Asara Resources (AS1:AU) has announced Drilling confirms grade continuity at depth and along strike

Asara Resources (AS1:AU) has announced Drilling confirms grade continuity at depth and along strike

Download the PDF here.

Asara Resources (AS1:AU) has announced Drilling confirms grade continuity at depth and along strike

Asara Resources (AS1:AU) has announced Drilling confirms grade continuity at depth and along strike

Download the PDF here.

Brightstar Resources (BTR:AU) has announced Sandstone Strategic Plan to Deliver Long-Life Production Hub

Brightstar Resources (BTR:AU) has announced Sandstone Strategic Plan to Deliver Long-Life Production Hub

Download the PDF here.

Coelacanth Energy Inc. (TSXV: CEI,OTC:CEIEF) (‘Coelacanth’ or the ‘Company’) announces that its board of directors approved the granting of incentive stock options (‘Options’) under its stock option plan to acquire up to an aggregate of 8,634,250 common shares (‘Common Shares’) of the Corporation (6,298,250 granted to certain of its directors and officers and 2,336,000 granted to certain of its employees) and to the granting of restricted share units (‘RSUs’) under its restricted share unit plan to obtain up to an aggregate of 5,369,500 Common Shares (4,224,250 granted to certain of its directors and officers and 1,145,250 granted to certain of its employees).

All of the Options are exercisable for a period of five years at a price of $0.80 per Common Share and 33⅓% of the Options will vest on the date that is one year after the date of the grant of such Options and the remainder will vest 33⅓% per year thereafter. All of the RSUs are exercisable for a period of three years at no additional cost and 33⅓% of the RSUs will vest on the date that is one year after the date of the grant of such RSUs and the remainder will vest 33⅓% per year thereafter.

Following the grant of Options and RSUs, Coelacanth has an aggregate of 30,220,931 Options and 9,865,698 RSUs outstanding. Coelacanth’s share based incentive plans limit the total number of Common Shares underlying the aggregate outstanding Options and RSUs to no more than 10% of the issued and outstanding Common Shares of 535,316,833. As of the date of this press release, the total number of Common Shares underlying the outstanding Options and RSUs on an aggregate basis is 40,086,629 or approximately 7.5% of the issued and outstanding Common Shares.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Coelacanth Energy Inc.

2110, 530 – 8th Ave SW

Calgary, Alberta T2P 3S8

Phone: 403-705-4525

www.coelacanth.ca

Mr. Robert J. Zakresky

President and Chief Executive Officer

Mr. Nolan Chicoine

Vice President, Finance and Chief Financial Officer

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

NOT FOR DISTRIBUTION IN TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES OF AMERICA

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281716

News Provided by TMX Newsfile via QuoteMedia

New Found Gold Corp. (TSXV: NFG) (NYSE American: NFGC) (‘New Found Gold’ or the ‘Company’) is pleased to announce key advancements at its 100%-owned Queensway Gold Project (‘Queensway’ or the ‘Project’) in Newfoundland and Labrador, Canada, which includes entering into a Phase I engineering, procurement and construction management services (‘EPCM’) contract.

Highlights of Key Project Advancements:

Offsite Mill Selection: The Company owns the fully permitted Pine Cove Mill (‘Pine Cove‘) and Nugget Pond Hydrometallurgical Gold Plant, both located in central Newfoundland. EPCM work will include upgrading and expanding Pine Cove for Queensway Phase 1 to benefit from the synergies of processing both Hammerdown and Queensway Phase 1 feed from a single facility.

Environmental Assessment: The Company has substantially completed its environmental baseline work at Queensway and plans to submit an Environmental Registration (‘ER‘) to the Newfoundland and Labrador (‘NL‘) Department of Environment, Conservation and Climate Change in late Q1/26. The ER serves to initiate the environmental assessment (‘EA‘) process for the Project, as per the NL Environmental Protection Act. Updates on the status of the EA process will be provided when available.

Project Finance: As previously announced, the Company has engaged Cutfield Freeman & Co. Ltd., an independent global mining finance advisory firm, to act as its project finance advisor with the objective of selecting the optimal financing package for the initial capital expenditure required to fund Queensway Phase 1 production2.

Technical Report: the Company plans to file an updated Technical Report, which will include an updated mineral resource estimate, in mid-2026.

Timeline: The Queensway Phase 1 project finance process is ongoing and EPCM work is underway with the objective of achieving first gold pour from Queensway Phase I in H2/27, pending receipt of all required permits.

Keith Boyle, CEO of New Found Gold stated ‘Commencing EPCM work is a key milestone in advancing Queensway. We believe our rapid timeline from initial mineral resource in early 2025 to a planned first gold pour in late 2027 is supported by a unique combination of factors, namely: significant drilling and technical work completed on a deposit with an at-surface, high-grade core; ownership of the recently acquired Pine Cove operation, equipped with a fully permitted milling and tailings facilities; and being located in a mining-positive region. Newfoundland and Labrador is a jurisdiction ranked in the top 10 globally in the Fraser Institute’s 2024 Annual Survey of Mining Companies and offers excellent access, infrastructure and a skilled labour force. Having executed on a number of key steps in 2025 and building a strong technical and operating team over the past year has put the Company in an excellent position to accelerate the development of Queensway in a strong gold price environment.’

