Strategic Minerals plc (AIM: SML; USOTC: SMCDF), an international mineral exploration and production company, is delighted to announce that its wholly owned subsidiary, Cornwall Resources Limited (‘CRL’), has received assay results from drillhole CRD036 – the first from Pad 2 within the Redmoor Tungsten-Tin-Copper Project (‘Redmoor’) in southeast Cornwall – including further confirmation high-grades of tungsten and tin within the Sheeted Vein System (‘SVS’).

CRD036 was aimed at twinning*1 historical drillholes and identifying mineralised continuity at shallower depths and within a hole designed to intersect a higher-grade, tin-dominant portion of the high-grade tungsten deposit.

Highlights:

Tin downhole intersections

- · High-grade intersections from new tin-dominant zones include:

- 0.50m @ 1.26% Sn, 0.02% Cu & 0.02% WO3 (1.06% WO3.Eq) from 314.82 m

- 0.95m @ 1.18% Sn, 0.01% Cu & 0.02% WO3 (0.99% WO3.Eq) from 336.05 m

- 0.70m @ 1.92% Sn, 1.09% Cu & 0.37% WO3 (2.23% WO3.Eq) from 383.40 m

Tungsten downhole intersections

- High-grade tungsten intersections include:

- 4.50m @ 0.47% WO3, 0.14% Sn & 0.24% Cu (0.65% WO3.Eq) from 372.50 m

- 1.00m @ 1.00% WO3, 0.02% Sn & 0.58% Cu (1.17% WO3.Eq) from 406.00 m

- 0.70m @ 0.86% WO3, 0.07% Sn & 0.82% Cu (1.13% WO3.Eq) from 432.00 m

- Further high-grade sample intervals, inside broad intersections, including:

- 18.50 m @ 0.14% WO3, 0.20% Sn & 0.25% Cu (0.37% WO3. Eq) from 371.50 m, (see Figure 1) containing:

- 0.80m @ 1.02% WO3, 0.09% Sn & 0.45% Cu (1.21% WO3.Eq) from 372.50 m

- 0.54m @ 1.85% WO3, 0.28% Sn & 0.22% Cu (2.13% WO3.Eq) from 374.51 m

Copper downhole intersections

- High-grade intersections include:

- 1.65m @ 1.09% Cu, 0.05% Sn & 0.23% WO3 (0.56% WO3.Eq) from 401.90 m

- 1.00m @ 1.03% Cu, 0.04% Sn & 0.01% WO3 (0.32% WO3.Eq) from 415.00 m

Silver*2

- CRD036, like previous drill holes, reports elevated silver values in relation to mineralisation within zones that are copper-rich, demonstrated by:

- 5.10m @ 0.66% Cu, 0.03% Sn & 0.34% WO3, and 15.5g/t Ag from 401.90 m, including 1.65 m @ 33.9 g/t Ag from 401.90 m

Twinning Results and Model Updates

Positive results from the drillhole twinning, and new insights into Redmoor deposit, including:

- Twinning results between CRD036 and RM80_05B & 05C (1980s drillholes) highlight continuity of structures and reproducibility of historical results. This provides confidence for the use of the 1980s drillhole data in the deposit model and Mineral Resource estimate (‘MRE’) thereby reducing future prefeasibility drilling requirements.

- Drillhole results have returned multiple zones of high-grade tin and copper intersections, supporting the presence and continuity of tin-copper lode structures within the existing Redmoor Mineral Resource, which will be further studied as part of the MRE update – these will be further detailed in a forthcoming update on the new Redmoor deposit model.

|

|

|

Figure 1: Box photos with sample intervals (Yellow Arrows), highlighting an 18.50m intersection including highlighted high-grade tungsten and tin intervals. All samples are listed in tungsten trioxide equivalent (WO3.Eq).

|

Dennis Rowland, CRL Managing Director, said:

‘The assay results report a trifecta of high-grade tungsten, tin and copper intersections for the first time from the 2025 programme within a tin-dominant zone of the deposit, along with analytical results for silver – which are being further investigated as part of ongoing metallurgical studies.

