(TheNewswire)

Vancouver, BC TheNewswire – February 3rd, 2026 Stellar AfricaGold Inc. (‘Stellar’ or the ‘Company’) (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold Project, located in the High Atlas Mountains of Morocco.

Results received to date confirm the presence of a structurally controlled orogenic gold system, with gold mineralization preferentially hosted within fractured diorite sills and associated carbonate-altered zones linked to secondary shear structures. These results materially advance the Company’s geological understanding of the project and provide a clear framework for follow-up drilling.

Assay results for two completed drill holes remain pending and will be released once received and validated. Following a temporary interruption due to unusually severe winter weather, diamond drilling resumed on January 30th, 2026, with at least two additional drill holes planned.

Highlights – Diamond Drilling

- Multiple gold-bearing zones intersected across several drill holes, confirming the presence and continuity of mineralization beyond the initial discovery hole TCK_001

- Best new intercept :

- TCK_006: 6.0m @ 3.81g/t Au from 69 m,

- highlights the development of higher-grade mineralization within stacked horizons

- Results support a refined structural model, with gold preferentially concentrated in competent host rocks affected by secondary shearing

- Drilling resumed on January 30th, 2026, targeting extensions of known mineralization and additional near-surface targets identified through mapping and trenching

Gold intercepts from drill hole TCK_001, including 13.0m @ 6.12g/t Au at 0.1g/t Cut-off grade, were reported previously (see Company news release dated January 8, 2026).

Updated Composite Drill Intercepts (0.20g/t Au Cut-off)

The Company has recalculated composite gold intersections for all drill holes completed to date using a 0.20g/t Au cut-off, a maximum internal dilution of 3.0 metres, and excluding dilution at interval boundaries. This compositing approach better reflects the continuity of mineralization observed within fractured diorite and carbonate-altered zones.

Table 1 below summarizes positive composite intercepts (0.2 g/t Au cut-off) from all drill holes completed to date.

Table – Summary of Gold Intercepts using 0.2 g/t Au cut-off

|

Hole ID

|

From (m)

|

To (m)

|

Interval (m)

|

Au (g/t)

|

|

TCK_001

|

76.0

|

79.0

|

3.0

|

0.47

|

|

83.0

|

87.0

|

4.0

|

1.07

|

|

89.0

|

90.0

|

1.0

|

0.25

|

|

93.0

|

99.0

|

6.0

|

3.48

|

|

125.0

|

137.0

|

12.0

|

6.62

|

|

TCK_002

|

73.0

|

74.0

|

1.0

|

0.87

|

|

79.0

|

80.0

|

1.0

|

0.35

|

|

TCK_003

|

179.0

|

182.0

|

3.0

|

0.22

|

|

104.0

|

205.0

|

1.0

|

0.23

|

|

207.0

|

209.0

|

2.0

|

0.22

|

|

TCK_004

|

79.0

|

80.0

|

1.0

|

0.96

|

|

85.0

|

86.0

|

1.0

|

0.23

|

|

89.0

|

103.0

|

4.0

|

2.45

|

|

120.0

|

121.0

|

1.0

|

1.06

|

|

TCK_006

|

0.0

|

3.0

|

3.0

|

0.6

|

|

35.0

|

48.0

|

13.0

|

0.5

|

|

55.0

|

57.0

|

2.0

|

0.51

|

|

69.0

|

75.0

|

6.0

|

3.81

|

|

87.0

|

90.0

|

3.0

|

0.47

|

Notes:

- Intervals are downhole lengths; true widths are not yet known.

- Grades are uncut, length-weighted averages.

- Composite intervals were calculated using a 0.20g/t Au cut-off with a maximum internal dilution of 3.0metres; dilution at interval boundaries is excluded.

