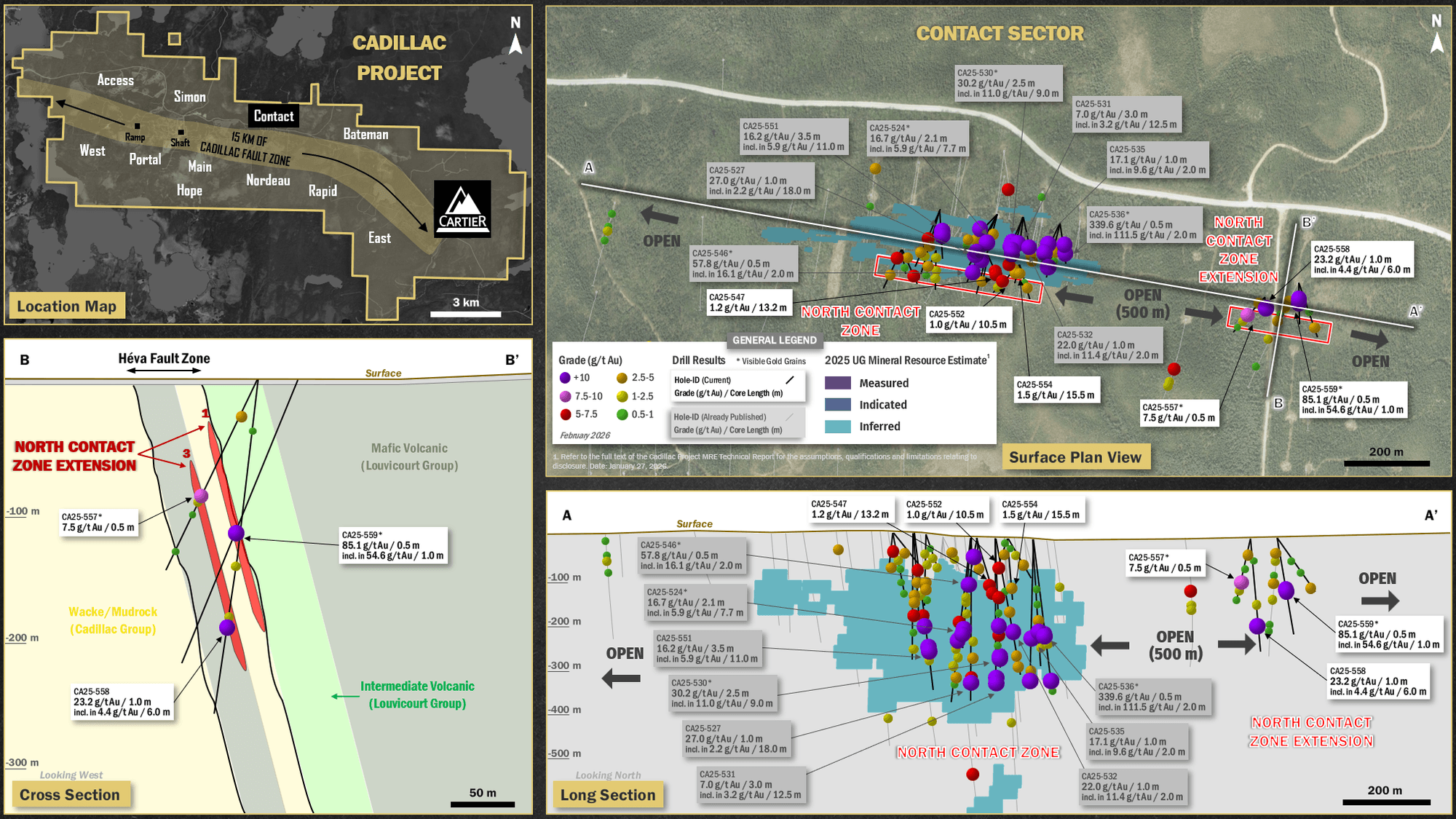

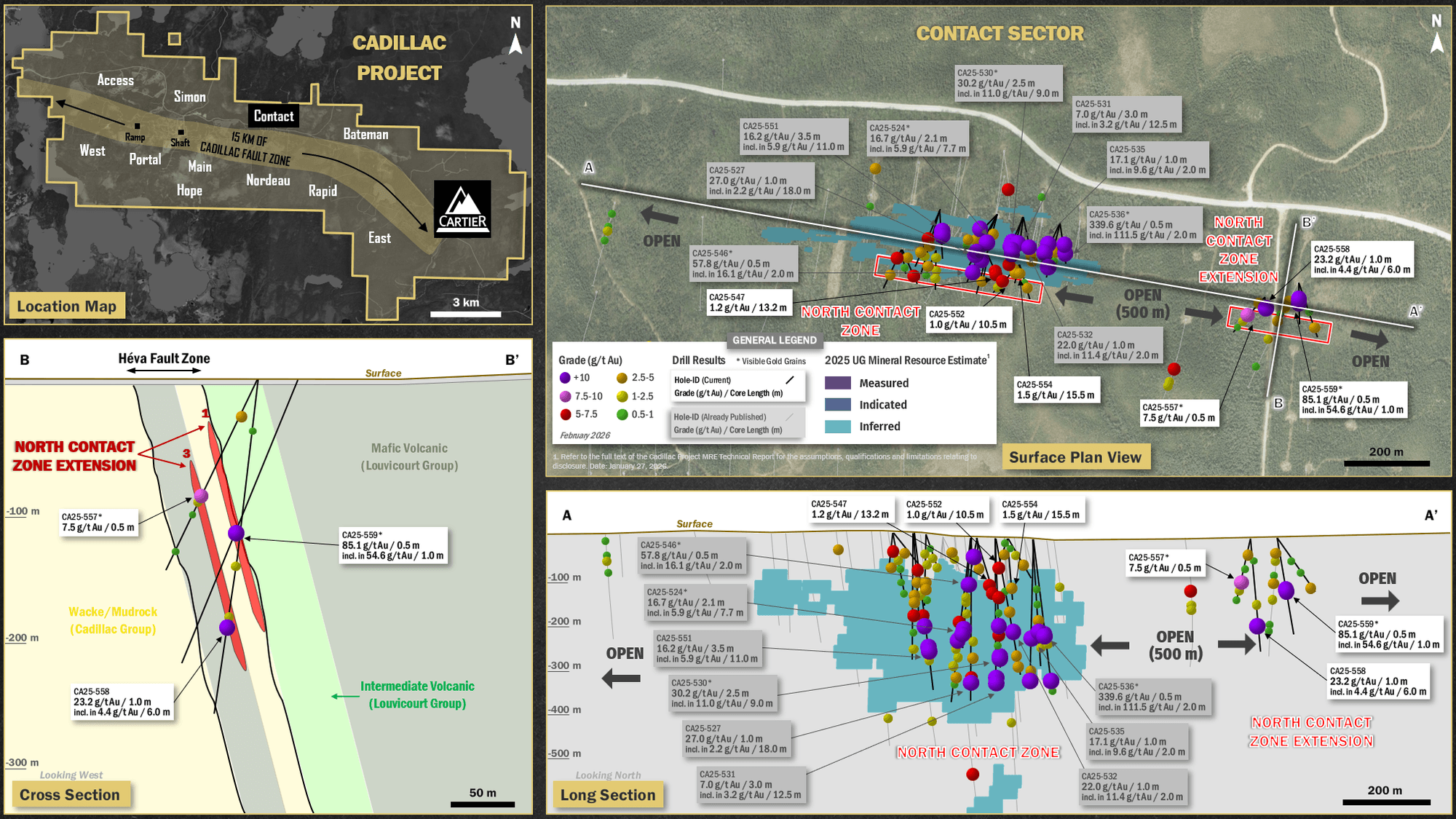

Cartier Resources Inc. (″ Cartier ″ or the ″ Company ″) (TSXV: ECR,OTC:ECRFF; FSE: 6CA) is pleased to announce the seventh batch of results from the 100,000-m drilling program (2 drill rigs), for the Contact Sector and more precisely, the North Contact Zone (″ NCZ ″) and its east extension, on the 100%-owned Cadillac Project, located in Val-d’Or (Abitibi, Quebec). The NCZ consists of three parallel high-grade gold zones: NC1, NC2 and NC3, spaced approximately 50 m apart.