Qualified Person

The scientific and technical information disclosed in this press release was reviewed and approved by Keith Boyle, P.Eng., CEO, and a Qualified Person as defined under National Instrument 43-101. Mr. Boyle consents to the publication of this press release by New Found Gold. Mr. Boyle certifies that this press release fairly and accurately represents the scientific and technical information that forms the basis for this press release.

About New Found Gold Corp.

New Found Gold is an emerging Canadian gold producer with assets in Newfoundland and Labrador, Canada. The Company holds a 100% interest in Queensway and owns the Hammerdown Operation, Pine Cove Operation and Nugget Pond Hydrometallurgical Gold Plant. The Company is currently focused on advancing Queensway to production and bringing the Hammerdown Operation into steady-state gold production.

In July 2025, the Company completed a PEA at Queensway (see New Found Gold news release dated July 21, 2025). Recent drilling continues to yield new discoveries along strike and down dip of known gold zones, pointing to the district-scale potential that covers a +110 km strike extent along two prospective fault zones at Queensway.

New Found Gold has a new board of directors and management team and a solid shareholder base which includes cornerstone investor Eric Sprott. The Company is focused on growth and value creation.

Keith Boyle, P.Eng.

Chief Executive Officer

New Found Gold Corp.

Contact

For further information on New Found Gold, please visit the Company’s website at www.newfoundgold.ca, contact us through our investor inquiry form at https://newfoundgold.ca/contact/contact-us/ or contact:

Fiona Childe, Ph.D., P.Geo.

Vice President, Communications and Corporate Development

Phone: +1 (416) 910-4653

Email: contact@newfoundgold.ca

Follow us on social media at https://www.linkedin.com/company/newfound-gold-corp, https://x.com/newfoundgold

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement Cautions

This press release contains certain ‘forward-looking statements’ within the meaning of Canadian securities legislation, including relating to WSP’s engagement to provide EPCM services for Queensway Phase 1 project development; the expected start of the EPCM work in Q1/26; the planned work on Pine Cove for Queensway Phase 1; the expected submission of an ER to the NL Department of Environment, Conservation and Climate Change in late Q1/26; the future updates on the status of the EA process; the anticipated filing of an updated Queensway technical report; and the expected first gold pour from Queensway Phase I, pending receipt of all required permits. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts, they are generally, but not always, identified by the words ‘expects’, ‘plans’, ‘anticipates’, ‘believes’, ‘interpreted’, ‘intends’, ‘estimates’, ‘projects’, ‘aims’, ‘suggests’, ‘indicate’, ‘often’, ‘target’, ‘future’, ‘likely’, ‘pending’, ‘potential’, ‘encouraging’, ‘goal’, ‘objective’, ‘prospective’, ‘possibly’, ‘preliminary’, and similar expressions, or that events or conditions ‘will’, ‘would’, ‘may’, ‘can’, ‘could’ or ‘should’ occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made, and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSXV, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include risks associated with the Company’s ability to complete exploration and drilling programs as expected, possible accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, risks associated with the interpretation of exploration results and the results of the metallurgical testing program, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company’s exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that might interfere with the Company’s business and prospects. The reader is urged to refer to the Company’s Annual Information Form and Management’s Discussion and Analysis, publicly available through the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR+) at www.sedarplus.ca for a more complete discussion of such risk factors and their potential effects.

1 for additional information see the Company’s news release dated July 21, 2025.

2 for additional information see the Company’s news release dated November 28, 2025.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281691

News Provided by TMX Newsfile via QuoteMedia

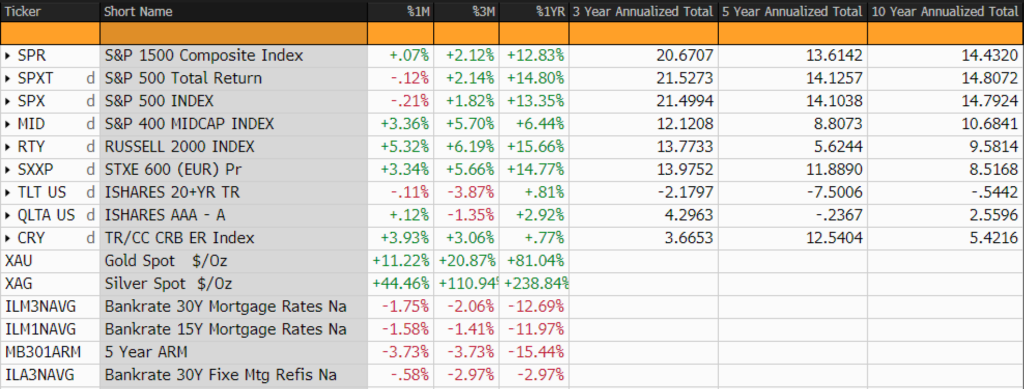

Gold and silver prices are skyrocketing past key psychological price levels to historic highs as investors flock to safe-haven assets.