Geological Interpretation

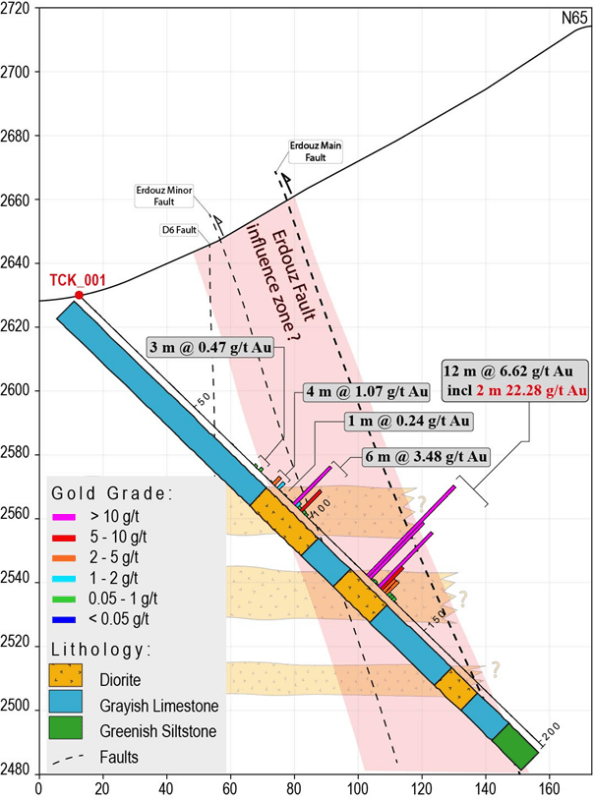

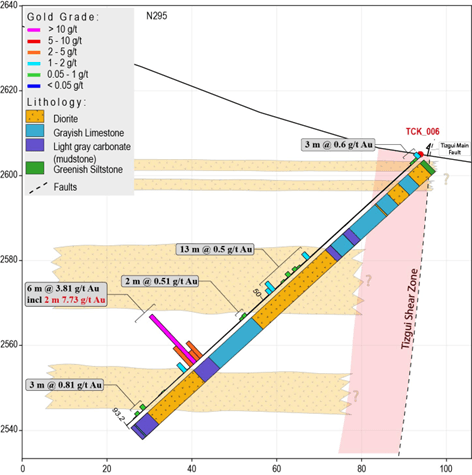

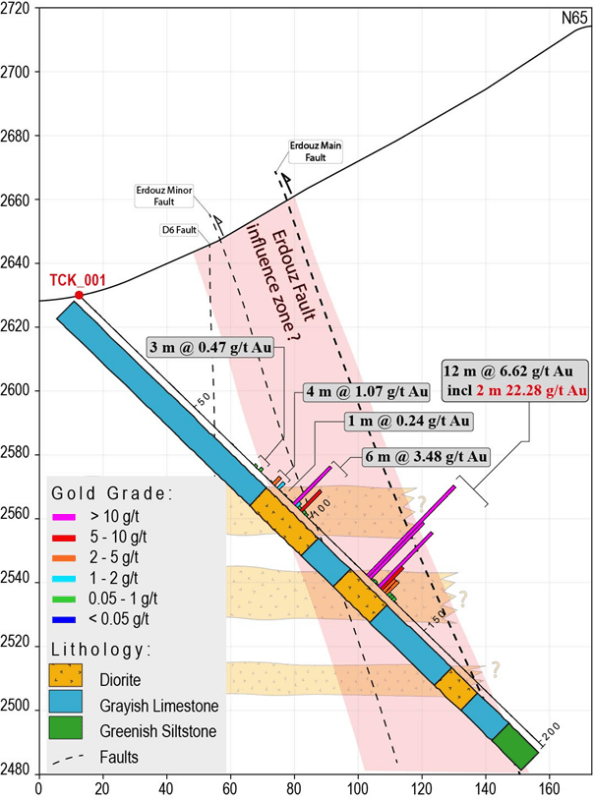

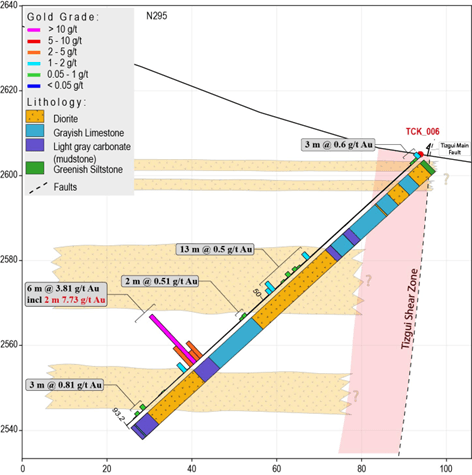

Drilling completed to date indicates that gold mineralization at Tichka Est is preferentially localized within competent lithologies, notably fractured diorite sills and adjacent carbonate units affected by secondary shear structures (cf. TCK_001 and TCK_006).

Click Image To View Full Size

Figure 1. Cross section of drillhole TCK_001 showing drillhole geology and gold assays.

Figure 2. Cross section of drillhole TCK_006 showing drillhole geology and gold assays.