Strategic Highlights from Contact Sector

Drill Hole Results (Figures 1 to 4)

NCZ East Extension

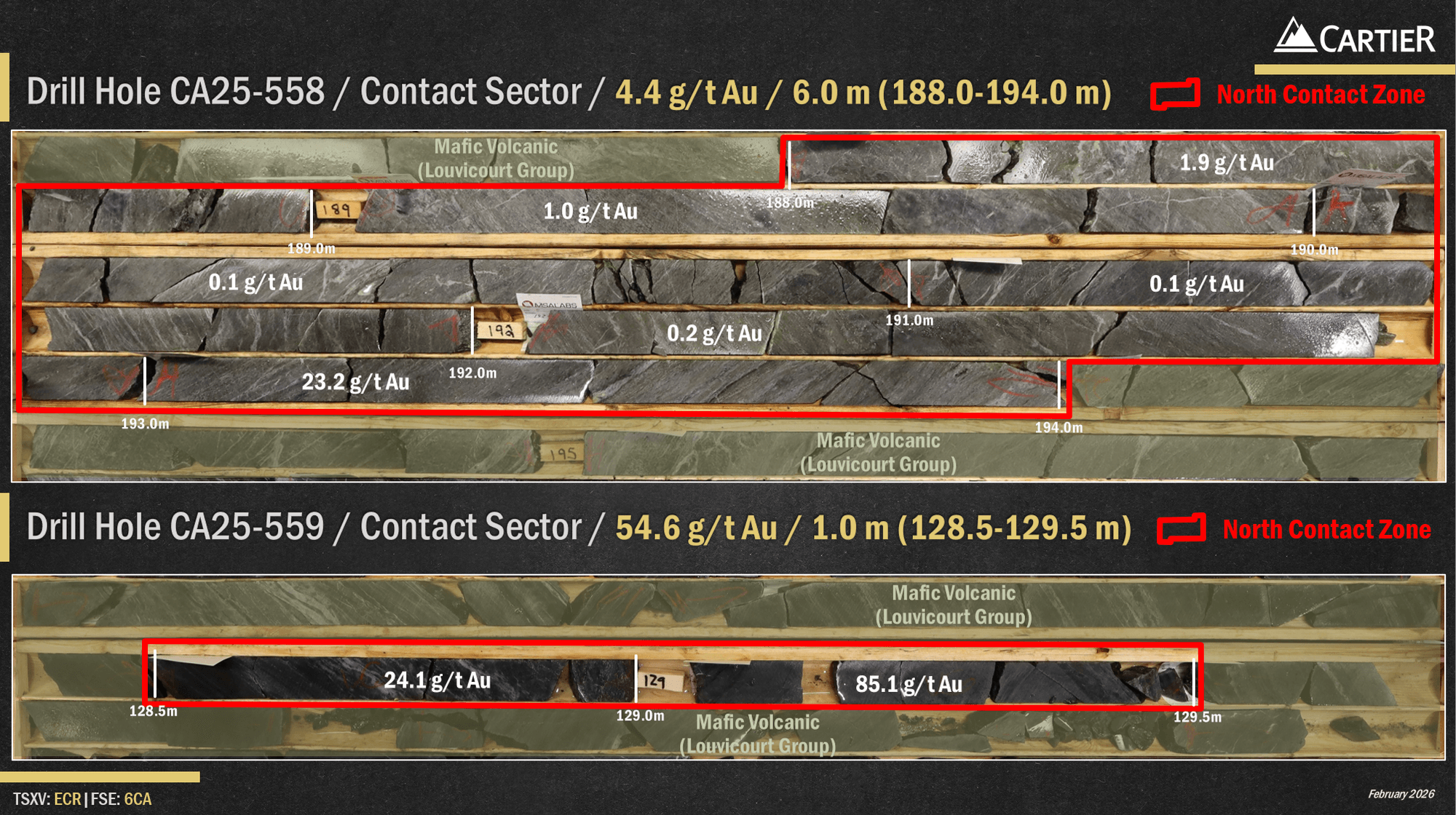

