gold mineralization identified at surface continues at depth within the lithocap. The results are significant because mineralized Lithocap’s are usually barren in similar Bolivian systems, indicating Cosuño’s potential for further discoveries at depth and in covered areas.

| Hole No |

From m |

To m |

Interval m |

Ag g/t |

Au g/t |

AgEq g/t |

Notes |

| CO-0001 |

23 |

85 |

62 |

38.1 |

0.22 |

56.96 |

Breccia 10.5-39.0 m, 40.5-77.5 m. |

| inc. |

35 |

64 |

29 |

56.03 |

0.28 |

80.03 |

|

| inc. |

35 |

40 |

5 |

97.72 |

0.39 |

131.15 |

|

| And |

48 |

52 |

4 |

114.15 |

0.42 |

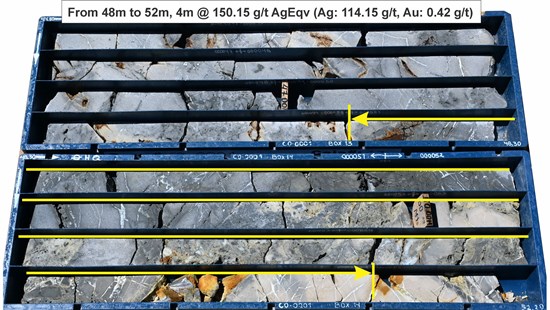

150.15 |

|

| CO-0002 |

41 |

76 |

33 |

23.43 |

0.46 |

62.86 |

Silicified tuff 46.0-83.0 m, Semi-massive sulphides 58.0-72.0 m. |

| inc. |

57 |

60 |

3 |

35.8 |

1.04 |

124.95 |

Au is higher grade in hole CO-0002. |

Table 1: Significant drill intersections in DDH CO-0001 and CO-0002.

Notes to the table:

- Silver equivalent (AgEq) = Ag + (Au * Au price/ Ag price). Assumes a recovery of 100% Ag and 100% Au given the project is early stage and there is no metallurgical test work to date.

- Prices used Au $3431.54/oz, Ag $40.03/oz (London Bullion Market Association 2025 Average)

- Above are core lengths as true widths are not known at this time.

Dr. Redwood commented, ‘The gold grades are higher than expected and over significant widths in the Jalsuri target. These results have achieved one of the objectives of the Phase I drill program which was to confirm that the silver anomalies defined by surface rock sampling continue at depth.’

Cosuño Drill Program Overview

The Program tested four high priority targets defined by structurally controlled, outcropping geochemically anomalous to highly anomalous silver-rich polymetallic zones characterized by silicification, intermediate to advanced argillic alteration, sulfides and brecciation: features typical of many significant Bolivian silver deposits. The targets occur within a large ~10.5 km² hydrothermal alteration system as defined by detailed mapping, geochemical sampling and remote sensing alteration studies.

Figures and additional geological background from the initial program can be found in the Company’s October 21, 2025, and November 14, 2025, news releases. Additional results from remaining nine holes will be released once received by assay labs over the coming weeks.

Detail

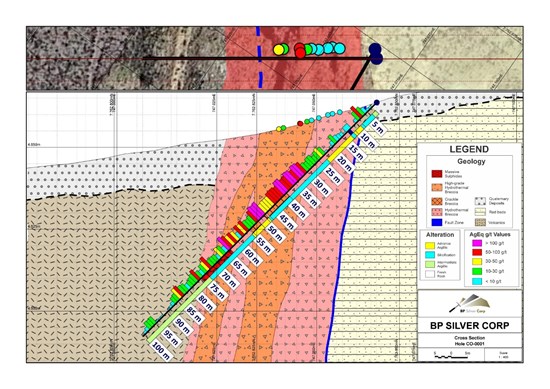

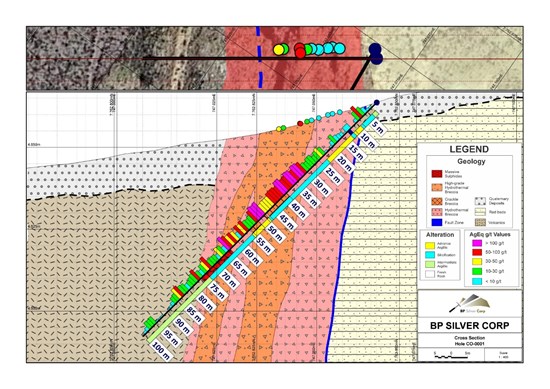

This marks the first drill program completed within the Cosuño Lithocap: Holes CO-0001 and CO-0002 were drilled in the Jalsuri target, a northwest-southeast trending ridge formed by a prominent mineralised structure (Figure 1 and 2).