What once seemed like a fairy tale dream shared among ardent gold bugs is now a reality in today’s ever-shifting new world order. Gold is now trading above US$5,000 per ounce while silver prices are now into the triple digits.

The spot price of gold broke through the US$5,000 mark on Sunday (January 25) and reached as high as US$5,110.23 per ounce in early morning trading on Monday (January 26).

The price of silver also reached an historic milestone, breaking through the US$100 per ounce mark and soaring as high as US$116.37 by 9:49 am PST. Although it is valued as an investment metal, silver is key for technology such as solar panels.

This latest price surge in precious metals comes as US President Donald Trump has threatened 100 percent tariffs on Canadian goods in response to Prime Minister Mark Carney’s latest trade deal with US rival China. Another contributing factor is a possible US government shutdown as the Senate Democrats push back on a new funding for the Department of Homeland Security. And there’s the US Federal Reserve interest rate decision upcoming on Wednesday (January 28).

On top of all that, investors are staring down the barrel of global economic implications of insurmountable debt levels and unresolved trade wars, which have led central banks around the world to bolster their gold reserves.

Gold price chart, January 19 to 26, 2026.

The yellow metal’s latest rise adds to an ongoing historic run.

After starting 2025 around US$2,640, gold had risen to the US$3,200 level by April. It stayed within a fairly flat range until the end of August, when it launched higher once again, breaking US$4,300 in mid-October.

The price of gold took a breather following that move, even falling briefly below US$4,000; however, its retracement was neither as steep nor as long as many market watchers expected it to be.

Gold began gaining steam again in mid-November, and took off again in earnest at the end of 2025.

In 2026, precious metals have continued to benefit from geopolitical tensions and economic uncertainty. Expectations of interest rate cuts after US Federal Reserve Chair Jerome Powell’s term ends later this year have provided support too. Trump’s feud with the Fed over rates took an eyebrow-raising turn on January 9, when the US Department of Justice served the Fed with grand jury subpoenas targeting Powell with a criminal indictment.

Last week, gold climbed higher as investors moved out of global stocks after Trump said over the weekend that European nations opposing his bid to acquire Greenland could face tariffs of up to 25 percent.

The nations targeted included France, Germany, the UK, Denmark, Norway, Sweden, the Netherlands and Finland. The news prompted fears of a full-blown US-Europe trade war, a weaker US dollar, higher inflation and a worsening outlook for the global economy. There were even concerns that the conflict over Greenland could seriously weaken or dismantle the NATO alliance. Gold is traditionally used as a hedge against such risks.

Greenland’s key geographic position in the Arctic has long been coveted by the US as a necessary strategic asset in its geopolitical struggle with Russia and China. “China and Russia want Greenland, and there is not a thing that Denmark can do about it,” Trump wrote on January 17 on his social media platform Truth Social. “Only the United States of America, under PRESIDENT DONALD J. TRUMP, can play in this game, and very successfully, at that!”

‘As soon as the probability of escalation increases, defensive capital tends to move preemptively, rather than waiting for tangible impacts to materialize in economic data. In this context, gold functions as a portfolio risk-balancing asset.’

European leaders responded with vows that they would not be blackmailed into allowing Trump to take Greenland, and said they were preparing counter measures to the president’s tariffs.

Perhaps the pressure worked, as Trump made a point of stating in his January 21 Davos speech: ‘I don’t have to use force. I don’t want to use force. I won’t use force.’

Elsewhere in the precious metals space, platinum rose to record highs on Monday, reaching US$2,933 per ounce. Palladium is also on a tear, soaring as high as US$2,188 per ounce, although it remains well below its record US$3,440 per ounce set in March 2022.

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Many of the worst policies have bipartisan support.

On January 9, President Trump announced on Truth Social that he was “calling for a one year cap on credit card interest rates of 10 percent” starting January 20.

When asked what the consequences would be if credit card companies didn’t comply, the president replied: “Then they are in violation of the law. Very severe things.” There is, in fact, no such law, but there are moves to change that.

A bill was introduced in the Senate last April by Sen. Bernie Sanders which “temporarily caps credit card interest rates at 10 percent.” On January 13, Rep. Maxine Waters threw her support behind President Trump’s proposal: “Let’s do it,” she said during a House Financial Services Committee hearing, “Let’s cap interest rates.”

Let’s not.

All price controls are based on the idea that the price is the problem to be solved. It is not. It is merely the symptom of some underlying issue in supply and demand for whatever good, service, or asset is under discussion. This is the same for minimum wages – which are price floors – or caps on credit card fees, which are price ceilings, just like rent controls.