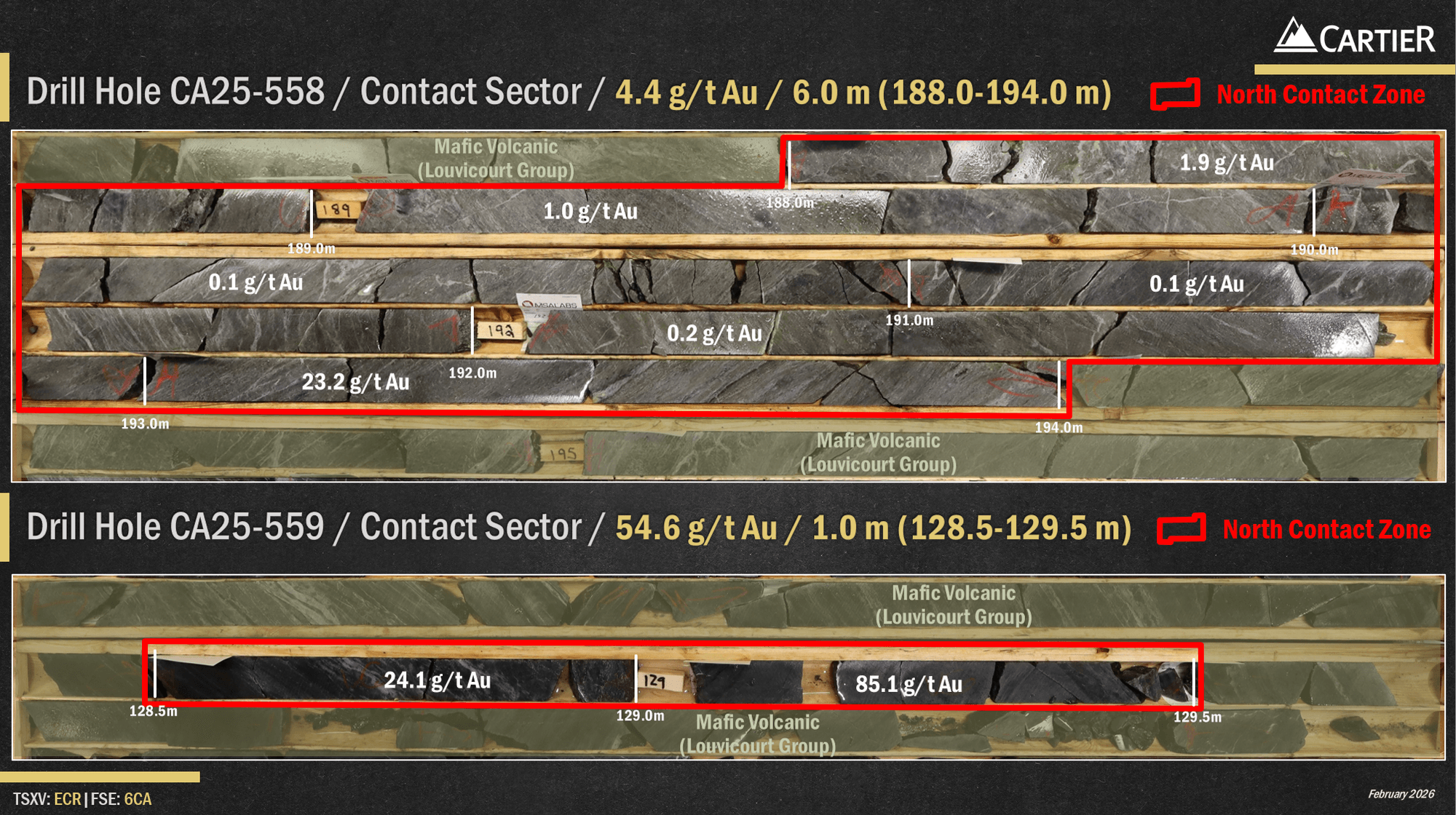

- CA25-559 intersected 54.6 g/t Au over 1.0 m including 85.1 g/t Au over 0.5 m (NC1 Zone).

