Kingsmen Resources Ltd. (TSXV: KNG,OTC:KNGRF) (OTCQB: KNGRF) (FSE: TUY) (‘Kingsmen’ or the ‘Company’) is pleased to report first assays from hole LC-25-008 that intersected significant new gold rich silver mineralization. This hole was drilled 160 meters from the previously reported high grade silver discovery of 1,028 gt silver equivalent over 1.45 meters (455 gt silver) from 190.25-191.70m including 1,742 gt silver equivalent over 0.70 meters (770 gt silver) from 190.85- 191.55m in hole LC-25-010 (see news release September of 24, 2025). These holes were drilled as part of the recently completed 12 hole 3,227.2 meter drill program on its 100% owned Las Coloradas silver project. The Las Coloradas project is in the Parral mining district of the Central Mexican Silver Belt, Chihuahua Mexico.

Four Key Highlights:

- HIGH GRADE SILVER DISCOVERY

- * 931 g/t silver equivalent with 1.28 g/t gold over 1.60 meters (521 g/t silver) from 156.4-158.0m.

- * Gold rich mineralization.

- NEW DISCOVERY – WIDE MINERALIZED ZONE

- *200 g/t silver equivalent & 0.28 g/t gold over 10.50 meters (97.4 g/t silver) from 154.5-165.0m.

- *New silver-gold target.

- * Hole drilled 160 meters from high grade hole LC-25-010.

- SHALLOW, NEAR-SURFACE MINERALIZATION

- Mineralization starts at approximately 135 meters vertical depth.

- *Multiple mineralization styles including massive sulphides.

- * Strong pathfinder elements (antimony, indium, bismuth, and tellurium) indicate larger system.

- SIGNIFICANT DISCOVERY POTENTIAL

- Less than 5% of property explored.

- *8.5 km2 consolidated historic mining district.

- *Multiple untested structures and veins.

- *Located in Mexico’s prolific Parral Silver District.

President, Scott Emerson commented, ‘The gold rich silver mineralization intersected in this hole is an exciting discovery on a previously unknown structure. The mineralized intercepts in this hole and hole LC-25-010 are significantly wider than those historically reported and mined by ASARCO for the Soledad mineralization. This new discovery, potentially adds a 3rd structure in what is a new area and the gold values significantly enhance the value of the mineralization. This mineralization is believed to be similar to that of the old La Prieta mine whose tailings are being reprocessed at GoGold’s, Parral operation. In addition, it opens the potential for additional significant discoveries in, to-date, untested structures which can be mapped at surface.’

Vice President of Exploration, Kieran Downes Ph.D., P.Geo. noted ‘The property continues to deliver exciting and promising results that show the potential for additional, new high-grade discoveries. There are many kilometers of veins/structures, all of which are prospective especially where dilatant zones for mineralization may be created by changes in attitude, splays, lithologic contacts and intersections. The shape of the mineralization may vary from simple vein to chimney to manto. The role of the intrusion intersected at depth, if any, will be evaluated in conjunction with the receipt of assays.’

Hole LC-25-008 was drilled to test two separate targets.

Hole LC-25-008 was drilled to test two separate targets.