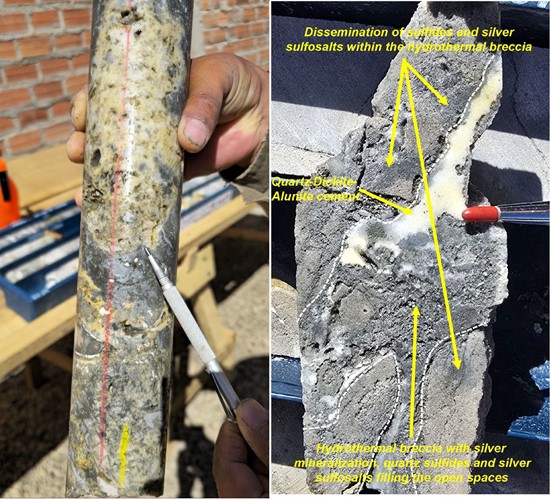

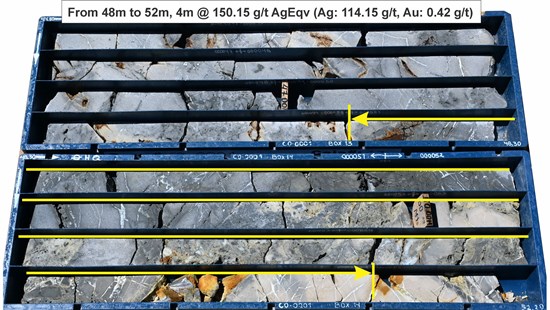

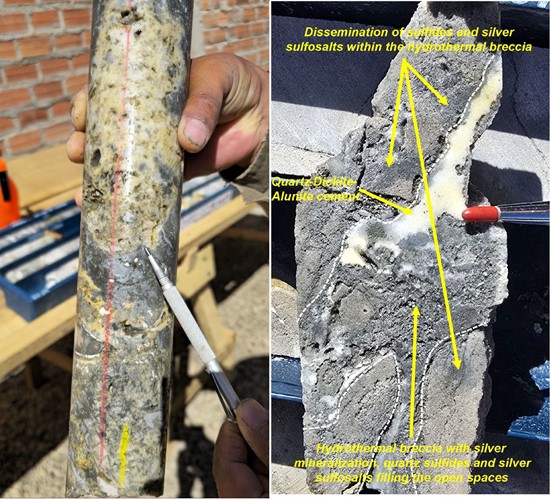

CO-0001 (Easting 747065 Northing 7762846) was drilled at an inclination of -45° and direction of 235° to a depth of 101.0 m. CO-0002 (Easting 747063 Northing 7762848) was drilled from the same platform at an inclination of -45° to an azimuth of 175° to a depth of 107.0 m (Table 1, Figure 1 & 2). Both holes cut tuffs with hydrothermal breccias, advanced argillic and argillic alteration, strong silicification, and semi-massive pyrite, all cut by late drusy veinlets of quartz, pyrite, tetrahedrite and silver sulphosalts (Figures 3 to 4).

Figure 1: Summary geological map showing surface geochemistry, initial priority targets and drillhole collar locations – Cosuño Silver Project, Bolivia.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11890/282337_1e8279b0d4637b0c_003full.jpg

Figure 2: Jalsuri Target Cross Section illustrating surface geochemistry, hole CO-0001 trace, mineralization, alteration and geology.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11890/282337_1e8279b0d4637b0c_004full.jpg

Figure 3: Hole CO-0001: Hydrothermal / crackle breccia, intense advanced argillic alteration with pyrite, sulfosalts and sulfides, quartz-alunite-dickite Veinlets, open space with druzy quartz.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11890/282337_1e8279b0d4637b0c_005full.jpg

Figure 4A (Left photo): Hole CO-0001: 49.70m, Polymictic breccia matrix supported pervasive silicification with disseminated sulfosalts, local vuggy silica and quartz-alunite-dickite. Figure 4B (Right Photo): Hole CO-0002: At 60m.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11890/282337_figure4.jpg

Executive Chair Appointment

The Company also announces that Dr. Mark Cruise, previously an independent director of BP Silver, has been appointed as the Company’s Executive Chair, effective February 2, 2026.

