First Development Resources plc (AIM: FDR), a UK-based, Australia-focused mineral exploration company with interests in Western Australia and the Northern Territory, is pleased to provide an update on its gold (‘Au’) focused exploration at the Selta Project (‘Selta’ or the ‘Project’), located in the Aileron Province of Australia’s Northern Territory.

HIGHLIGHTS

- The high-resolution aeromagnetic (‘AMAG’) and radiometric (‘RAD’) geophysical survey over the Lander West regional gold target area has been successfully completed, covering approximately 4,200-line kilometres and delivering a high-quality geophysical survey dataset for targeting Au.

- Updated AMAG / RAD images are being interpreted, enhancing FDR’s understanding of subsurface geology, structures, and alteration patterns for drill targeting gold mineralisation associated with anomalous surface geochemical and historical shallow drilling results.

- These new airborne geophysical survey results will be integrated with ongoing Gradient Array Induced Polarisation (‘GAIP’) survey results and historical geochemistry from surface sampling and shallow drilling to refine and prioritise target zone for future drilling.

- Planning and applications for land access and heritage approvals over target areas is currently underway.

Tristan Pottas, Chief Executive Officer of FDR, commented:

‘Completion of the high-resolution AMAG and radiometric survey at Lander West represents a major step forward and it has materially improved our understanding of the subsurface geology and structural controls on mineralisation. We are grateful for the support received from Thomson Airborne, who delivered a high-quality, professional dataset on schedule over the holiday period.

The integration of the AMAG / RAD data with results from the ongoing GAIP survey and historical geochemical information will allow us to systematically refine and prioritise gold drill targets. We are very pleased with the quality of the datasets delivered and look forward to advancing Lander West through the next phase of exploration.’

AMAG / RAD SURVEY OUTCOMES

The completed AMAG / RAD survey was flown by Thomson Airborne Pty Ltd in early January 2026 using 100m spaced flight lines to generate high-resolution magnetic and radiometric datasets along approximately 4,200-line kilometres. The survey has delivered detailed imaging of structural features, lithological boundaries, and alteration signatures across the Lander West gold target area.