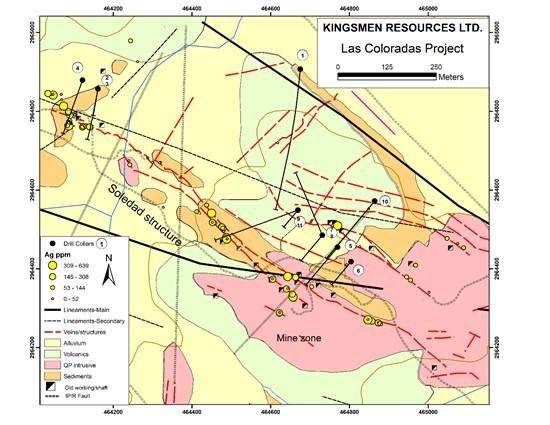

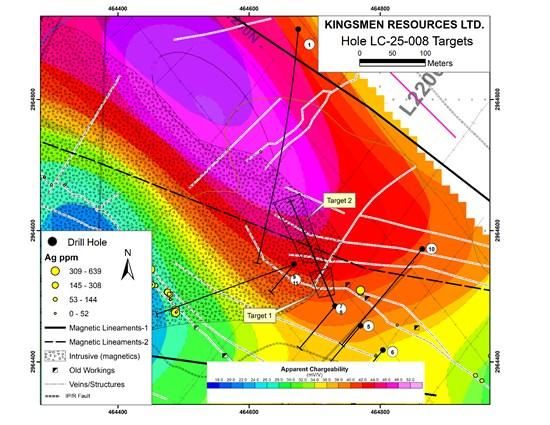

- Target 1 was the intersection of a NE-trending vein/structure with a flexure/cymoid curve in a NW-trending vein/structure at the margin of a magnetic high (Figures 1 and 2). The flexure is approximately 400 meters long and may have may have created a dilatant zone(s) in Target 1 and beyond. The hole bottomed in intrusive confirming the interpretation of the magnetics. Target 1 returned the significant intersection reported here (Table 1).

- Target 2 was the intersection of NW-trending and NE-trending structures/vein systems, in an area of high chargeability and resistivity, at the margin of a magnetic high/intrusive (Figure 2). Assays are pending.

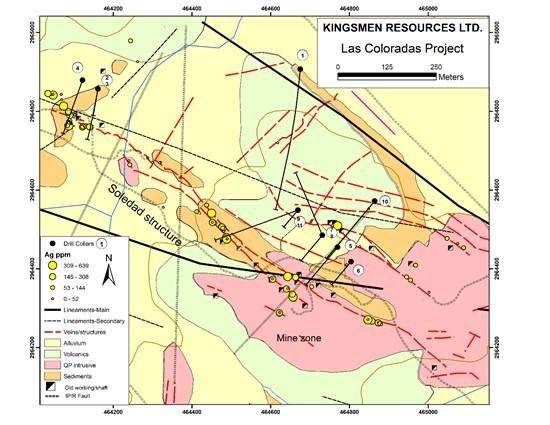

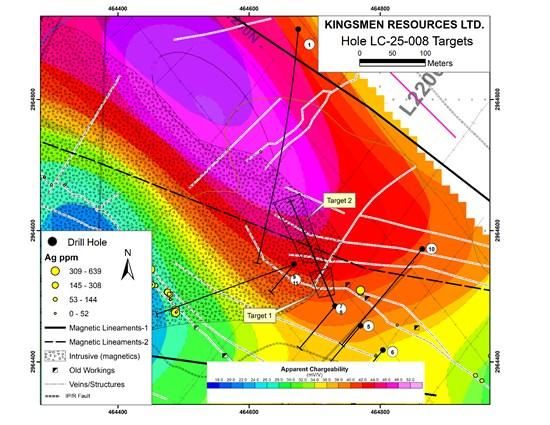

Hole LC-25-008 (Table 1; Table 2; Table 3) intersected an alteration zone with massive sulphide mineralization from approximately 154.5 to 165.0 meters (10.50 meters) downhole. The silver rich massive sulphide mineralization comprises sphalerite, galena, arsenopyrite, and pyrite (Figure 3 and 4). The mineralization is strongly anomalous in pathfinder elements antimony, bismuth, indium, arsenic and tellurium (Table 1). Silver values vary with galena-sphalerite content. Significant gold is associated with the high-grade silver mineralization and varies with the arsenopyrite content. Of note is the presence of associated elevated to anomalous tellurium, a significant indicator of gold mineralization. The mineralization exhibits late-stage faulting and brecciation. The hole bottomed in a fine to medium grained feldspar porphyry carrying disseminated pyrite confirming the interpretation of the magnetics.