Drillhole results continue to return multiple zones of high-grade tin and copper intersections, supporting the presence and continuity of tin-copper lode structures within the existing Redmoor Mineral Resource, which will be further modelled. This drillhole was designed as a twin of holes drilled by Southwest Minerals (SWM) in the 1980s and provides further confidence in these historical datasets.

Following the receipt of these results, an update on the new Redmoor deposit model and the outcome of the twinning programme is expected shortly.’

Mark Burnett, Strategic Minerals Executive Director, said:

‘Positive results such as these further highlight Redmoor’s position as the highest-grade, undeveloped tungsten resource in Europe, and amongst the highest grade globally.

This is a crucial time for critical minerals projects, given significant global supply chain shifts alongside export controls resulting in a marked increase in metal prices and interest in the sector. The Board are focussed on the acceleration of the Redmoor project through an updated mineral resource and planned prefeasibility study (‘PFS’) thereafter. This will be supported by the recently completed fundraise for a significant infill drilling programme, designed to shorten drillhole spacing within the resource, as the major requirement for converting the deposit to an Indicated resource classification ahead of the planned PFS.’

Detail of analytical results from CRD036

Table 1: Drillhole collar data for CRD036.

|

Pad

Number

|

Collar

|

Orientation at Collar

|

Total Depth (m)

|

|

Easting (m)

|

Northing (m)

|

Elevation (m)

|

Azimuth (⁰)

|

Dip (⁰)

|

|

2

|

235710.00

|

71254.00

|

185

|

176

|

65

|

461.70

|

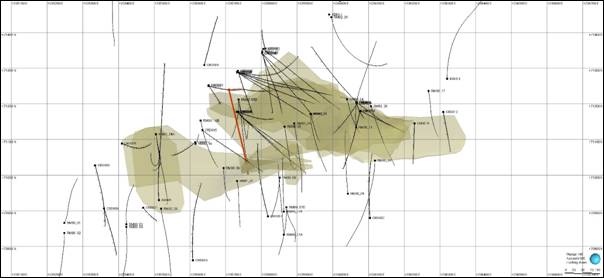

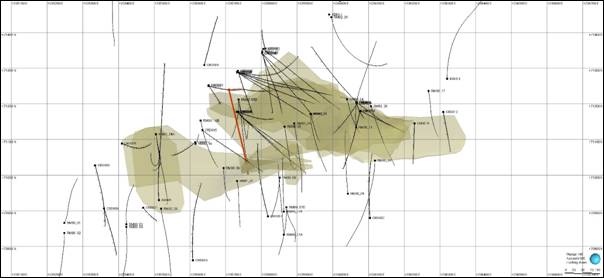

Figure 2: Plan (top-down) view of the previously modelled high-grade domains (gold) used in the 2019 Redmoor MRE, showing CRD036 (in red) and other CRL and SWM drillhole traces (black). CRD036 is an infill hole aimed at testing short-spaced continuity of structure and grade.

Drill hole CRD036 (see Table 1 & Figure 2) was intentionally drilled to twin historical drilling results and confirm the presence of tin and copper-rich structures historically drilled (drill hole RM80_05B and 05C), along with identifying the higher-grade tin-rich section of the resource and shallower extent of the SVS system. The outcomes of the twinning programme will be further detailed shortly alongside updates to the deposit model, ahead of the MRE update expected Q1 2026.

Laboratory assay results for drillhole CRD036 have returned further positive results from the current drilling programme, containing high-grade results, with tungsten (WO3) grades reaching 1.85%, copper (Cu) grades reaching 1.09%, and very-high-grade tin (Sn) grades reaching 1.92%, from a zone of the deposit known to be enriched in tin concentrations, coupled with silver (Ag) grades of up to 33.9 g/t correlated with copper mineralisation.

Table 2 below, contains the details of the composite sample intersections including sample depths, thickness, metal content, and tungsten equivalent calculations, as well as the mineralisation style recorded by CRL geologists. The tungsten equivalent (WO3. Eq.) highlights the value-add from tin and copper to the tungsten grades of the sample intervals. Appendix 1 includes full details of each sample included in these composite intersections.