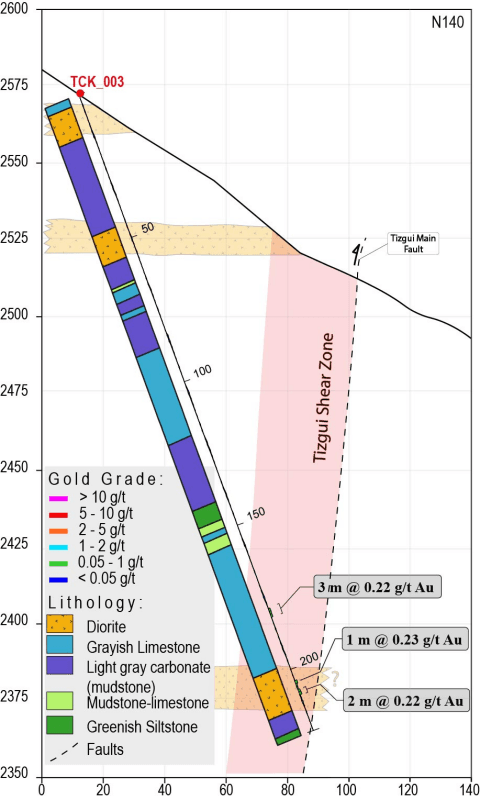

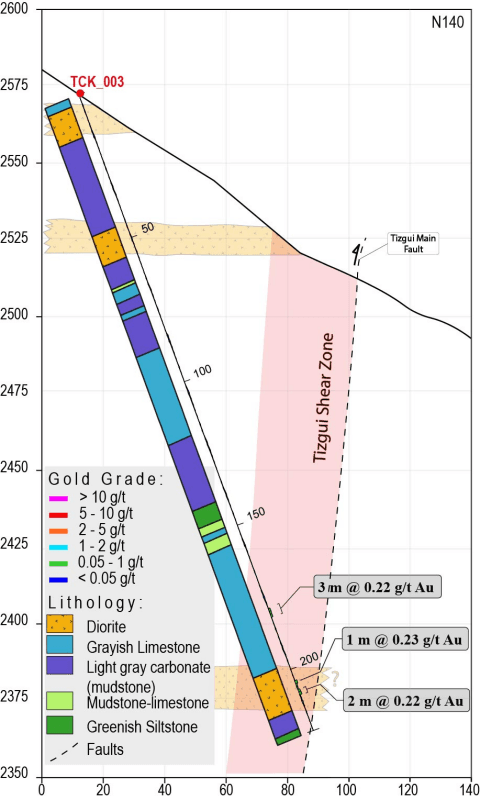

Drill hole TCK_003 intersected the Tizgui Shear Zone, characterized by intense brecciation and pervasive calcite veining, but returned limited gold values. This is interpreted to reflect efficient fluid transport along major regional structures, with gold deposition occurring preferentially in zones of elevated fracture density within rigid host rocks rather than within the shear zones themselves.

Click Image To View Full Size

Figure 3. Cross sections of drillholes TCK_003 showing drillhole geology and gold assays.

Drilling and surface observations further indicate that the mineralized diorite bodies occur predominantly as sub-horizontal sills. This geometry promotes the development of laterally extensive fracture networks within competent rocks, enhancing fluid–rock interaction and gold precipitation, particularly where these sills are intersected by secondary shear structures.

Overall, this interpretation is consistent with an orogenic gold system and refines the Company’s exploration model by delineating high-priority structural–lithological traps.

Next Steps

Now that drilling has resumed, the Company plans to :

- Continue two additional holes on the secondary shear structures interpreted to be linked to the Erdouz Fault System

- Evaluate structural repetitions and stacked mineralized horizons identified through surface and further drilling work.

CEO Commentary

Stellar President and CEO J. François Lalonde commented ‘These results confirm that Tichka Est hosts a structurally controlled gold system, with mineralization concentrated within fractured diorite and associated carbonate-altered zones rather than within the main fault zones themselves. The refined geological model and interpretations provide a clear roadmap for the next phase of drilling as operations resume.’

Quality Assurance / Quality Control

All drill core was logged, sampled, and securely transported to Afrilab, an ISO-certified laboratory in Marrakech, Morocco. Gold analyses were completed using standard fire assay methods. A comprehensive QA/QC program was implemented, including the insertion of blanks, duplicates, and certified reference materials.

The drilling campaign at Tichka Est is being conducted by two geologists from the African Bureau of Mining Consultants, under the supervision of Mr. Yassine Belkabir.