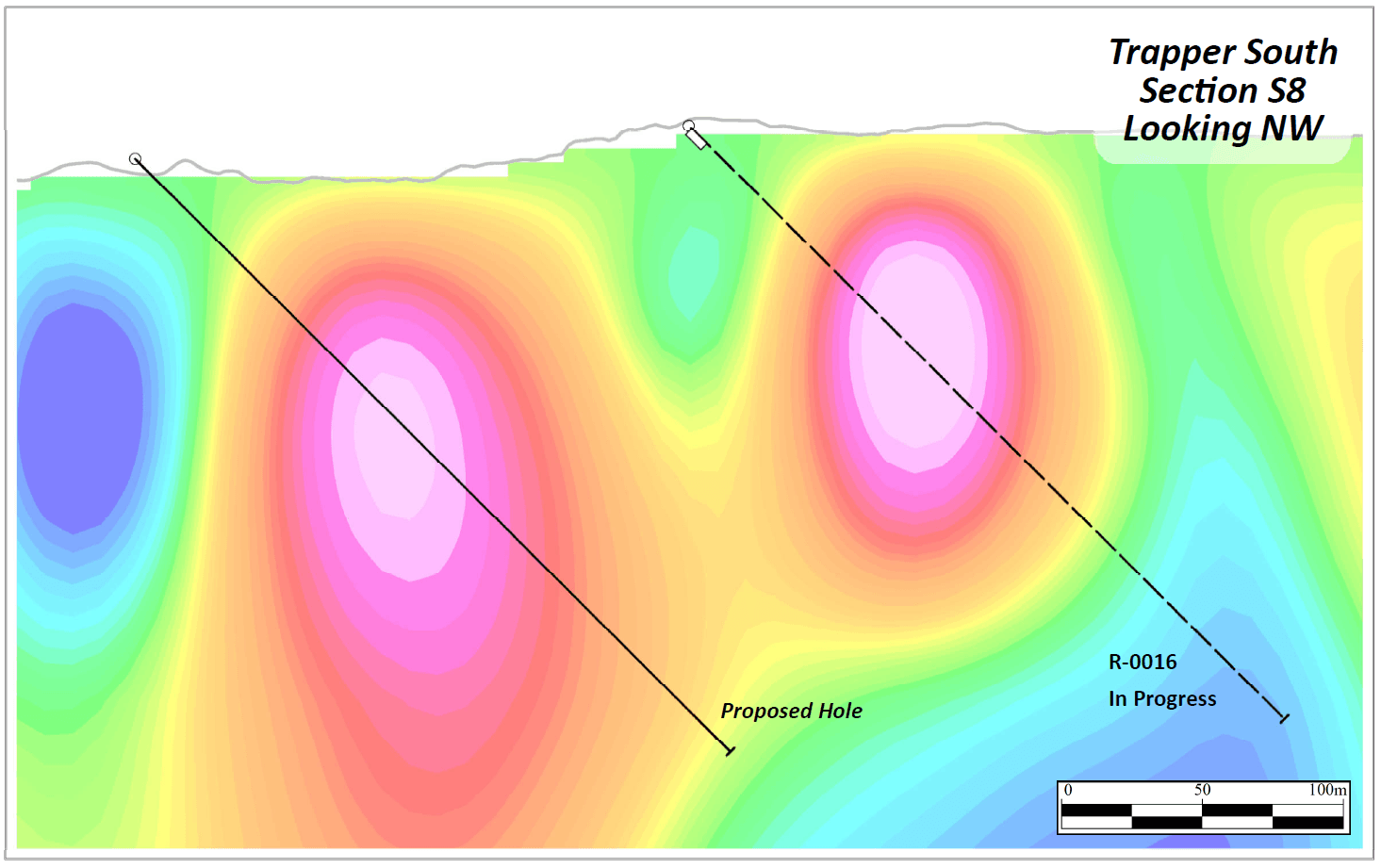

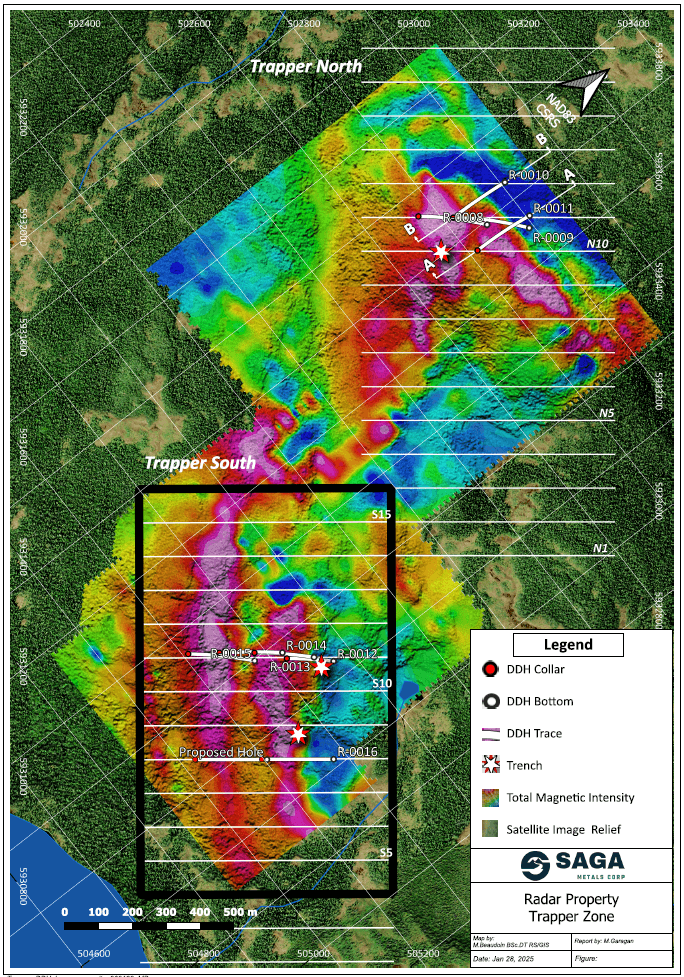

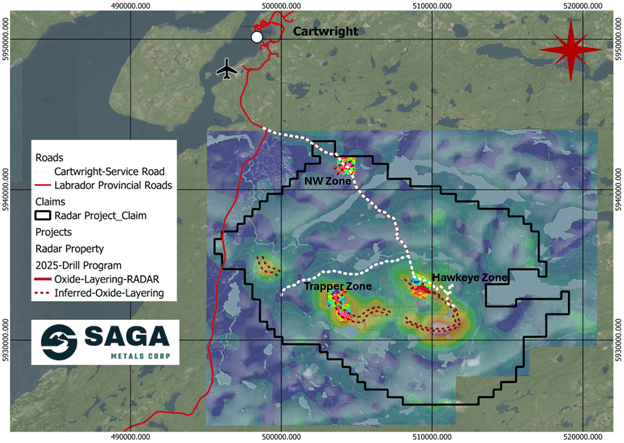

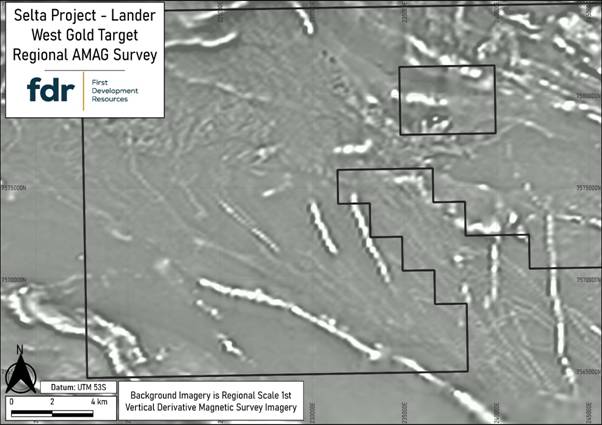

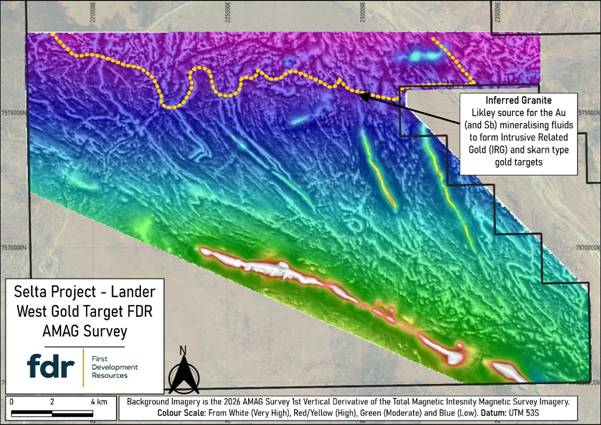

A comparison between the original regional airborne magnetic anomaly imagery and the new FDR acquired high-resolution AMAG imagery is provided in Figure 1 (original) and Figure 2 (newly acquired imagery). The new AMAG survey data have been processed to provide very detailed imagery on the subsurface geology and structure that will help FDR’s technical team to better constrain structures of interest for drill targeting Au mineralisation.

Figure 2 presents the First Vertical Derivative (‘1VD’) of Total Magnetic Intensity reduced to magnetic pole (TMI RTP) filtered anomaly image. Additional data processing methods and three-dimensional (‘3D’) inversion modelling results are being reviewed to identify areas of granitic intrusive contacts with meta-sediments and meta-volcanic host rocks, zones of folding and faulting, and hydrothermal alteration zones, which are key targeting criteria for potential gold mineralisation.

The newly acquired AMAG / RAD data results will be integrated with chargeability and resistivity information generated from the ongoing GAIP geophysics survey to better constrain and target potential mineralised zones at depth for follow up air-core (‘AC’) drilling transects to test shallow targets and reverse circulation (‘RC’) drilling to test deeper GAIP targets and drill under historical shallow Au anomaly zones. This combined geophysical interpretation, together with historical geochemical datasets, will underpin a robust, multi-disciplinary targeting framework to identify and prioritise drill-ready gold targets.

LANDER WEST GOLD TARGET

Following detailed desktop studies, FDR has identified the Lander West regional gold target area as a priority focus within the broader Selta Project. This target has been supported by a comprehensive gold targeting study completed by Resource Potentials Pty Ltd (‘ResPot’), a Perth, Western Australia-based Mineral Exploration and Geophysical Consultancy. ResPot has been commissioned to integrate historical drilling, geological, geophysical, and geochemical datasets to help FDR define high-potential gold targets for follow-up work.