The mineralized zone has a brecciated section from 155.95 to 157.0 meters composed of translucent quartz veins, white quartz, and masses of sulfides arranged in a stockwork. Sphalerite predominates with pyrite, smaller amounts of galena and arsenopyrite are also present. Arsenopyrite predominates in the quartz veining. From 157.0 to 158.45 m, there is a cavity with clusters of arsenopyrite, pyrite, galena, sphalerite and druses with prismatic quartz and possibly jamesonite crystals. The host rocks are sediments displaying moderate shear deformation, intense green chloritic alteration and silicification.

Table 1 Analyses

| Hole |

From |

To |

Width |

Au ppm |

Ag ppm |

As ppm |

Bi ppm |

Cu ppm |

In ppm |

Pb ppm |

Sb ppm |

Te ppm |

Zn ppm |

| LC-25-008 |

143.60 |

144.40 |

0.80 |

0.005 |

1.2 |

548 |

1.5 |

18.1 |

0.974 |

121 |

17.85 |

0 |

2800 |

| LC-25-008 |

144.40 |

144.80 |

0.40 |

0.005 |

1.48 |

499 |

1.72 |

13.4 |

0.93 |

194 |

5.45 |

0 |

2110 |

| LC-25-008 |

144.80 |

145.20 |

0.40 |

0.006 |

1.4 |

572 |

1.57 |

13.4 |

0.152 |

175 |

3.07 |

0.05 |

194 |

| LC-25-008 |

145.20 |

146.00 |

0.80 |

0.005 |

0.69 |

183.5 |

0.81 |

19.1 |

0.066 |

79 |

2.49 |

0 |

93 |

| LC-25-008 |

146.00 |

147.00 |

1.00 |

0.005 |

1.44 |

136 |

2.48 |

19.5 |

0.388 |

76 |

1.78 |

0 |

921 |

| LC-25-008 |

147.00 |

147.40 |

0.40 |

0.008 |

2 |

589 |

5.56 |

18 |

1.31 |

92 |

3.99 |

0.1 |

6570 |

| LC-25-008 |

147.40 |

148.00 |

0.60 |

0 |

0.58 |

71.1 |

1.16 |

20 |

0.049 |

23 |

1.17 |

0 |

105 |

| LC-25-008 |

148.00 |

149.00 |

1.00 |

0 |

0.58 |

88 |

1.02 |

24.1 |

0.056 |

33 |

3.33 |

0 |

86 |

| LC-25-008 |

149.00 |

150.00 |

1.00 |

0 |

0.88 |

176.5 |

1.36 |

22.9 |

0.087 |

74 |

4.03 |

0 |

138 |

| LC-25-008 |

150.00 |

151.00 |

1.00 |

0 |

0.94 |

96.3 |

1.68 |

28.6 |

0.069 |

39 |

2.19 |

0 |

104 |

| LC-25-008 |

151.00 |

151.60 |

0.60 |

0.005 |

1.18 |

144 |

1.8 |

23.5 |

0.111 |

112 |

8.1 |

0 |

274 |

| LC-25-008 |

151.60 |

152.30 |

0.70 |

0 |

0.75 |

80.7 |

1.5 |

30.8 |

0.07 |

39 |

1.86 |

0 |

133 |

| LC-25-008 |

152.30 |

153.00 |

0.70 |

0 |

0.65 |

148.5 |

0.94 |

20.4 |

0.154 |

44 |

2.56 |

0 |

214 |

| LC-25-008 |

153.00 |

153.50 |

0.50 |

0 |

0.66 |

51.9 |

1.14 |

21.7 |

0.033 |

36 |

2.18 |

0 |

58 |

| LC-25-008 |

153.50 |

154.00 |

0.50 |

0.007 |

1.62 |

425 |

2 |

31.4 |

1.1 |

154 |

4.6 |

0 |

3210 |

| LC-25-008 |

154.00 |

154.50 |

0.50 |

0 |

1.16 |

244 |