Table 2: Highlights of downhole composite sample intersections returned from recently received results from drillhole CRD036 showing interval lengths and subsequent assay results for WO3, Sn & Cu. A tungsten equivalent result has also been calculated. Composited values use a downhole length weighted average of grades.

|

Sample Start

|

From (m)

|

To (m)

|

Interval (m)

|

WO3 %

|

Cu %

|

Sn %

|

WO3 eq. %

|

Comments

|

|

CRL005876-81

|

308.72

|

315.32

|

6.60

|

0.02

|

0.08

|

0.26

|

0.25

|

Lode-Style Sn Mineralisation

|

|

incl. CRL005876

|

308.72

|

309.36

|

0.64

|

0.01

|

0.15

|

0.38

|

0.36

|

Lode-Style Sn Mineralisation

|

|

incl. CRL005878

|

311.02

|

313.00

|

1.98

|

0.03

|

0.05

|

0.24

|

0.24

|

Lode-Style Sn Mineralisation

|

|

and CRL005881

|

314.82

|

315.32

|

0.50

|

0.02

|

0.02

|

1.26

|

1.06

|

Lode-Style Sn Mineralisation

|

|

CRL005893-95

|

333.00

|

337.00

|

4.00

|

0.21

|

0.13

|

0.37

|

0.55

|

Lode-Style Sn Mineralisation

|

|

incl. CRL005893

|

333.00

|

335.00

|

2.00

|

0.41

|

0.09

|

0.14

|

0.55

|

S.V.S Mineralisation

|

|

incl. CRL005895

|

336.05

|

337.00

|

0.95

|

0.02

|

0.01

|

1.18

|

0.99

|

Lode-Style Sn Mineralisation

|

|

CRL005901-03

|

344.95

|

348.00

|

3.05

|

0.16

|

0.15

|

0.13

|

0.31

|

Lode-Style + SVS Mineralisation

|

|

incl. CRL005901

|

344.95

|

345.50

|

0.55

|

0.01

|

0.34

|

0.57

|

0.57

|

Lode-Style Sn Mineralisation

|

|

and CRL005903

|

347.05

|

348.00

|

0.95

|

0.52

|

0.13

|

0.04

|

0.59

|

S.V.S Mineralisation

|

|

CRL005907-08

|

352.00

|

354.00

|

2.00

|

0.00

|

0.43

|

0.13

|

0.22

|

Lode-Style Cu+Sn Mineralisation

|

|

CRL005913

|

356.60

|

357.30

|

0.70

|

0.45

|

0.06

|

0.04

|

0.51

|

S.V.S Mineralisation

|

|

CRL005925-44

|

371.50

|

390.00

|

18.50

|

0.14

|

0.25

|

0.20

|

0.37

|

S.V.S Mineralisation

|

|

incl. CRL005927-33

|

372.50

|

377.00

|

4.50

|

0.47

|

0.24

|

0.14

|

0.65

|

S.V.S Mineralisation

|

|

cont. CRL005927

|

372.50

|

373.30

|

0.80

|

1.02

|

0.45

|

0.09

|

1.21

|

S.V.S Mineralisation

|

|

and CRL005931

|

374.51

|

375.05

|

0.54

|

1.85

|

0.22

|

0.28

|

2.13

|

S.V.S Mineralisation

|

|

incl. CRL005939

|

383.40

|

384.10

|

0.70

|

0.37

|

1.09

|

1.92

|

2.23

|

Lode-Style Cu+Sn Mineralisation

|

|

and CRL005944

|

389.00

|

390.00

|

1.00

|

0.02

|

0.25

|

0.36

|

0.39

|

Lode-Style Sn Mineralisation

|

|

CRL005948

|

394.00

|

395.00

|

1.00

|

0.09

|

0.50

|

0.35

|

0.52

|

Lode-Style Cu+Sn Mineralisation

|

|

CRL005954-55

|

399.00

|

401.00

|

2.00

|

0.02

|

0.09

|

0.29

|

0.28

|

Lode-Style Cu+Sn Mineralisation

|

|

CRL005957-61

|

401.90

|

407.00

|

5.10

|

0.34

|

0.66

|

0.03

|

0.55

|

S.V.S Mineralisation

|

|

incl. CRL005957

|

401.90

|

403.55

|

1.65

|

0.23

|

1.09

|

0.05

|

0.56

|

S.V.S Mineralisation

|