Lander West is interpreted as a continuation of the Stafford Gold Trend, where the adjacent ground hosts high-grade gold and antimony (‘Sb’) mineralisation in the same geological units extending to the southeast (1). Gold mineralisation is believed to be shear-hosted, associated with zones of deformation and hydrothermal alteration, which produce subtle but measurable variations in magnetic response. Within Lander West, a very large granitic batholith, with smaller granite stocks along its margin, have been identified by the AMAG data to sit below thin sand cover sediments, and these granites are a likely source for the Au (and Sb) mineralising fluids to form Intrusive Related Gold (‘IRG’) and skarn type gold targets with FDR’s land holding. High-resolution geophysical datasets are therefore critical to refining drill targets and advancing FDR’s gold exploration programme.

NEXT STEPS

Interpretation and 3D inversion modelling of the integrated AMAG / RAD, GAIP survey results and geochemical datasets is underway, and the result is already informing key areas for follow-up exploration planning, including the design and prioritisation of future AC and RC drilling programmes at Lander West. This systematic, data-driven approach is intended to maximise discovery potential while maintaining a disciplined and cost-effective exploration strategy over such a large gold target area.

Further updates will be provided as interpretation progresses and exploration activities advance.

Figure 1: Original regional scale AMAG data anomaly image (1VD filtered and grey colour scale) from the Selta Project Lander West gold target area.

Figure 2: Newly-acquired first vertical derivate (1VD) on total magnetic intensity (TMI) filtered AMAG anomaly imagery from the Selta Project Lander West gold target area. This processing method helps sharpen shallow geological effects, such as fault systems, folds and shear zones, and it clearly identified a newly discovered granite contact in the north, which is a likely driver for hydrothermal fluids and heat to produce Au mineralisation.

REFERENCE

1. iTech Minerals Ltd (ASX: ITM) announcement dated 12 January 2026

(2924-03045120-2A1647835&v=undefined)

QUALIFIED PERSON STATEMENT

The technical information contained in this disclosure has been reviewed and approved by Mr Nicholas O’Reilly (MSc, DIC, MIMMM QMR, MAusIMM, FGS), who is a qualified geologist and acts as the Qualified Person under the AIM Rules – Note for Mining and Oil & Gas Companies. Mr O’Reilly is a principal consultant working for Mining Analyst Consulting Ltd which has been retained by First Development Resources plc to provide technical support.

GLOSSARY

|

Term |

Definition |

|

3D Inversion Modelling |

A technique that converts geophysical survey data into a three-dimensional (3D) map of underground structures, highlighting areas likely to host minerals. |

|

Aeromagnetic (AMAG) survey |

An airborne geophysical survey that measures variations in the Earth’s magnetic field to map subsurface geology and structures. |

|

Air-Core (AC) Drilling |

A drilling method for sampling shallow rocks efficiently, commonly used in early-stage exploration. |

|

Alteration patterns |

Recognisable changes in rocks caused by hot fluids moving through them, which can help indicate where valuable minerals may be concentrated. |

|

Chargeability information (GAIP Survey) |

Measures how strongly subsurface rocks hold an electric charge after introducing an electrical transmitter current into the ground, helping identify zones with disseminated sulphide minerals linked to gold. |

|

First Vertical Derivative (1VD) |

A magnetic data filter processing technique that calculates the rate of change of the magnetic field with height, enhancing short-wavelength anomalies and sharpening the edges of magnetic anomalies related to geological contacts, alteration zones, faults, and shear zones. |

|

Geochemical information |

Chemical data from rocks, soils, or fluids that is used to identify and understand areas with potential mineral deposits. |

|

Geophysical survey |

A method of measuring physical property changes in the Earth, such as magnetism, gravity, or electrical conductivity, to identify subsurface geological rock units, structures and potential mineral deposits. |

|

Gradient Array Induced Polarisation (GAIP) survey |

A geophysical survey method that maps anomalies caused by subsurface geology and mineralisation by measuring electrical properties of the ground. GAIP helps identify and prioritise prospective gold targets for follow-up exploration and drilling. |

|

Granitic Batholith |

A large underground granite body often associated with mineral deposits. |

|

High-resolution (AMAG Survey) |

Refers to geophysical data collected at closely spaced intervals (100m or less), providing detailed and precise information about subsurface magnetic features to improve target definition for exploration. |

