Red Metal Resources Ltd. (CSE: RMES,OTC:RMESF) (OTC Pink: RMESF) (FSE: I660) (‘Red Metal’ or the ‘Company’) is pleased to announce it has commenced a detailed LiDAR (Light Detection and Ranging) survey over the Carrizal property, focusing on the Farellon Project.

Highlights

- Data collection is expected to be completed between February 2nd and 8th.

- LiDAR provides high-resolution, three-dimensional maps of surface features at cm scale resolution. It operates by emitting laser pulses toward the ground from an aircraft or a drone and measuring the time it takes for the pulses to return after reflecting off the surface. Applying hillshading at multiple angles to the data reveals structural lineaments and offsets that are not visible in satellite imagery, giving a clear vision of the tectonic framework.

- The LiDAR survey over the Farellon portion of the Carrizal Property will be used to aid in extending vein hosting structures out from mapped extents, identify historic workings that have been filled over time and are no longer obvious at surface or through satellite imagery, conduct detailed geological contact mapping, and identify any subtle structures with potential to be pathways for mineralization.

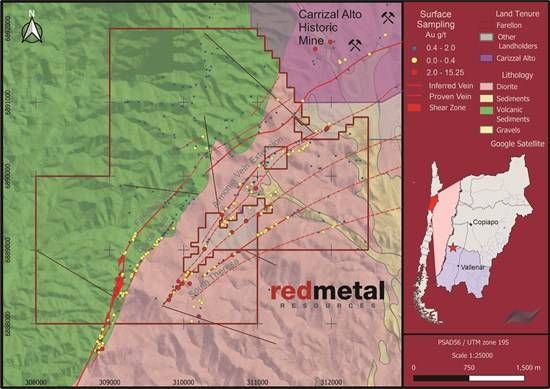

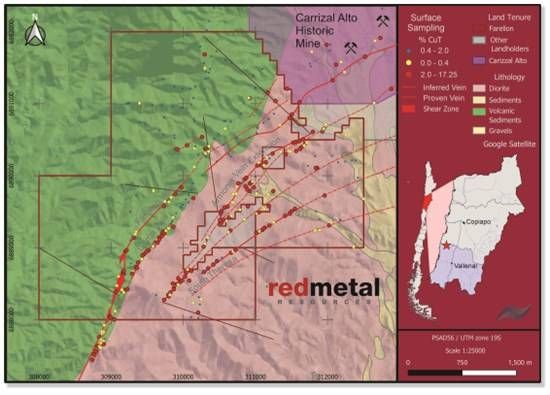

Prior surface work on the Carrizal Property identified distinct mineralization zonation. The South Theresa and Armonia veins in the southeast of the project show a higher gold-to-copper ratio compared to the Farellon and Gorda veins in the west (Figures 1 & 2). The LiDAR data, combined with existing extensive surface sampling and mapping, will be instrumental in developing high-priority drill targets for future drilling.

Red Metal Resources President and CEO, Caitlin Jeffs, stated: ‘Utilizing high-resolution LiDAR allows us to identify historic workings and subtle structural pathways that satellite imagery simply cannot catch. This is a cost-effective way to develop better targets focusing on the most promising gold and copper zones identified in our recent surface programs.’

The LiDAR survey will be flown over 1,293 hectares using a DJI Matrice 300 + LiDAR L2 scanner used by Red Rock SpA.

Figure 1: Historic gold surface samples with proven and inferred mapped veins

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4932/282668_0de75dde244b2ad1_001full.jpg

Figure 2: Historic copper surface samples with proven and inferred mapped veins

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4932/282668_0de75dde244b2ad1_002full.jpg

Highlights of surface sampling on the Farellon Property, including samples taken in 1996, 2012, 2022 and 2025.