- CA25-558 graded 4.4 g/t Au over 6.0 m including 23.2 g/t Au over 1.0 m (NC3 Zone).

- CA25-557 reported 7.5 g/t Au over 0.5 m (NC3 Zone).

NCZ

- CA25-554 intersected 1.5 g/t Au over 15.5 m (NC3 Zone).

- CA25-547 graded 1.2 g/t Au over 13.2 m (NC3 Zone).

- CA25-552 reported 1.0 g/t Au over 10.5 m (NC3 Zone).

Significance for Investors

- Holes CA25-557, 558 and 559 discovered high-grade gold zones 500 metres along eastern strike extension of the NC1 and NC3 gold zones, significantly expands the North Contact main mineralized system. These new results, consistently associated with visible gold grains and sulphides, demonstrate the gold-fertile and robust geological continuity of the Contact Sector.

- Holes CA25-547, 552 and 554 confirmed NCZ extends to surface and remains open at depth, supporting the potential for shallow development scenarios and significant resource expansion. The NCZ represents an extensive and large mineralized gold system (400 m in strike length by 300 m in depth), comprised of multiple stacked gold zones with significant grades, widths and continuity.

- The combination of exposed bedrock, minimal overburden (5 m) and proximity to year-round road access (250 m) positions Contact Sector as a highly strategic asset for more flexible operating scenarios and further improving the project economics.

Next Steps

- Further expansion drilling is planned to expand NCZ gold mineralization at depth (300-600 m), connect footprint of NCZ and its eastern extensions and determine gold enrichment with the primary objective of upgrading the mineral resource estimate.

- Additional exploration drilling is required to test several new high-priority regional targets along strike of the Contact Sector and the Héva Fault Zone, backed by detailed structural and geological modelling and VRIFY’s artificial intelligence (AI) driven targeting.

‘ This discovery and results conclude what was planned at the Contact Sector of the current 100,000-meter program. Obviously, we’re convinced of the high gold potential of this segment of the Héva Fault and we are actively working to increase the current drilling program to 250,000 metres. The Contact Sector will no doubt receive focussed attention. This expanded campaign is designed to unlock maximum shareholder value and demonstrate the Cadillac Project’s potential as a mining camp scale. ‘ – Philippe Cloutier, President and CEO of Cartier.

‘ The North Contact Zone, its new eastern extensions and the systematic presence of visible gold grains over 1 km of the Héva Fault Zone highlights the strength and scale of the gold system. This newly identified fault is rapidly becoming a highly growth opportunity for the Cadillac project and defined by numerous untested geophysical anomalies over 5 km, readily accessible, providing huge upside potential for making gold discoveries. Our team is currently designing the add-on drill program to ready timely execution and strong results for shareholders. ‘ – Ronan Deroff, Vice President Exploration of Cartier.

Table 1: Drill hole best assay results from Contact Sector

| Hole Number |

From (m) |

To (m) |

Core Length** (m) |

Au (g/t) Uncut |

Vertical Depth (m) |

Zone |

| CA25-547 |

105.8 |

119.0 |

13.2 |

1.2 |

≈100 |

NC3 |

| CA25-552 |

77.5 |

88.0 |

10.5 |

1.0 |

≈60 |

NC3 |

| CA25-554 |

100.5 |

116.0 |

15.5 |

1.5 |

≈100 |

NC3 |

| CA25-557 |

105.1 |

105.6 |

0.5 |

7.5* |

≈90 |

NC3 |

| CA25-558 |

188.0 |

194.0 |

6.0 |

4.4 |

≈190 |

NC3 |

| Including |

193.0 |

194.0 |

1.0 |

23.2 |

| CA25-559 |

128.5 |

129.5 |

1.0 |

54.6* |

≈120 |

NC1 |

| Including |

128.5 |

129.0 |

0.5 |

24.1* |

| Including |

129.0 |

129.5 |

0.5 |

85.1* |

* Occurrences of visible gold (VG) have been noted in the drill core at various intervals. ** Based on the observed intercept angles within the drill core, true thicknesses are estimated to represent approximately 50-75% of the reported core length intervals.