|

Hydrothermal alteration |

Changes in rock caused by hot, mineral-rich fluids, often forming new minerals and altering the rock’s original composition. |

|

Intrusive Related Gold (IRG) |

Gold associated with igneous intrusions, commonly forming structurally controlled or disseminated deposits. |

|

Line Kilometre |

One kilometre of a geophysical survey line flown or surveyed. Total line kilometres indicate the survey’s overall coverage. |

|

Lithological boundary |

The contact or transition between different rock types, which can influence how fluids move and where minerals may accumulate. |

|

Metasediments |

Sediment-based rocks that have been metamorphosed, often forming targets for mineral exploration. |

|

Meta-volcanic host rocks |

Volcanic rocks altered by heat or pressure that host or control the formation of mineral deposits. |

|

Mineralisation |

The process by which valuable minerals are formed and concentrated in rocks, creating zones that may be mined for metals or other resources. |

|

Radiometric (RAD) survey |

Measures natural gamma radiation from rocks and regolith related to potassium (K), thorium (Th) and uranium (U) concentrations in the surface outcrop to highlight areas altered by minerals, helping pinpoint potential gold and other deposits. |

|

Resistivity information (GAIP Survey) |

Measures how strongly subsurface rocks resist electrical current, helping map geological rock units, structures, sulphide mineralisation and hydrothermal alteration zones |

|

Reverse-Circulation (RC) Drilling |

A standard exploration drilling approach that produces clean samples for assessing mineral deposits. |

|

Shear hosted |

Describes a rock or mineral deposit that occurs within, and is controlled by, a shear zone, where deformation created pathways for hydrothermal fluids and mineral deposition. |

|

Shear zone |

A zone of intense deformation where rocks have been sheared and fractured, often hosting gold due to the increased porosity formed along the shear zone. |

|

Skarn-Type Gold Targets |

Gold deposits formed where igneous intrusions alter carbonate rocks, creating mineral-rich zones. |

|

Stafford Gold Trend |

A regionally significant mineralised corridor in the Northern Territory, Australia, known for hosting gold and high-grade antimony deposits, which provides structural and geological continuity for exploration targets like Lander West. |

|

Structural feature |

A geological break or deformation in rocks such as faults, shear zones, or folds. |

|

Subsurface geology |

The type, structure, and arrangement of rocks below the Earth’s surface that help explain how mineral deposits may have formed. |

|

Total Magnetic Intensity (TMI) |

The measured strength of the Earth’s magnetic field at a location, including contributions from both the regional geomagnetic field and local magnetic variations caused by subsurface geology. |

|

Zone of deformation |

An area of rock altered or deformed by stress, such as faulting or folding. |

For further information visit www.firstdevelopmentresources.com or contact the following:

|

First Development Resources plc Tristan Pottas (CEO) |

Tel: +44 (0) 20 3778 1397 |

|

Beaumont Cornish Limited Nominated Adviser Roland Cornish / Asia Szusciak |

Tel: +44 (0) 20 7628 3396 |

|

SI Capital Limited Broker Nick Emerson |

Tel: +44 (0) 1483 413 500 |

Beaumont Cornish Limited (‘Beaumont Cornish’) is the Company’s Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish’s responsibilities as the Company’s Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

ABOUT FIRST DEVELOPMENT RESOURCES

First Development Resources’ assets comprise eight granted tenements covering a total area of 2,314.4km2. Five of the tenements, comprising three prospective copper-gold projects, are located in Western Australia (WA), while the remaining three tenements, comprising a rare-earth element (REE), uranium, lithium and gold project, are located in the Australian’s Northern Territory. All tenements are wholly owned by FDR. The assets are a mixture of drill ready and earlier stage exploration.

The WA Projects include the Company’s Wallal Project, as well as Ripon Hills and Braeside West Projects, which are all situated in the Paterson Province, which is widely regarded as one of the most productive regions in Australia for the discovery of world-class gold-copper deposits, and is home to several world-class mines and more recent discoveries.

The Selta Project in the Northern Territory is located in an area considered to be highly prospective for uranium and rare-earth element mineralisation, along with base and precious metal mineralisation. Numerous companies are actively exploring within the region.

Beyond the existing portfolio, FDR is actively looking to expand its portfolio through the acquisition of early-stage exploration projects in Australia.

Source