Dr. Cruise brings over 30 years of global mining experience from early-stage exploration to production in the base, precious metal and critical mineral industries. His expertise encompasses technical strategy, capital markets (raising over $1B), merger & acquisitions and advanced stakeholder negotiations. He has co-founded and led several billion-dollar exploration and mining companies, and most recently served as COO and CEO of New Pacific Metals, who are developing two silver deposits exceeding 200 million ounces each in Bolivia.

Investor Relations Partnership

BP Silver also announces effective February 1, 2026, it has engaged Adelaide Capital (‘Adelaide‘), a leading investor relations and capital markets advisory firm, to provide investor relations and consulting services to the Company.

Adelaide is a full-service investor relations firm that brings a unique and powerful perspective and a re-engineered investor relations business model. Adelaide will work closely with BP Silver to develop and deploy a comprehensive capital markets program, which includes assisting with non-deal road shows, virtual campaigns, social media, conferences and assisting with investor communication. In exchange for Adelaide’s services, and pursuant to an investor relations consulting agreement (the ‘IRA‘), the Company has agreed to pay a monthly fee of C$10,000 for a three-month term. Adelaide is an arm’s length company based in Toronto, Ontario. As of the date hereof, Adelaide does not have any interest, directly or indirectly, in the Company or its securities except for being previously granted 50,000 options of the Company. The IRA is subject to approval by the TSX Venture Exchange.

Qualified Person

The technical information contained in this news release has been reviewed and approved by Dr. Stewart D. Redwood, PhD, FIMMM, a Director of the Company and a Qualified Person as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects. As Dr. Redwood is a director of the Company, he is not independent under National Instrument 43-101.

Mineralization at the Pulacayo deposit is not necessarily indicative of mineralization at the Cosuño Project. Information on production from the Pulacayo deposit was obtained SERGEOMIN, Bulletin of the National Service of Geology and Mining, No. 30, pp. 119-120.

QA/QC

The work program was designed and supervised by Gonzalo Lemuz, P.Geo, the Company’s Chief Operating Officer, who was responsible for all aspects of the work, including the Quality Assurance and Quality Control (QA/QC) program. On-site personnel at the Project rigorously collect and track samples which are then security sealed and shipped to ALS laboratory in Oruro for sample preparation. The core samples were prepared by ALS at their laboratory in Oruro, Bolivia and the sample pulps were shipped to their laboratory in El Callao, Peru for analysis. ALS is accredited to ISO/IEC 17025:2017 and ISO9001:2015. ALS is independent of BP Silver. Silver and multi-elements were analysed by aqua regia digestion and ICP-MS finish. Gold was analysed by fire assay and AA finish. BPAG inserted certified standard reference materials (CSRM), blanks and duplicates to monitor QAQC. All diamond drill holes were drilled in HQ diameter. The average core recovery was 97.5% for CO-0001 and 95% for CO-0002.

About BP Silver Corp.

BP Silver Corp. is a Canadian exploration company focused on advancing high-grade silver projects in Bolivia. The Company’s flagship asset, the Cosuño Project, is strategically located in the prolific Bolivian silver belt, a region with a rich mining history and significant untapped discovery potential. With a strong technical team and a disciplined exploration strategy, BP Silver is positioned to unlock value for its shareholders through the discovery and development of major silver deposits.

For further information please contact:

Tim Shearcroft, Chief Executive Officer

604-307-7032

Info@BPSilverCorp.com

Cautionary Statement Regarding Forward-Looking Information:

Information set forth in this news release contains forward-looking statements. These statements reflect management’s current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. The Company cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond the Company’s control. Such factors include, among other things: future prices and the supply of silver and other precious and other metals; future demand for silver and other valuable metals; inability to raise the money necessary to incur the expenditures required to retain and advance the property; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; risks of the mineral exploration industry; delays in obtaining governmental approvals; and failure to obtain necessary regulatory or shareholder approvals. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Source

This post appeared first on investingnews.com