0.93 |

21.1 |

0.135 |

112 |

12.65 |

0 |

126 |

| LC-25-008 |

154.50 |

155.00 |

0.50 |

0.007 |

14.1 |

446 |

4.28 |

23.4 |

1.77 |

2490 |

34 |

0.26 |

1895 |

| LC-25-008 |

155.00 |

155.50 |

0.50 |

0.009 |

8.91 |

866 |

3.45 |

26.9 |

1.06 |

1420 |

23.4 |

0.19 |

1260 |

| LC-25-008 |

155.50 |

155.95 |

0.45 |

0.015 |

23.3 |

2200 |

14.1 |

32.6 |

4.91 |

3780 |

87.9 |

1.09 |

8090 |

| LC-25-008 |

155.95 |

156.20 |

0.25 |

0.077 |

395 |

>10000 |

400 |

141 |

86.9 |

61400 |

296 |

18.25 |

123000 |

| LC-25-008 |

156.20 |

156.40 |

0.20 |

0.051 |

70 |

>10000 |

48.1 |

39.7 |

8.51 |

11500 |

64.3 |

2.46 |

18650 |

| LC-25-008 |

156.40 |

156.70 |

0.30 |

0.169 |

968 |

>10000 |

771 |

208 |

169 |

154000 |

2640 |

20.6 |

250000 |

| LC-25-008 |

156.70 |

157.00 |

0.30 |

0.569 |

568 |

>10000 |

359 |

48.5 |

21.2 |

108000 |

708 |

11.7 |

30100 |

| LC-25-008 |

157.00 |

158.00 |

1.00 |

1.825 |

373 |

>10000 |

525 |

119.5 |

59.5 |

71700 |

9640 |

16.7 |

100500 |

| LC-25-008 |

158.00 |

158.45 |

0.45 |

1.62 |

69.1 |

>10000 |

227 |

9 |

2.44 |

3050 |

1085 |

7.5 |

3990 |

| LC-25-008 |

158.45 |

159.00 |

0.55 |

0.047 |

6.2 |

>10000 |

19.65 |

5.7 |

0.697 |

501 |

134.5 |

0.24 |

1320 |

| LC-25-008 |

159.00 |

159.55 |

0.55 |

0.206 |

11.9 |

>10000 |

61.5 |

10.4 |

1.145 |

1405 |

672 |

1.48 |

3030 |

| LC-25-008 |

159.55 |

160.20 |

0.65 |

0.007 |

4.13 |

252 |

2 |

18.6 |

0.215 |

60 |

29.3 |

0 |

308 |

| LC-25-008 |

160.20 |

160.90 |

0.70 |

0.015 |

2.62 |

845 |

2.66 |

18.6 |

1.025 |

104 |

31.2 |

0 |

3040 |

| LC-25-008 |

160.90 |

161.50 |

0.60 |

0 |

0.53 |

85 |

1.07 |

22.6 |

0.059 |

30 |

28.8 |

0 |

110 |

| LC-25-008 |

161.50 |

162.50 |

1.00 |

0.011 |

2.46 |

342 |

15.35 |

26.2 |

0.531 |

62 |

34.1 |

0 |

2580 |

| LC-25-008 |

162.50 |

163.00 |

0.50 |

0.024 |

1.94 |

77.2 |

1.56 |

18.8 |

0.178 |

22 |

22.4 |

0 |

128 |

| LC-25-008 |

163.00 |

164.00 |

1.00 |

0.013 |

2.1 |

1060 |

2.98 |

23.6 |

0.169 |

32 |

21 |

0 |

441 |

| LC-25-008 |

164.00 |

165.00 |

1.00 |

0.017 |

3.27 |

574 |

2.59 |

23.6 |

0.172 |

37 |

33.2 |

0 |

91 |

| LC-25-008 |

165.00 |

165.50 |

0.50 |

0.015 |

0.99 |

863 |

0.84 |

15.4 |

0.215 |

18.8 |

21.5 |

0.07 |

65 |

| LC-25-008 |

165.50 |

166.60 |

1.10 |

0 |

0.64 |

87.7 |

2.79 |

20.2 |

0.028 |

26.5 |

12.35 |

0 |

63 |

True width cannot be determined at this time and reported widths are drilled intervals.