Diamond drilling was conducted using HQ diameter core. Core runs were retrieved every 3.0 m or less, with recovery measured and recorded for each run. Core was oriented with a Reflex ACT III tool, photographed (wet and dry), and logged for lithology, alteration, mineralization, and structure.

Sampling intervals for assay were typically one meter in length, defined by geological boundaries. Core was cut with a diamond saw, LHS half-core archived, and RHS half-core submitted for analysis.

Sample preparation and assaying were performed by Afrilab in Marrakech, an ISO-certified laboratory independent of the Company. Samples were crushed to 70% passing 2 mm, split to 250 g, and pulverized to 85% passing 75 μm. Gold assays were performed using 50 g fire assay with an atomic absorption spectroscopy (AAS) finish. Over-limit assays (>5 g/t Au) were re-assayed.

QA/QC program consisted of 26 reference materials (standards), 26 blanks inserted by geologists and 18 duplicates at regular intervals. In addition, Laboratory QA/QC protocols included internal blanks, standards, and duplicates, with performance reported to the exploration team for independent review. No material QA/QC issues were noted in the batches reported.

Qualified Person

The technical information contained in this release has been reviewed and approved by Yassine Belkabir, CEng MIMMM, a Stellar director and a Qualified Person under National Instrument 43-101

About the Tichka Est Gold Project

The Tichka Est Gold Project comprises seven permits covering an area of 82km2 located in the High Altas region of Morocco approximately 90km south of Marrakech. Under an earn-in agreement with Morocco’s National Office for Hydrocarbons and Mining (ONYHM) Stellar can earn an 85% interest after incurring exploration expenditures totaling US$2.39M (C$3.5M) over three years.

To date early-stage exploration (mapping, sampling, trenching and a small first pass RC drill program) has identified three gold-bearing zones: Zone A extending over 450 meters along strike, Zone B: extending over two kilometers along strike and Zone C extending over two kilometers along strike. Additionally, regional stream sediment sampling over a 12 km2 area surrounding the three known gold zones identified numerous other metal anomalous zones that warrant further mapping and sampling. In total the following anomalies have been highlighted: 6 zones anomalous for gold, 5 zones anomalous for silver, 2 zones anomalous for copper and 3 zones anomalous for lead and zinc. Most areas of the seven permits have never received any modern exploration.

For more detailed information on the Tichka Est Gold Project readers are referred to Stellar’s website at www.stellarafricagold.com.

About Stellar AfricaGold Inc.

Stellar AfricaGold Inc. is a Canadian precious metal exploration company focused on precious metals in North and West Africa, with active programs in Morocco and Côte d’Ivoire. Stellar’s principal exploration projects are its advancing gold discovery at the Tichka Est Gold Project in Morocco, and its early-stage exploration Zuénoula Gold Project in Côte d’Ivoire which is now operated in joint venture with MetalsGrove Mining Ltd subsidiary, MetalsGrove CDI Pty Ltd.

The Company is listed on the TSX Venture Exchange symbol TSX.V: SPX, the Tradegate Exchange TGAT: 6YP and the Frankfurt Stock Exchange FSX: 6YP.

The Company maintains its head office in Vancouver, BC and has a country office in Marrakech, Morocco.

Stellar’s President and CEO J. François Lalonde can be contacted at +1 514-9940654 or by email at lalondejf@stellarafricagold.com

Additional information is available on the Company’s website at www.stellarafricagold.com.

On Behalf of the Board

J. François Lalonde

President & CEO

This news release contains ‘forward-looking statements’ within the meaning of applicable Canadian securities laws, including statements regarding the grant of PSUs, the potential vesting of such PSUs upon the achievement of future production milestones, the issuance of common shares of the Company upon settlement of vested PSUs, and the acceptance of the TSX Venture Exchange.

Forward-looking statements are based on expectations, estimates and projections as at the date of this news release and are subject to known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those expressed or implied. Such risks and uncertainties include, but are not limited to, the Company not achieving the production milestones described herein, changes in business plans or commodity prices, failure to obtain regulatory approvals, and the risk factors described in the Company’s most recent Management’s Discussion and Analysis and Annual Information Form, which are available on SEDAR+ at www.sedarplus.ca.

Forward-looking statements are not guarantees of future performance and should not be unduly relied upon. Except as required by law, the Company undertakes no obligation to update or revise any forward-looking statements contained herein.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2026 TheNewswire – All rights reserved.