An interest rate is a price like any other. Specifically, it is the rental price of capital, and it is set by the supply of and demand for capital: where demand is high relative to supply, the price will be high, and where it is low, the price will be low, ceteris paribus.

If a market interest rate is high, reflecting high demand for capital relative to the supply of it, setting a legal maximum rate below it will neither expand the supply of nor reduce the demand for credit. Quite the opposite. If demand was high relative to supply at a rate of, say, 10 percent, it is only likely to increase if a legal maximum of 5 percent is introduced. On the other side, those supplying credit at 10 percent are likely to supply less of it at 5 percent.

Price controls, whether they are caps on credit card interest rates, rent controls, or minimum wages, only exacerbate the problems they are intended to solve because they treat the symptoms rather than the causes.

If we know what a cap on credit card interest rates wouldn’t do, do we know what it would do?

A cap on credit card interest rates would, like any price ceiling, increase demand and reduce supply. It would prevent people who have to pay above the legal maximum rate to access credit from doing so.

Interest rates differ from most other prices — of shoes or haircuts — in that different people pay different amounts for the same thing: a $10,000 loan. One borrower might pay 8 percent interest, while another pays 14 percent or 20 percent, even though all receive the same $10,000 upfront.

These differences reflect, among other things, the riskiness of the loan. Someone with a good credit history or a decent amount of collateral will pay less to borrow a given amount over a given period than someone without these. The consequences of an interest rate cap will, then, be different for different people.

Someone whose credit history or collateral means that it makes sense to lend to them at a rate of, say, four percent, will still be able to borrow if the legal cap is set above that, at, say, 10 percent. But someone without this credit history or collateral and who it only makes sense to lend to at a rate of, say, 15 percent, will be excluded from the market for credit. These folks will not get access to cheaper credit by legislative fiat; they just won’t get access to credit at all.

If credit will dry up for riskier borrowers, it doesn’t follow that their demand for it will: they may still need it to meet unexpected costs, for example. And, frozen out of legitimate credit markets, they may turn to illegitimate ones. As economist Paul Samuelson wrote in 1989, interest rate caps “result in drying up legitimate funds to the poor who need it most and will send them into the hands of the illegal loan sharks.” It is precisely the lower-income borrowers these caps are intended to help who will be hit hardest by them.

The only alternative is that the cost of providing credit to these borrowers is recouped elsewhere through higher fees. As Iain Murray notes, this will be “either to merchants who will pass on their higher fees to consumers…or to the consumers in the cost of card fees. If consumers have to pay more in fees, that will almost certainly price some people out of the market.”

Once again, it is precisely the lower-income borrowers this measure is intended to help who will be hit hardest by it.

Several studies of similar state policies support this. “One study looked at the effect of the 36 percent interest rate cap in Illinois and found, as economic theory predicts, that both the availability of small-dollar loans and the status of consumers’ financial well-being had decreased in the two years after the enactment of the restriction,” Nicholas Anthony writes. “Most notably, the number of loans that were issued to the financially vulnerable fell by 44 percent in the six months after the rate cap was enacted.”

Another study in South Dakota found that the enactment of a 36 percent interest rate cap drove payday lenders out of business. A study by the Mercatus Center found that “Arkansas’s binding 17 percent interest rate cap imposes a substantial cost on the state’s residents, who drive to neighboring states to take out small-dollar installment loans.” Another study found, similarly, that “many small loans made to residents of border counties in North Carolina actually originate in South Carolina” as residents of the former travel to the latter to circumvent their home state’s interest rate cap. Indeed, in Georgia and North Carolina, where payday loans have been banned since 2004 and 2005 respectively, researchers found that “Compared with households in states where payday lending is permitted, households in Georgia have bounced more checks, complained more to the Federal Trade Commission about lenders and debt collectors, and filed for Chapter 7 bankruptcy protection at a higher rate. North Carolina households have fared about the same.”

This is not to deny that there are problems.

As Thomas Savidge noted in December 2024, “A recent survey of Americans shows that the average household’s credit card balance is $9,706, just $1,416 below the record high in 2008. In addition, 40 percent of households now rely on credit cards to pay bills.” With a 40-year high spike in inflation only slightly behind us, this isn’t surprising.

But the problems, in that case, are supply side ones of energy and housing, for example, which force prices up with excessive taxes, fees, and regulations, or of lax monetary policy. Once again, credit card interest rate caps are treating the symptom, not the problem. On the campaign trail, candidate Trump blasted Kamala Harris’ “Soviet-style” plans for price controls. He was right then, and is, like Bernie Sanders and Maxine Waters, wrong now.

The daughter of a senior Iranian official who publicly criticized U.S. involvement against President Donald Trump regarding intervening in Iran’s protests has reportedly been fired from her teaching post at a top U.S. college.

The Emory Wheel, Emory University’s news outlet, reported the School of Medicine Dean announced in an email Jan. 24 that Fatemeh Ardeshir-Larijani was no longer a university employee.