|

incl. CRL005961

|

406.00

|

407.00

|

1.00

|

1.00

|

0.58

|

0.02

|

1.17

|

S.V.S Mineralisation

|

|

CRL005963

|

408.00

|

409.00

|

1.00

|

0.00

|

0.21

|

0.32

|

0.32

|

Lode-Style Cu+Sn Mineralisation

|

|

CRL005966-77

|

411.48

|

420.77

|

9.29

|

0.15

|

0.39

|

0.05

|

0.29

|

Lode-Style + SVS Mineralisation

|

|

incl. CRL005966-71

|

411.48

|

415.00

|

3.52

|

0.18

|

0.29

|

0.09

|

0.33

|

S.V.S Mineralisation

|

|

incl. CRL005972

|

415.00

|

416.00

|

1.00

|

0.01

|

1.03

|

0.04

|

0.32

|

Lode-Style Cu Mineralisation

|

|

and CRL005975

|

418.00

|

420.77

|

2.77

|

0.22

|

0.47

|

0.02

|

0.37

|

S.V.S Mineralisation

|

|

CRL005982-84

|

425.96

|

428.78

|

2.82

|

0.16

|

0.56

|

0.08

|

0.38

|

S.V.S Mineralisation

|

|

incl. CRL005982

|

425.96

|

426.9

|

0.94

|

0.45

|

0.51

|

0.07

|

0.64

|

S.V.S Mineralisation

|

|

CRL005988

|

432.00

|

432.70

|

0.70

|

0.86

|

0.82

|

0.07

|

1.13

|

S.V.S Mineralisation

|

Note*1 Twinned drillholes refer to new CRL drillholes which are aimed to intersect SVS mineralisation in close proximity to previous historical drilling undertaken by South West Minerals in 1978-1982, in order to verify the robustness of the historical drilling data, as well as test the continuity/reproducibility of grade and structure across the spacing between the drillholes.

Note*2 Further silver analysis and commentary will follow completion of metallurgical testworks and resource modelling, noting there is no assumption at this stage that silver will be recoverable or economically reportable in the Mineral Resource.

Note*3 Tungsten Equivalent (WO3.Eq) Calculation: WO₃ (EQ)% = WO₃%+(Sn% x 0.82) + (Cu% x 0.27)

Commodity price assumptions: WO₃ US$ 43,000/t, Sn US$ 32,525/t, Cu US$ 9,429/t. Using the 12-month average to September 2025. Recovery assumptions: total WO₃ recovery 72%, total Sn recovery 68% and total Cu recovery 85%. Payability assumptions of 81%, 90% and 90% respectively.

Competent Person Statement:

The information in this announcement that relates to Sampling Techniques and Data and Exploration Results has been reviewed and approved by Mr Laurie Hassall, MSci (Geology), FIMMM, QMR, FGS, who is a full-time employee of Snowden Optiro. Mr Hassall holds a Master of Science degree in Geology from the University of Southampton and is a Fellow of the Institute of Materials, Minerals and Mining (FIMMM), through which he is also accredited as Qualified for Minerals Reporting (QMR). He is also a Fellow of the Geological Society of London (FGS).

Snowden Optiro has been engaged by Cornwall Resources Limited to provide independent technical advice. Mr Hassall, a full-time employee of Snowden Optiro, is acting as the Competent Person and is independent of Cornwall Resources Limited. He has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration, and to the activity being undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code), and under the AIM Rules.