Table 2 Silver equivalents

| Hole |

|

From |

To |

Width(m) |

Ag Eq ppm |

Ag ppm |

Au ppm |

Pb% |

Zn% |

| LC-25-008 |

|

154.50 |

165.00 |

10.50 |

200 |

97.4 |

0.28 |

1.66 |

2.22 |

| |

incl |

155.95 |

159.55 |

3.60 |

496 |

274 |

0.81 |

4.81 |

6.26 |

| |

incl |

155.50 |

158.45 |

2.95 |

623 |

355 |

0.95 |

5.79 |

7.61 |

| |

incl |

155.50 |

158.00 |

2.50 |

688 |

383 |

0.83 |

6.78 |

8.9 |

| |

incl |

156.40 |

158.00 |

1.60 |

931 |

521 |

1.28 |

9.39 |

11.53 |

The silver equivalent calculation formula is AgEq(g/t) = ((Ag grade (g/t) x (Ag price per ounce/31.10348) x Ag recovery) + (Pb grade (%) x (Pb price per tonne/100) x Pb recovery) + (Zn grade (%) x (Zn price per tonne/100) x Zn recovery) + (Au grade (g/t) x (Au price per ounce/31.10348) x Au recovery)) / (Ag price per ounce/31.10348 x Ag recovery). The prices used were US$3675/oz gold, US$2960/t zinc, US$2003/t lead and US$42/oz silver. Recoveries are estimated at 40% for gold, 91% for lead, 85% for zinc and 92% for silver based on published figures by Kootenay Silver Inc. for sulphide mineralization in the Cigarra deposit, Chihuahua, Mexico, a deposit with similar style mineralization (https://kootenaysilver.com/news/kootenay/2024/kootenay-silver-announces-updated-mineral-resource-estimate-for-la-cigarra-project-chihuahua-mexico).

Table 3 Collar and survey table

| Hole_ID |

Easting |

Northing |

Elevation |

Az |

Dip |

EOH |

| LC-25-001 |

464675 |

2964907 |

1630 |

185 |

-50 |

594.00 |

| LC-25-002 |

464161 |

2964857 |

1634 |

190 |

-50 |

201.00 |

| LC-25-003 |

464161 |

2964857 |

1634 |

190 |

-70 |

200.35 |

| LC-25-004 |

464122 |

2964879 |

1634 |

200 |

-45 |

203.45 |

| LC-25-005 |

464770 |

2964455 |

1661 |

220 |

-60 |

248.45 |

| LC-25-006 |

464804 |

2964418 |

1660 |

220 |

-60 |

152.85 |

| LC-25-007 |

464731 |

2964485 |

1662 |

220 |

-60 |

167.60 |

| LC-25-008 |

464731 |

2964485 |

1660 |

337 |

-70 |

506.80 |

| LC-25-009 |

464669 |

2964549 |

1660 |

220 |

-75 |

215.65 |

| LC-25-010 |

464864 |

2964572 |

1651 |

220 |

-45 |

269.45 |

| LC-25-011 |

464669 |

2964549 |

1660 |

250 |

-45 |

315.80 |

| LC-25-012 |

463522 |

2964744 |

1640 |

45 |

-45 |

151.80 |

Figure 1

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9640/276747_0124ba7af4384ae1_009full.jpg

Figure 2

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9640/276747_0124ba7af4384ae1_010full.jpg

Figure 3 Mineralization

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9640/276747_0124ba7af4384ae1_011full.jpg

Figure 4 Mineralization (part) – split core

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9640/276747_0124ba7af4384ae1_012full.jpg

Holes 5, 6, 7 and 10 tested a 100-meter length of the Soledad system centered on the Soledad shaft. Holes 9 and 11 tested the structure in the area of the Rosario shaft. Holes 2, 3 and 4 tested a 50-meter segment of the Soledad structure/vein system in the DBD target. Hole 12 tested under old workings on the Soledad II structure/vein system. Holes1 and 8 tested a geological/geophysical target. The target was the intersection of NW-trending and NE-trending structures/vein systems, in an area of high chargeability and resistivity on an interpreted NW-trending magnetic structure.