Ardeshir-Larijani was an assistant professor in the department of hematology and medical oncology at Emory’s medical school.

‘The announcement follows a Jan. 19 protest where Iranian-American demonstrators gathered outside Emory’s Winship Cancer Institute to oppose the employment of Fatemeh Ardeshir-Larijani by the University,’ the outlet said.

Ardeshir-Larijani’s Emory faculty page and her Emory Healthcare pages were also no longer visible online.

The nonprofit Alliance Against Islamic Regime of Iran Apologists (AAIRIA) claimed that Ardeshir-Larijani had lived and worked in the U.S. for several years.

The group also cited the professional profile on Emory Healthcare’s official website as showing a listing for a woman called Ardeshir-Larijani who is a U.S.-trained hematologist-oncologist and practicing in Atlanta.

The claims had first drawn attention amid escalating tensions between the U.S. and Iran following the outbreak of protests and reports of deaths during an intense crackdown from Dec. 28.

Trump warned of potential U.S. action in response.

In a Jan. 2 Truth Social post, the president warned that if Iran ‘violently kills peaceful protesters’ the U.S. ‘will come to their rescue,’ saying ‘we are locked and loaded and ready to go.’

Trump’s remarks prompted warnings from senior Iranian officials, who said any American interference would cross a ‘red line.’

Ali Larijani had posted on X that U.S. interference in Iran’s internal affairs would ‘[destabilize] the entire region’ and ‘[destroy] American interests.’

‘The American people must know that Trump is the one who started this adventure,’ he wrote, ‘and they should pay attention to the safety of their soldiers.’

AAIRIA responded by urging U.S. authorities to review the immigration and visa status of Ardeshir-Larijani and her husband.

The group urged officials to determine whether continued residence in the U.S. aligns with U.S. law, national security considerations and principles of accountability and human rights, in a statement shared online.

Rep. Buddy Carter, R-Ga., also called on Emory to dismiss Ardeshir-Larijani and the state’s medical board to revoke her medical license.

Ardeshir-Larijani’s dismissal also arrived two weeks after sanctions had been placed on her father by the Treasury Department, who said that he ‘is responsible for coordinating the response to the protests on behalf of the Supreme Leader of Iran and has publicly called for Iranian security forces to use force to repress peaceful protesters,’ and has publicly defended the regime’s actions.

Ali Larijani has portrayed the U.S. as a hostile power in the past.

A 2018 report by The Washington Times highlighted what critics described as a double standard among Iranian officials whose relatives live or work in Western countries.

Fox News Digital has reached out to the White House and the Department of Homeland Security for comment and Emory University for comment.

As of December 31, 2025, data for 11 of the 24 components of the Business Conditions Monthly have not yet been published. The timing of their release remains uncertain.

Recent inflation data present a cautiously encouraging picture, though timing differences across measures matter for interpretation. December’s CPI showed underlying price pressures continuing to cool, with core CPI rising just 0.2 percent month over month and 2.6 percent year over year, matching a four-year low after earlier readings were distorted by shutdown-related data gaps and seasonal effects. Shelter costs rebounded modestly and remained the largest contributor to monthly inflation, but outside housing, price increases were notably restrained, with core CPI excluding shelter rising only 0.1 percent and core goods prices flat, reinforcing evidence that tariff pass-through to consumers has been milder and may already have peaked. The Fed’s preferred gauge, core PCE — which reflects October and November conditions rather than December — told a similar, if slightly firmer, story: monthly core PCE inflation slowed into November, annualized measures eased further, and year-over-year inflation held near the upper two-percent range. Beneath the headline, services prices continued to exert some upward pressure, particularly in “supercore” categories, while market-based prices remained comparatively subdued. Taken together, the CPI and PCE data suggest that the disinflation process is intact but uneven, with housing and certain service categories slowing more gradually than goods. For households, this means inflation is increasingly less about broad price acceleration and more about a still-elevated price level, which continues to weigh on perceptions of affordability even as the overall pace of price growth moderates.

Recent labor market data point to a continued cooling in employment conditions, though without clear signs of a sharp deterioration. Job openings fell to 7.15 million in November, the lowest level in more than a year, and hiring slowed further, signaling that employers remain cautious about expanding headcount even as they largely avoid outright layoffs. The decline in vacancies — especially in leisure and hospitality, health care, transportation, and warehousing — has brought the ratio of openings to unemployed workers down to 0.9, its lowest level since early 2021 and a stark contrast to the overheated conditions of 2022. At the same time, layoffs eased to a six-month low, voluntary quits picked up modestly in select sectors, and December data from ADP showed private payrolls rising again after a brief contraction, consistent with a labor market that is softening but still functioning. Announced job cuts fell sharply in December, while hiring plans improved, offering tentative reassurance after a year marked by elevated layoffs and historically weak hiring intentions.