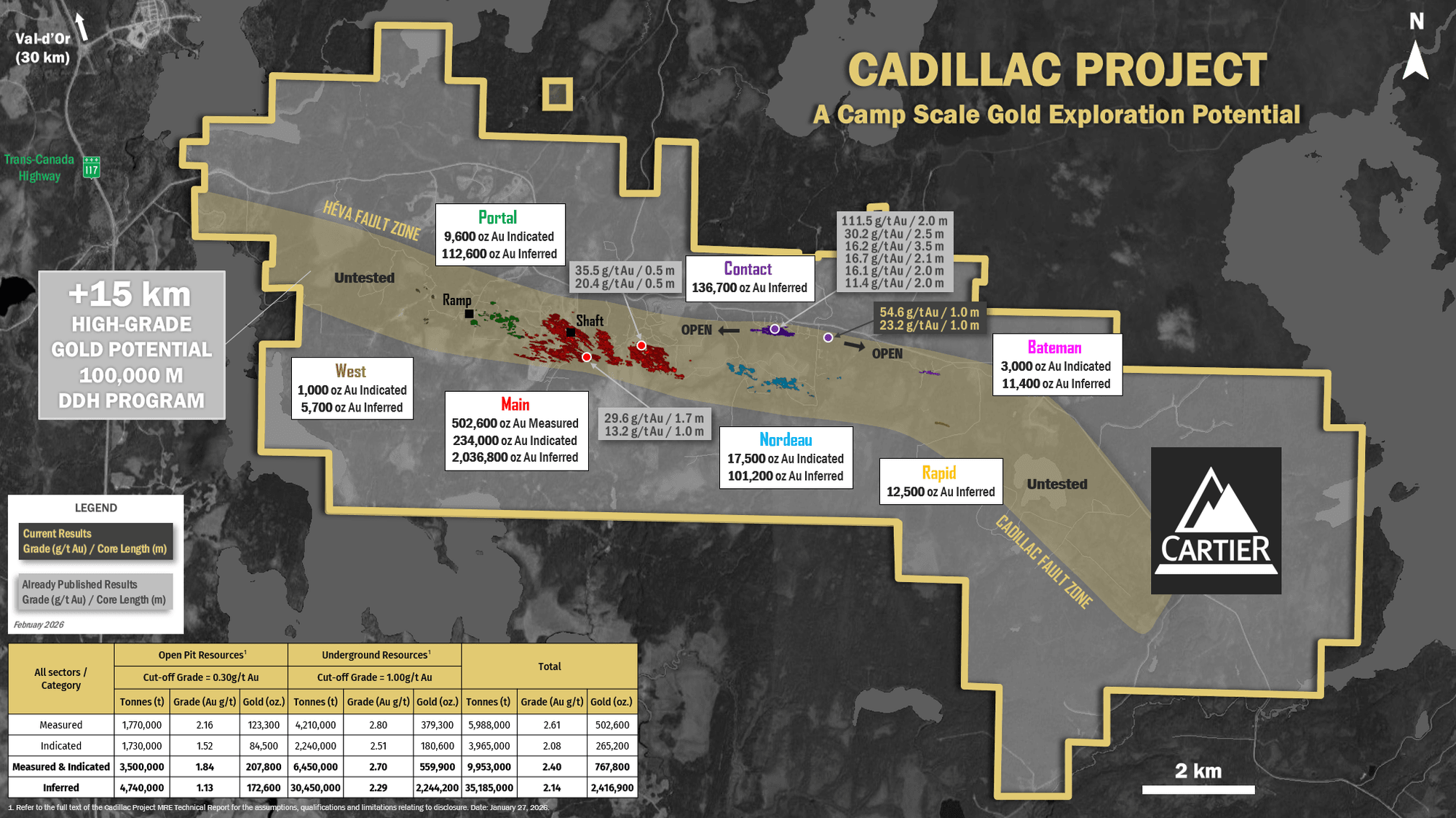

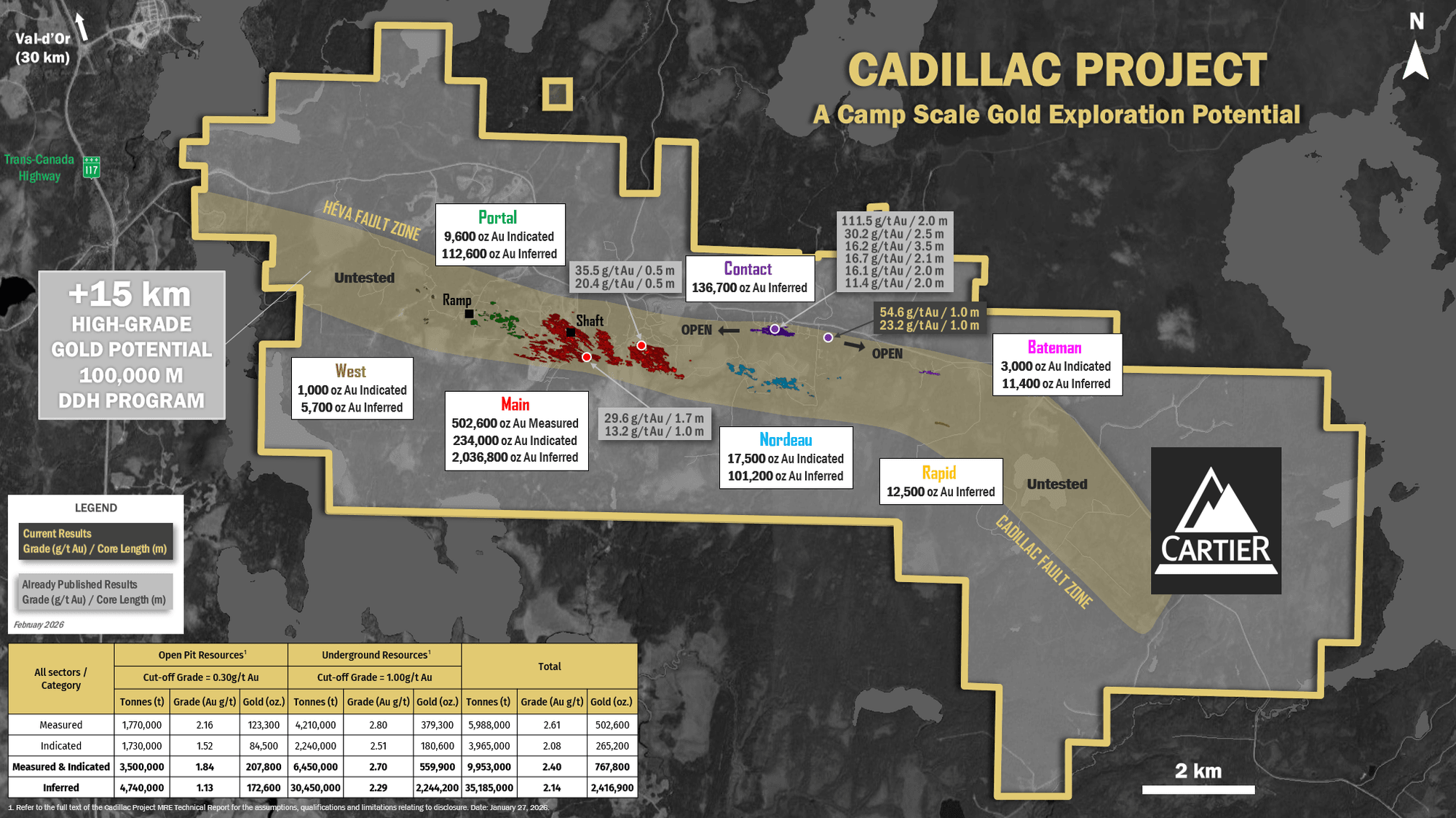

Figure 1: Location of the new drill results (regional plan view)

