(TheNewswire)

|

|||||||||

|

|

|

|||||||

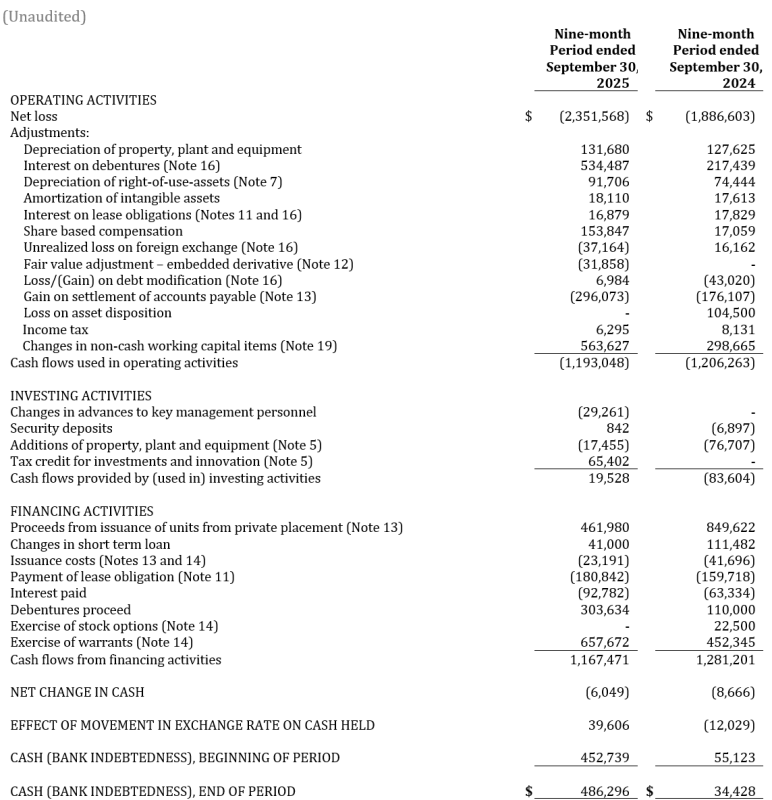

Brossard, Quebec, November 28, 2025 TheNewswire – CHARBONE CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (‘ CHARBONE ‘ or the ‘ Company ‘), a North American producer and distributor specializing in clean Ultra High Purity (‘ UHP ‘) hydrogen and strategic industrial gases today announces its financial and operational results for the three and nine-month periods ending September 30, 2025.

Construction of the Sorel-Tracy facility Phase 1A is completed. All components are installed and connected on-site and commissioning testing in progress, remaining on track to start production of first hydrogen molecule in the coming days.

Q3 2025 HIGHLIGHTS:

-

Net operating loss decreased by 17% to $577,159 in the 3-months period ending September 30, 2025, down from $697,894 in Q2 2025 (activities still tightening general and administrative expenses).

-

Recognition of revenues following the advancement of activities from the Master Collaborative Agreement to support the deployment of a Malaysian green hydrogen project development announced in Q2 2025.

-

On September 30, 2025, the Company issued new secured convertible debentures to replace previous convertible debentures and with an additional amount of $303,634 for a total of $2,050,000. The replacement debentures are bearing monthly interests at a 12% annual rate, convertible at $0.07 per share and maturing in one year.

-

Following the signature of an Asset Purchase Agreement with Harnois Énergies Inc., CHARBONE has completed the acquisition and reinstallation at its Sorel-Tracy site of the operational hydrogen production and refueling equipment. On October 6, 2025, the Company has issued 13,333,334 common shares at $0.075 per share, representing $1 million in equity consideration to Harnois Énergies Inc. as a part of the payment of the acquisition transaction.

CHARBONE’s disciplined financial management, and new strategic partnerships position the company to achieve its vision of becoming a North American leader in clean UHP hydrogen and industrial gases distribution networks. These advancements underscore its commitment to being a game-changer in the energy transition.