Survey-based indicators from the Institute for Supply Management reinforced this mixed picture, with services employment accelerating to its strongest pace in nearly a year even as manufacturing headcounts continued to contract. Overall, the employment landscape heading into 2026 appears characterized by slower hiring, reduced labor market tightness, and growing caution among employers: conditions that suggest diminishing momentum rather than an outright downturn, but one that remains sensitive to shifts in growth, policy, and confidence.

Conditions in the goods-producing sector remain soft, with manufacturing continuing to lag the broader economy despite some tentative signs of stabilization. ISM data showed factory activity contracting in December by the most since 2024, underscoring persistent weakness in output and demand, while S&P Global’s flash January survey indicated that manufacturing activity improved only marginally and remained near its weakest level since mid-2024. New orders at manufacturers returned to modest growth in January after a brief contraction, suggesting demand may be bottoming but not yet rebounding convincingly. Employment conditions in manufacturing remain under pressure, with headcounts still shrinking, albeit at a slower pace, as firms remain reluctant to add workers amid elevated costs and policy uncertainty. Pricing pressures eased somewhat, but both input costs and prices received remain inconsistent with a rapid return to price stability. Overall, manufacturing appears to be moving off its lows but remains constrained by weak demand, cautious hiring, and lingering cost pressures.

In contrast, the services sector ended the year on notably stronger footing even as early-2026 data point to a more measured pace of expansion. The ISM services index jumped to 54.4 in December, its highest reading in more than a year, driven by robust gains in new orders, business activity, exports, and the strongest growth in services employment since February. Demand was broad-based across key industries such as retail, finance, accommodation and food services, and health care, although commentary continued to reflect unease around tariffs, pricing pressures, and uncertainty. At the same time, S&P Global’s flash January data showed services growth slowing to its weakest pace since April, with new business and hiring close to stall speed as firms weighed high costs and softer demand. While input and output price measures eased modestly, they remain elevated, suggesting inflationary pressures in services are diminishing only gradually. Taken together, services activity has provided an important source of resilience for the economy, but momentum appears to be moderating as the sector enters the new year.

US consumer sentiment improved meaningfully in January, rising to a five-month high as households became more optimistic about both the broader economy and their personal finances. The University of Michigan’s sentiment index climbed to 56.4, its largest monthly gain since June with improvements evident across income, age, education, and political groups. Despite the rebound, overall sentiment remains more than 20 percent below year-ago levels, reflecting continued strain from elevated prices and concerns about a cooling labor market. Inflation expectations eased modestly, with consumers anticipating four percent price increases over the next year and lower long-term inflation than previously reported, even as high prices continue to weigh on purchasing power. At the same time, improved buying conditions for durable goods and stronger views of personal finances suggest households remain willing to spend, helping sustain economic momentum despite lingering affordability pressures.

That cautiously improving tone is echoed on the business side, where small business sentiment strengthened again in December as inflation pressures and labor frictions continued to ease. The NFIB small business optimism index rose to 99.5, driven primarily by a sharp improvement in expectations for future business conditions and a notable decline in uncertainty to its lowest level since mid-2024. Inflation receded as a top concern, with both actual and planned price increases moderating, reinforcing the broader picture of cooling cost pressures seen elsewhere in the economy. Labor conditions were more mixed: hiring plans softened modestly, but job openings remained elevated and fewer owners cited labor quality as their primary problem, suggesting improved balance rather than outright weakness. Offsetting these gains, expectations for real sales growth and capital spending edged lower, leaving the overall outlook one of improving confidence tempered by caution around demand and expansion heading into the new year.

Questions about affordability and consumer strain during the holiday season were partly answered by the January 14 retail sales report, which showed US consumers continuing to spend with notable resilience into the year-end. Retail sales rose 0.6 percent in November, the strongest monthly gain since July, led by a rebound in auto purchases and broad-based strength across most retail categories despite lingering concerns about prices and job security. Excluding autos, sales still climbed a solid 0.5 percent, and the control group measure that feeds directly into GDP posted another firm gain, pointing to continued momentum in goods spending at the end of the year. Holiday promotions, record online sales, and the use of Buy Now Pay Later options helped sustain demand, particularly as higher income households continued to anchor overall consumption while lower income consumers remained more price sensitive. Spending at restaurants and bars also rebounded, suggesting that services consumption retained some momentum alongside goods. While the figures are not adjusted for inflation and therefore partly reflect price effects, recent CPI data indicating that tariff-related price pass-through has likely peaked may help support real goods demand going forward. Taken together, the data reinforce a picture of a still-active but increasingly bifurcated consumer, one capable of sustaining near-term growth even as affordability pressures remain a meaningful constraint for many households.

Also posting a larger-than-expected gain at the end of 2025 was US industrial production, which rose 0.4 percent in December, though the details of the report were less uniformly strong. The bulk of the increase came from a surge in utilities output, alongside gains in nondurable goods and transit equipment, rather than from core investment-heavy manufacturing segments. While overall manufacturing output also surprised to the upside, production of consumer durables and information-processing equipment declined, highlighting continued softness in areas most closely tied to household demand and technological investment. Capacity utilization improved modestly but remains consistent with a manufacturing sector operating below historical norms. Taken together, the data point to stabilization in industrial activity, but a manufacturing recovery that is proceeding slowly and unevenly beneath the headline strength.