QAQC

The drill core (HQ size) was geologically logged and sampled. The full drill core was sawn with a diamond blade rock saw. One half of the sawn drill core was bagged and tagged for analysis. The remaining half portion was returned to the drill core tray and stored. Bagged samples are securely stored prior to submission for analysis. Samples were submitted to ALS Geochemistry-Chihuahua for multielement analysis following four-acid digestion (code ME-MS61), and gold by fire assay-AA (code Au-AA23). Quality assurance and quality control (QA/QC) is maintained by the systematic insertion of certified standard reference materials (CSRM), blanks and duplicates into the sample stream. Assay results will be announced following receipt, compilation and confirmation. ALS Geochemistry operates under a Global Geochemistry Quality Manual that complies with ISO/IEC 17025:2017.

About Las Coloradas

The Las Coloradas Project (8.5 km2 -3.3 sq miles) represents a consolidation of a historic mining district which covers numerous silver-gold-lead-zinc-copper mines previously exploited by ASARCO (American Smelting and Refining Company), the U.S. based subsidiary of Grupo Mexico.

Las Coloradas is in the Parral mining district of the Central Mexican Silver Belt, and is located approximately 30 kilometers southeast of the city of Hidalgo de Parral and 40 kilometers east of the San Francisco de Oro and Santa Barbara mining districts where several old major mines are located, such as La Prieta, Veta Colorada, Palmilla, Esmeralda, San Francisco del Oro and Santa Barbara. Click here to see locator map: https://www.kingsmenresources.com/area-history

Qualified Person

Kieran Downes, Ph.D., P.Geo., a director of Kingsmen and Qualified Person as defined by National Instrument 43-101, has reviewed and approved the scientific and technical disclosure set out in this news release.

About Kingsmen Resources

Kingsmen Resources is a mineral exploration company focused on advancing its 100% held projects, the Las Coloradas silver/gold project and Almoloya gold/silver project located in the prolific mining district of Parral Mexico. The projects host historic past producing high-grade silver mines. They are considered to be prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other, on-trend, high-grade deposits. In addition, the company has a 1% NSR on the La Trini claims which form part of the Los Ricos North project operated by GoGold Resources Inc. in Mexico. Kingsmen is a publicly-traded company (TSXV: KNG,OTC:KNGRF) (OTCQB: KNGRF) (FSE: TUY) and is headquartered in Vancouver, British Columbia.

On behalf of the Board,

Signed: ‘Scott Emerson‘

Scott Emerson, President & CEO

Phone: 6046859316

Email: se@kingsmenresources.com

Follow us on: LinkedIn, Instagram and X

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements:

Certain disclosure contained in this news release may constitute forward-looking information or forward-looking statements, within the meaning of Canadian securities laws. These statements may relate to this news release and other matters identified in the Company’s public filings. In making the forward-looking statements the Company has applied certain factors and assumptions that are based on the Company’s current beliefs as well as assumptions made by and information currently available to the Company. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. These risks and uncertainties include but are not limited to: the political environment in which the Company operates continuing to support the development and operation of mining projects; the threat associated with outbreaks of viruses and infectious diseases; risks related to negative publicity with respect to the Company or the mining industry in general; planned work programs; permitting; and community relations. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276747

Locksley Resources (LKY:AU) has announced Trading Halt

Locksley Resources (LKY:AU) has announced Trading Halt

Hole LC-25-008 was drilled to test two separate targets.

Hole LC-25-008 was drilled to test two separate targets.