Mr Hassall consents to the inclusion in this announcement of the matters based on his information, in the form and context in which it appears. He confirms that, to the best of his knowledge, there is no new information or data that materially affects the information contained in previous market announcements, and that the form and context in which the information is presented has not been materially modified.

|

For further information, please contact:

|

|

|

|

|

|

Strategic Minerals plc

|

+44 (0) 207 389 7067

|

|

Mark Burnett

|

|

|

Executive Director

|

|

|

Website:

|

www.strategicminerals.net

|

|

Email:

|

info@strategicminerals.net

|

|

|

|

Follow Strategic Minerals on:

|

|

|

X:

|

@StrategicMnrls

|

|

LinkedIn:

|

https://www.linkedin.com/company/strategic-minerals-plc

|

|

|

|

SP Angel Corporate Finance LLP

|

+44 (0) 20 3470 0470

|

|

Nominated Adviser and Broker

|

|

|

Matthew Johnson/Charlie Bouverat/Grant Barker

Zeus Capital Limited

Joint Broker

Harry Ansell/Katy Mitchell

|

+44 (0) 203 829 5000

|

|

|

|

Vigo Consulting

|

+44 (0) 207 390 0234

|

|

Investor Relations

|

|

|

Ben Simons/Peter Jacob/Anna Sutton

|

|

|

Email:

|

strategicminerals@vigoconsulting.com

|

|

Notes to Editors

About Strategic Minerals plc and Cornwall Resources Limited

Strategic Minerals plc (AIM: SML; USOTC: SMCDY) is an AIM-quoted, producing minerals company, actively developing strategic projects in the UK, United States and Australia.

In 2019, the Company completed the 100% acquisition of Cornwall Resources Limited and the Redmoor Tungsten-Tin-Copper Project.

The Redmoor Project is situated within the historically significant Tamar Valley Mining District in Cornwall, United Kingdom, with a JORC (2012) Compliant Inferred Mineral Resource Estimate published 14 February 2019:

|

Cut-off (SnEq%)

|

Tonnage (Mt)

|

WO3

%

|

Sn

%

|

Cu

%

|

Sn Eq1

%

|

WO3 Eq

%

|

|

>0.45 <0.65

|

1.50

|

0.18

|

0.21

|

0.30

|

0.58

|

0.41

|

|

>0.65

|

10.20

|

0.62

|

0.16

|

0.53

|

1.26

|

0.88

|

|

Total Inferred Resource

|

11.70

|

0.56

|

0.16

|

0.50

|

1.17

|

0.82

|

1 Equivalent metal calculation notes; Sn(Eq)% = Sn% x 1 + WO3% x 1.43 + Cu% x 0.40. WO3(EQ)% = Sn% x 0.7 + WO3 + Cu% x 0.28. Commodity price assumptions: WO₃ US$ 33,000/t, Sn US$ 22,000/t, Cu US$ 7,000/t. Recovery assumptions: total WO3 recovery 72%, total Sn recovery 68% & total Cu recovery 85% and payability assumptions of 81%, 90% and 90% respectively

More information on Cornwall Resources can be found at: https://www.cornwallresources.com

In September 2011, Strategic Minerals acquired the distribution rights to the Cobre magnetite project in New Mexico, USA, through its wholly owned subsidiary Southern Minerals Group. Cobre has been in production since 2012 and continues to provide a sustainable revenue stream for the Company.

In March 2018, the Company completed the acquisition of the Leigh Creek Copper Mine situated in the copper rich belt of South Australia. The Company has entered into an exclusive Call Option with South Pacific Mineral Investments Pty Ltd trading as Cuprum Metals to acquire 100% of the project.

About the CIOS Good Growth Fund and UK Shared Prosperity Fund

This project is part-funded by the UK Government through the UK Shared Prosperity Fund. Cornwall Council is responsible for managing projects funded by the UK Shared Prosperity Fund through the Cornwall and the Isles of Scilly Good Growth Programme.

Cornwall and Isles of Scilly has been allocated £184 million for local investment through the Shared Prosperity Fund. This new approach to investment is designed to empower local leaders and communities, so they can make a real difference on the ground where it’s needed the most.

The UK Shared Prosperity Fund proactively supports delivery of the UK-government’s five national missions: pushing power out to communities everywhere, with a specific focus to help kickstart economic growth and promoting opportunities in all parts of the UK.