Economic activity improved modestly across most of the United States in recent weeks, according to the Federal Reserve’s Beige Book, marking a clear step up from the largely stagnant conditions reported in prior cycles. Growth was described as “slight to modest” in a majority of districts, reflecting a post-shutdown normalization rather than a broad acceleration. Labor market conditions remained stable but subdued, with employment levels largely unchanged and wage growth moderating toward what contacts described as more “normal” rates. Price pressures were generally moderate, though an increasing number of firms reported beginning to pass through tariff-related costs as pre-tariff inventories were exhausted and margin pressures intensified. These findings are consistent with policymakers’ view that the labor market has cooled but remains on solid footing, even as inflation continues to run above the Federal Reserve’s target. Against this backdrop, and following three rate cuts late in 2025, officials appear inclined to proceed cautiously on further easing.

At the district level, anecdotes reinforced this mixed but steady picture of the economy. Some regions reported early signs of improvement in manufacturing demand, particularly tied to data center construction and infrastructure-related investment, while others noted flat activity in transportation and persistent affordability challenges for households. Tariffs featured prominently in business commentary, with firms across multiple districts describing higher input costs, compressed margins, and selective price increases passed on to customers. Labor dynamics were generally balanced, with temporary hiring picking up in some areas and displaced workers often reabsorbed quickly, though large-scale hiring remained limited. Several contacts highlighted the growing use of automation and artificial intelligence to boost productivity, albeit with minimal near-term impact on employment levels. Overall, the Beige Book portrays an economy regaining modest momentum, constrained by cost pressures and policy uncertainty but not exhibiting signs of acute stress.

Several near-term tailwinds are supporting economic momentum, though they are accompanied by growing policy-related uncertainty. Markets continue to price in at least one Federal Reserve rate cut later this year, reflecting a mix of moderating inflation, softer payroll growth, and a still-low unemployment rate, all of which help sustain financial conditions that are not overtly restrictive. Fiscal policy is turning notably stimulative, with new tax deductions and adjusted withholding tables set to deliver a sizable boost to household cash flow and business investment in early 2026. At the same time, regulatory easing and credit loosening, ranging from lower capital requirements for banks to renewed support for mortgage markets, are likely to spur lending and risk-taking. Together, these forces create a powerful short-run growth impulse, reinforcing consumer spending, capital expenditure, and asset prices. However, uncertainty surrounding the Supreme Court’s ruling on Federal Reserve governance has introduced a new risk channel, as any perceived erosion of central bank independence could quickly destabilize rate expectations and financial markets.

Counterbalancing these tailwinds are structural and policy-driven headwinds that complicate the outlook. Trade policy remains a meaningful drag, as evidence shows that US importers and households are absorbing most of the cost of higher tariffs, particularly on consumer goods, autos, and capital equipment, rather than benefiting from offsetting price concessions from foreign exporters. Tariff-inclusive import prices have risen nearly in lockstep with imposed duties, squeezing margins and raising domestic cost pressures even as headline inflation cools. These effects vary by trading partner, but overall they suggest tariffs are acting more like a tax on US firms and consumers than as a lever for foreign burden-sharing. More broadly, concerns about rising public debt, elevated asset valuations, and an increasingly accommodative alignment of fiscal, monetary, and credit policy raise longer-term risks to financial stability. For now, growth is being pulled forward by stimulus and easing conditions, but the durability of that expansion depends on whether today’s policy tailwinds eventually give way to inflation, market imbalances, or institutional strain.

It would be remiss not to mention the astounding run in precious metals over the past thirty days, with both gold and silver posting historic gains amid mounting economic and policy uncertainty. Gold has surged to the cusp of $5,000 an ounce, driven by a powerful mix of falling real yields, fading confidence in fiat currencies, concerns over Federal Reserve independence, and sustained international central bank purchases. The rally reflects a classic “debasement trade,” as investors seek protection from expansive fiscal policy, rising debt burdens, and the perception that monetary restraint is giving way to political pressure. Silver has moved even more dramatically, breaking above $100 an ounce for the first time as haven demand collided with a structurally tight supply backdrop and speculative fervor across global retail markets. Its dual role as both an industrial input and financial asset has amplified volatility, particularly amid trade tensions, geopolitical strain, and shifting expectations around tariffs and monetary policy. Together, the moves in gold and silver underscore a broader erosion of confidence in traditional anchors — currencies, bonds, and institutions — adding a distinct financial market tailwind to the narrative of heightened uncertainty shaping the current economic environment.