Management is motivated to keep working on structuring deals to finance further project investments and expansion,’ said Benoit Veilleux, Chief Financial Officer and Corporate Secretary of CHARBONE . ‘CHARBONE is moving into execution mode to unlock its strong growth potential .

Click Image To View Full Size

Click Image To View Full Size

About CHARBONE CORPORATION

CHARBONE is a developer and producer of clean Ultra High Purity (UHP) hydrogen with a growing industrial gas distribution platform. Through a modular approach, CHARBONE is focused on developing a network of clean hydrogen production facilities throughout North America and select markets abroad, starting with its flagship Sorel-Tracy project in Quebec. The Company’s integrated model reduces risk, enhances scalability, and enables diversified revenue streams through partnerships in helium and other specialty gases. CHARBONE is committed to supporting the global transition to a lower-carbon economy by providing accessible, decentralized clean hydrogen and specialty gas solutions while supporting underserved industrial gas customers and accelerating the shift to localized clean energy. CHARBONE is listed on the TSX Venture Exchange (TSXV: CH) , the OTC Markets (OTCQB: CHHYF) , and the Frankfurt Stock Exchange (FSE: K47) . For more information, please visit: www.charbone.com .

Forward-Looking Statements

This news release contains statements that are ‘forward-looking information’ as defined under Canadian securities laws (‘forward-looking statements’). These forward-looking statements are often identified by words such as ‘intends’, ‘anticipates’, ‘expects’, ‘believes’, ‘plans’, ‘likely’, or similar words. The forward-looking statements reflect management’s expectations, estimates, or projections concerning future results or events, based on the opinions, assumptions and estimates considered reasonable by management at the date the statements are made. Although Charbone believes that the expectations reflected in the forward-looking statements are reasonable, forward-looking statements involve risks and uncertainties, and undue reliance should not be placed on forward-looking statements, as unknown or unpredictable factors could cause actual results to be materially different from those reflected in the forward-looking statements. The forward-looking statements may be affected by risks and uncertainties in the business of Charbone. These risks, uncertainties and assumptions include, but are not limited to, those described under ‘Risk Factors’ in the Corporation’s Filing Statement dated March 31, 2022, which is available on SEDAR at www.sedar.com; they could cause actual events or results to differ materially from those projected in any forward-looking statements.

Except as required under applicable securities legislation, Charbone undertakes no obligation to publicly update or revise forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release .

|

Contact Charbone Hydrogen Corporation |

|

|

Telephone: +1 450 678 7171 |

|

|

Email: ir@charbone.com Benoit Veilleux CFO and Corporate Secretary |

|

Copyright (c) 2025 TheNewswire – All rights reserved.

News Provided by TheNewsWire via QuoteMedia

Discovery Ridge Pit, Griffon Gold Mine Project, White Pine County, Nevada

Discovery Ridge Pit, Griffon Gold Mine Project, White Pine County, Nevada

Rapid Critical Metals Limited (‘Rapid,’ ‘RCM’ or ‘Company’) is pleased to announce that it has completed the acquisition of the Webbs Consol Silver Project (Webbs Consol) in northeast New South Wales, comprising EL 8933 and EL 9454 from Lode Resources Limited (ASX: LDR) (Lode Resources).

Rapid Critical Metals Limited (‘Rapid,’ ‘RCM’ or ‘Company’) is pleased to announce that it has completed the acquisition of the Webbs Consol Silver Project (Webbs Consol) in northeast New South Wales, comprising EL 8933 and EL 9454 from Lode Resources Limited (ASX: LDR) (Lode Resources).

Corazon Mining Ltd (ASX:CZN) (‘Corazon’ or ‘Company’) is pleased to announce the granting of two key tenements at its Two Pools Gold Project (‘Two Pools’ or the ‘Project’) in the Gascoyne region of Western Australia (Figure 1).

Corazon Mining Ltd (ASX:CZN) (‘Corazon’ or ‘Company’) is pleased to announce the granting of two key tenements at its Two Pools Gold Project (‘Two Pools’ or the ‘Project’) in the Gascoyne region of Western Australia (Figure 1).