For more information, visit

https://www.gov.uk/government/publications/uk-shared-prosperity-fund-prospectus

For more information, visit https://ciosgoodgrowth.com

Appendix 1

Table 3: Composite intersections and individual sample results, including, sample numbers, depths and widths, metal contents and tungsten equivalent calculations.

|

Sample Start

|

From (m)

|

To (m)

|

Interval (m)

|

WO3 %

|

Cu %

|

Sn %

|

WO3 eq. %

|

|

CRL005876-81

|

|

|

|

|

|

|

|

|

CRL005876

|

308.72

|

309.36

|

0.64

|

0.01

|

0.15

|

0.38

|

0.36

|

|

CRL005877

|

309.36

|

311.02

|

1.66

|

0.03

|

0.05

|

0.07

|

0.10

|

|

CRL005878

|

311.02

|

313.00

|

1.98

|

0.03

|

0.05

|

0.24

|

0.24

|

|

CRL005879

|

313.00

|

314.82

|

1.82

|

0.02

|

0.12

|

0.11

|

0.15

|

|

CRL005881

|

314.82

|

315.32

|

0.50

|

0.02

|

0.02

|

1.26

|

1.06

|

|

CRL005893-95

|

|

|

|

|

|

|

|

|

CRL005893

|

333.00

|

335.00

|

2.00

|

0.41

|

0.09

|

0.14

|

0.55

|

|

CRL005894

|

335.00

|

336.05

|

1.05

|

0.00

|

0.31

|

0.10

|

0.17

|

|

CRL005895

|

336.05

|

337.00

|

0.95

|

0.02

|

0.01

|

1.18

|

0.99

|

|

CRL005901-03

|

|

|

|

|

|

|

|

|

CRL005901

|

344.95

|

345.50

|

0.55

|

0.01

|

0.34

|

0.57

|

0.57

|

|

CRL005902

|

345.50

|

347.05

|

1.55

|

0.00

|

0.10

|

0.03

|

0.06

|

|

CRL005903

|

347.05

|

348.00

|

0.95

|

0.52

|

0.13

|

0.04

|

0.59

|

|

CRL005907-08

|

|

|

|

|

|

|

|

|

CRL005907

|

352.00

|

353.00

|

1.00

|

0.00

|

0.34

|

0.03

|

0.12

|

|

CRL005908

|

353.00

|

354.00

|

1.00

|

0.00

|

0.52

|

0.22

|

0.32

|

|

CRL005913

|

356.60

|

357.30

|

0.70

|

0.45

|

0.06

|

0.04

|

0.51

|

|

CRL005925-44

|

|

|

|

|

|

|

|

|

CRL005925

|

371.50

|

372.00

|

0.50

|

0.01

|

0.42

|

0.21

|

0.29

|

|

CRL005926

|

372.00

|

372.50

|

0.50

|

0.02

|

0.08

|

0.07

|

0.10

|

|

CRL005927

|

372.50

|

373.30

|

0.80

|

1.02

|

0.45

|

0.09

|

1.21

|

|

CRL005928

|

373.30

|

374.51

|

1.21

|

0.05

|

0.04

|

0.03

|

0.08

|

|

CRL005931

|

374.51

|

375.05

|

0.54

|

1.85

|

0.22

|

0.28

|

2.13

|

|

CRL005932

|

375.05

|

376.00

|

0.95

|

0.12

|

0.39

|

0.30

|

0.48

|

|

CRL005933

|

376.00

|

377.00

|

1.00

|

0.15

|

0.20

|

0.08

|

0.27

|

|

CRL005934

|

377.00

|

378.00

|

1.00

|

0.02

|

0.39

|

0.22

|

0.30

|

|

CRL005935

|

378.00

|

378.90

|

0.90

|

0.04

|

0.07

|

0.08

|

0.12

|

|

CRL005936

|

378.90

|

380.90

|

2.00

|

0.00

|

0.51

|

0.13

|