Recent economic indicators point to continued forward motion, but one increasingly driven by policy stimulus and financial conditions rather than broad-based organic strength. Consumer spending and services activity remain firm, helped by tax relief, easing credit, and moderating inflation, even as goods production, hiring, and capital investment advance more slowly. Price pressures are cooling, yet elevated living costs and tariff pass-through continue to constrain real purchasing power and business margins. At the same time, questions surrounding trade policy, debt accumulation, and the independence of monetary institutions have emerged as new, more prominent sources of risk. The sharp rallies in gold and silver serve as a market-level signal of that unease, reflecting not recession fear, but growing skepticism about the durability and tradeoffs of today’s policy mix.

President Donald Trump said Sunday that it was ‘too late’ to halt construction of a new ballroom at the White House, despite a newly filed lawsuit challenging the project.

In a post on Truth Social, Trump described the ballroom as ‘a GIFT (ZERO taxpayer funding) to the United States of America,’ estimating its cost at $300 million and saying it was financed through private donations.

Trump said the lawsuit was brought by the National Trust for Historic Preservation, criticizing the group for filing it after construction was already underway.

‘Why didn’t these obstructionists and troublemakers bring their baseless lawsuit much earlier?’ he wrote.

Trump added that the East Wing was ‘changed, built and rebuilt over the years’ and that ‘it bore no resemblance or relationship to the original building.’

On July 31, White House press secretary Karoline Leavitt announced the planned construction of a 90,000-square-foot ballroom. The sprawling ballroom will accommodate approximately 650 seated guests and will stay true to the classical design of the White House.

The White House does not have a formal ballroom, and the new ballroom will take the place of the current East Wing of the White House.

Since his return to office, Trump has wasted no time in reshaping the look and feel of the White House and the National Mall.

Trump has previously unveiled a new monument dubbed the ‘Arc de Trump,’ which is planned to commemorate the nation’s 250th anniversary next year.

He said the large arch, a near twin of Paris’s iconic Arc de Triomphe, will welcome visitors crossing the Arlington Memorial Bridge from Arlington National Cemetery into the heart of the nation’s capital.

Trump’s taste for opulence is unmistakable in the Oval Office, where golden accents now decorate the nation’s most iconic workspace, a reflection of his personal style.

Since then, Trump has added gold accents throughout the Oval Office to include decorative details along the ceiling and around the doorway trim. Even the cherubs inside the door frames were given a gilded makeover.

Outside the Oval Office, the Trump administration unveiled the ‘Presidential Walk of Fame,’ a series of portraits of past presidents now displayed along the West Wing colonnade.

The portrait of former President Joe Biden features his signature, created with an autopen, a machine that holds a pen and reproduces a person’s handwriting through programmed movements. The Trump administration has also installed several large mirrors in gold frames along the walkway.

Trump also said he renovated the Lincoln bathroom in the White House because it did not reflect the style of President Abraham Lincoln’s era.

‘I renovated the Lincoln Bathroom in the White House. It was renovated in the 1940s in an art-deco green tile style, which was totally inappropriate for the Lincoln Era,’ Trump wrote in an Oct. 31 Truth Social post.

One of the key negotiators who helped end the last government shutdown won’t support a Department of Homeland Security (DHS) funding bill, further adding to the likelihood of another closure.

Sen. Angus King, I-Maine, told CBS’ Face the Nation on Sunday that he could not support the current, six-bill funding package as is because it included the DHS funding bill. King was a pivotal figure in ending the last shutdown, and was one of only eight Senate Democratic caucus members to join Republicans to end it.

King, like other members of the Senate Democratic caucus, is infuriated by the death of Alex Pretti, the 37-year-old nurse who was shot dead by a border patrol agent in Minneapolis on Saturday.

Congressional Democrats have railed against Immigration and Customs Enforcement (ICE) agents entering Minnesota and elsewhere, but begrudgingly agreed to support the DHS bill until the chaos over the weekend unfolded.

‘I hate shutdowns,’ King said. ‘I’m one of the people that helped negotiate the solution to the last — the end of the last shutdown, but I can’t vote for a bill that includes ICE funding under the circumstances.’

King’s resistance to the package comes after Senate Minority Leader Chuck Schumer, D-N.Y., announced that Senate Democrats would not support the legislation, increasing the odds of a partial government shutdown by the end of the week.

It also comes on the heels of ICE entering King’s home state of Maine for operation Catch of the Day, where Democratic Gov. Janet Mills is running to beat Sen. Susan Collins, R-Maine, in a pivotal Senate race that could determine the balance of power in the upper chamber.

King argued that there was an ‘easy way out’ of the funding snafu — Senate Majority Leader John Thune, R-S.D., could separate out the DHS funding bill and let lawmakers vote on the remaining five bills.

However, should that happen, the House would still have to weigh in. The lower chamber won’t return to Washington, D.C., until next month, all but ensuring a partial government shutdown by Friday unless lawmakers can reach a compromise agreement.

‘Let’s have an honest negotiation,’ King said. ‘Put some guardrails on what’s going on, some accountability, and that would solve this problem. We don’t have to have a shutdown.’