Table 1: Grab Sample Highlights (1)(2)

| Easting UTM |

Northing UTM |

Year Sampled |

CuT % Total Cu |

Au g/t |

| 315582 | 6891342 | 1996 | 9.99 | 0.8 |

| 313429 | 6891457 | 1996 | 8.73 | 0.5 |

| 311948 | 6890653 | 1996 | 6.15 | 0.5 |

| 311278 | 6891037 | 1996 | 6.15 | 0.5 |

| 311113 | 6889560 | 1996 | 1.27 | 13.5 |

| 308110 | 6893340 | 1996 | 1.74 | 12.1 |

| 308019 | 6893061 | 1996 | 1.48 | 10.4 |

| 308868 | 6885882 | 1996 | 4.23 | 9.7 |

| 310652 | 6889237 | 1996 | 3.94 | 9.4 |

| 308040 | 6892737 | 1996 | 1.06 | 7.9 |

| 310281 | 6889013 | 1996 | 2.25 | 7.4 |

| 308351 | 6885794 | 1996 | 3.00 | 5.5 |

| 307880 | 6892676 | 1996 | 1.12 | 5.2 |

| 308208 | 6893642 | 1996 | 0.69 | 4.7 |

| 310281 | 6889013 | 1996 | 1.46 | 4.2 |

| 308006 | 6893075 | 1996 | 1.98 | 3.9 |

| 308838 | 6887625 | 1996 | 1.89 | 3.7 |

| 309888 | 6889743 | 2012 | 5.78 | 0.1 |

| 309490 | 6888943 | 2022 | 6.26 | 1.7 |

| 310916 | 6891077 | 2022 | 5.77 | 0.1 |

| 310082 | 6888543 | 2022 | 3.70 | 4.9 |

| 309800 | 6888323 | 2022 | 4.59 | 3.4 |

| 310602 | 6888689 | 2025 | 17.25 | 5.0 |

| 310368 | 6889189 | 2025 | 8.00 | 0.7 |

| 309378 | 6888671 | 2025 | 7.23 | 1.9 |

(1) Management cautions that prospecting surface rock samples and associated assays, as discussed herein, are selective by nature and represent a point location, and therefore may not necessarily be fully representative of the mineralized horizon sampled.

(2) This table represents a selection of highlights including 25 samples out of 422 samples taken.

Qualified Person

The technical content of this news release has been reviewed and approved by Caitlin Jeffs, P. Geo, who is a Qualified Person (‘QP’) as defined in National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About Red Metal Resources Ltd.

Red Metal Resources is a mineral exploration company focused on growth through acquiring, exploring and developing clean energy and strategic minerals projects. The Company’s portfolio of projects includes seven separate mineral claim blocks and mineral claim applications, highly prospective for Hydrogen, covering 172 mineral claims and totalling over 4,546 hectares, located in Ville Marie, Quebec and Larder Lake, Ontario, Canada. As well, the Company has a Chilean copper project, located in the prolific Candelaria iron oxide copper-gold (IOCG) belt of Chile’s coastal Cordillera. Red Metal is quoted on the Canadian Securities Exchange under the symbol RMES, on OTC Link alternative trading system on the OTC Pink marketplace under the symbol RMESF and on the Frankfurt Stock Exchange under the symbol I660.

For more information, visit www.redmetalresources.com

Contact:

Red Metal Resources Ltd.

Caitlin Jeffs, President & CEO

1-866-907-5403

invest@redmetalresources.com

www.redmetalresources.com

Forward-Looking Statements – All statements in this press release, other than statements of historical fact, are ‘forward-looking information’ within the meaning of applicable securities laws. Red Metal provides forward-looking statements for the purpose of conveying information about current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. These risks and uncertainties include but are not limited to the ability to raise adequate financing, receipt of required approvals, as well as those risks and uncertainties identified and reported in Red Metal’s public filings under its SEDAR+ profile at www.sedarplus.ca. Although Red Metal has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Red Metal disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Neither the Canadian Securities Exchange nor the Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/282668

News Provided by TMX Newsfile via QuoteMedia