0.25

|

|

CRL005937

|

380.90

|

382.05

|

1.15

|

0.02

|

0.13

|

0.12

|

0.15

|

|

CRL005938

|

382.05

|

383.40

|

1.35

|

0.00

|

0.05

|

0.03

|

0.04

|

|

CRL005939

|

383.40

|

384.10

|

0.70

|

0.37

|

1.09

|

1.92

|

2.23

|

|

CRL005941

|

384.10

|

386.15

|

2.05

|

0.01

|

0.03

|

0.04

|

0.05

|

|

CRL005942

|

386.15

|

387.45

|

1.30

|

0.02

|

0.30

|

0.19

|

0.26

|

|

CRL005943

|

387.45

|

389.00

|

1.55

|

0.02

|

0.03

|

0.12

|

0.13

|

|

CRL005944

|

389.00

|

390.00

|

1.00

|

0.02

|

0.25

|

0.36

|

0.39

|

|

CRL005948

|

394.00

|

395.00

|

1.00

|

0.09

|

0.50

|

0.35

|

0.52

|

|

CRL005954-55

|

|

|

|

|

|

|

|

|

CRL005954

|

399.00

|

400.00

|

1.00

|

0.02

|

0.05

|

0.34

|

0.30

|

|

CRL005955

|

400.00

|

401.00

|

1.00

|

0.02

|

0.14

|

0.24

|

0.25

|

|

CRL005957-61

|

|

|

|

|

|

|

|

|

CRL005957

|

401.90

|

403.55

|

1.65

|

0.23

|

1.09

|

0.05

|

0.56

|

|

CRL005958

|

403.55

|

405.00

|

1.45

|

0.01

|

0.52

|

0.04

|

0.18

|

|

CRL005959

|

405.00

|

406.00

|

1.00

|

0.36

|

0.23

|

0.02

|

0.44

|

|

CRL005961

|

406.00

|

407.00

|

1.00

|

1.00

|

0.58

|

0.02

|

1.17

|

|

CRL005963

|

408.00

|

409.00

|

1.00

|

0.00

|

0.21

|

0.32

|

0.32

|

|

CRL005966-77

|

|

|

|

|

|

|

|

|

CRL005966

|

411.48

|

412.40

|

0.92

|

0.01

|

0.30

|

0.23

|

0.28

|

|

CRL005967

|

412.40

|

413.00

|

0.60

|

0.43

|

0.16

|

0.10

|

0.56

|

|

CRL005968

|

413.00

|

413.70

|

0.70

|

0.03

|

0.20

|

0.02

|

0.10

|

|

CRL005971

|

413.70

|

415.00

|

1.30

|

0.27

|

0.39

|

0.01

|

0.39

|

|

CRL005972

|

415.00

|

416.00

|

1.00

|

0.00

|

1.03

|

0.04

|

0.32

|

|

CRL005973

|

416.00

|

417.00

|

1.00

|

0.02

|

0.19

|

0.01

|

0.08

|

|

CRL005974

|

417.00

|

418.00

|

1.00

|

0.08

|

0.05

|

0.02

|

0.10

|

|

CRL005975

|

418.00

|

418.92

|

0.92

|

0.30

|

0.51

|

0.02

|

0.46

|

|

CRL005976

|

418.92

|

420.00

|

1.08

|

0.29

|

0.41

|

0.02

|

0.42

|

|

CRL005977

|

420.00

|

420.77

|

0.77

|

0.02

|

0.52

|

0.02

|

0.18

|

|

CRL005982-84

|

|

|

|

|

|

|

|

|

CRL005982

|

425.96

|

426.90

|

0.94

|

0.45

|

0.51

|

0.07

|

0.64

|

|

CRL005983

|

426.90

|

428.00

|

1.10

|

0.01

|

0.75

|

0.10

|

0.30

|

|

CRL005984

|

428.00

|

428.78

|

0.78

|

0.03

|

0.35

|

0.04

|

0.16

|

|

CRL005988

|

432.00

|

432.70

|

0.70

|

0.86

|

0.82

|

0.07

|

1.13

|

Source

This post appeared first on investingnews.com