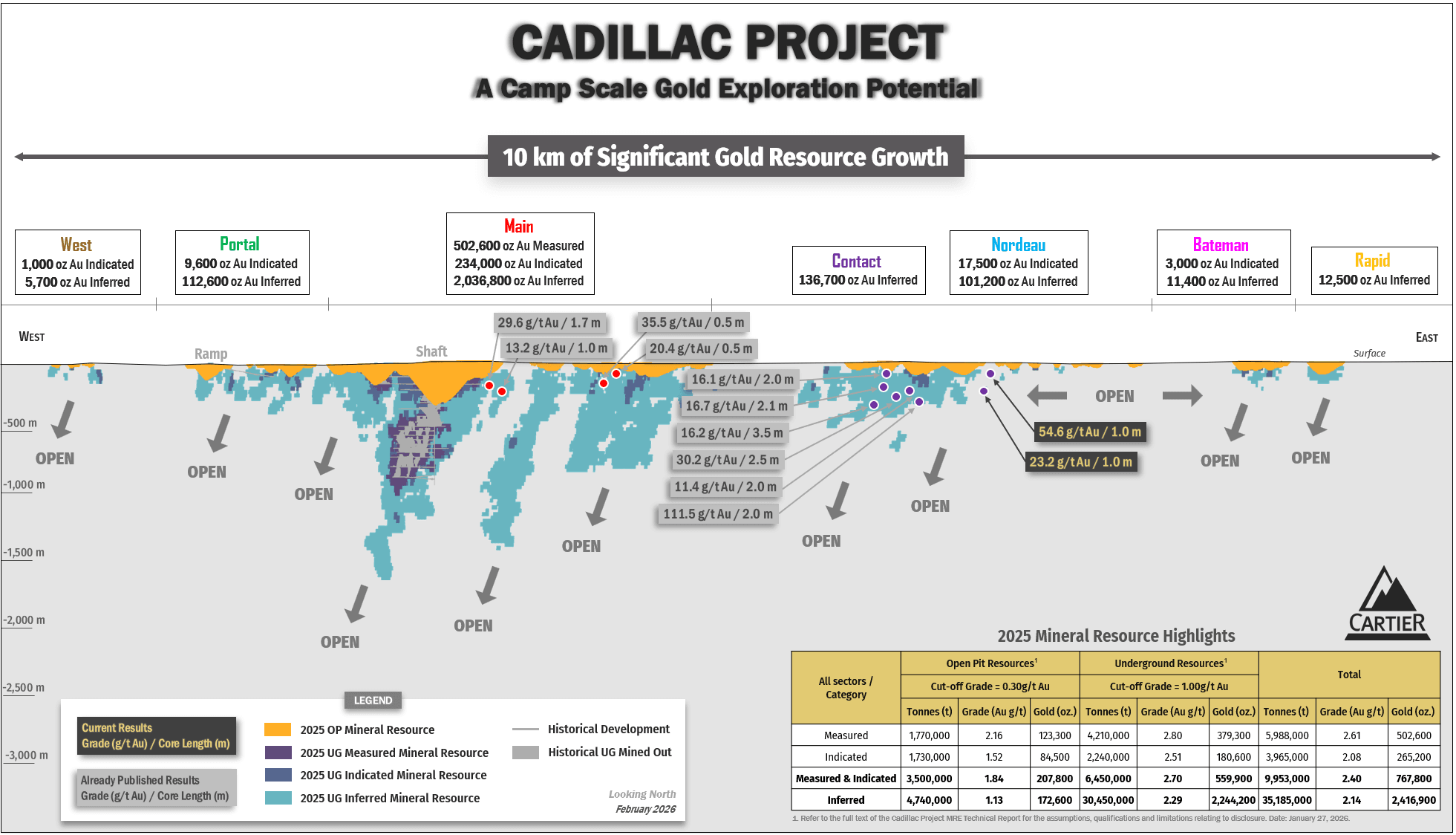

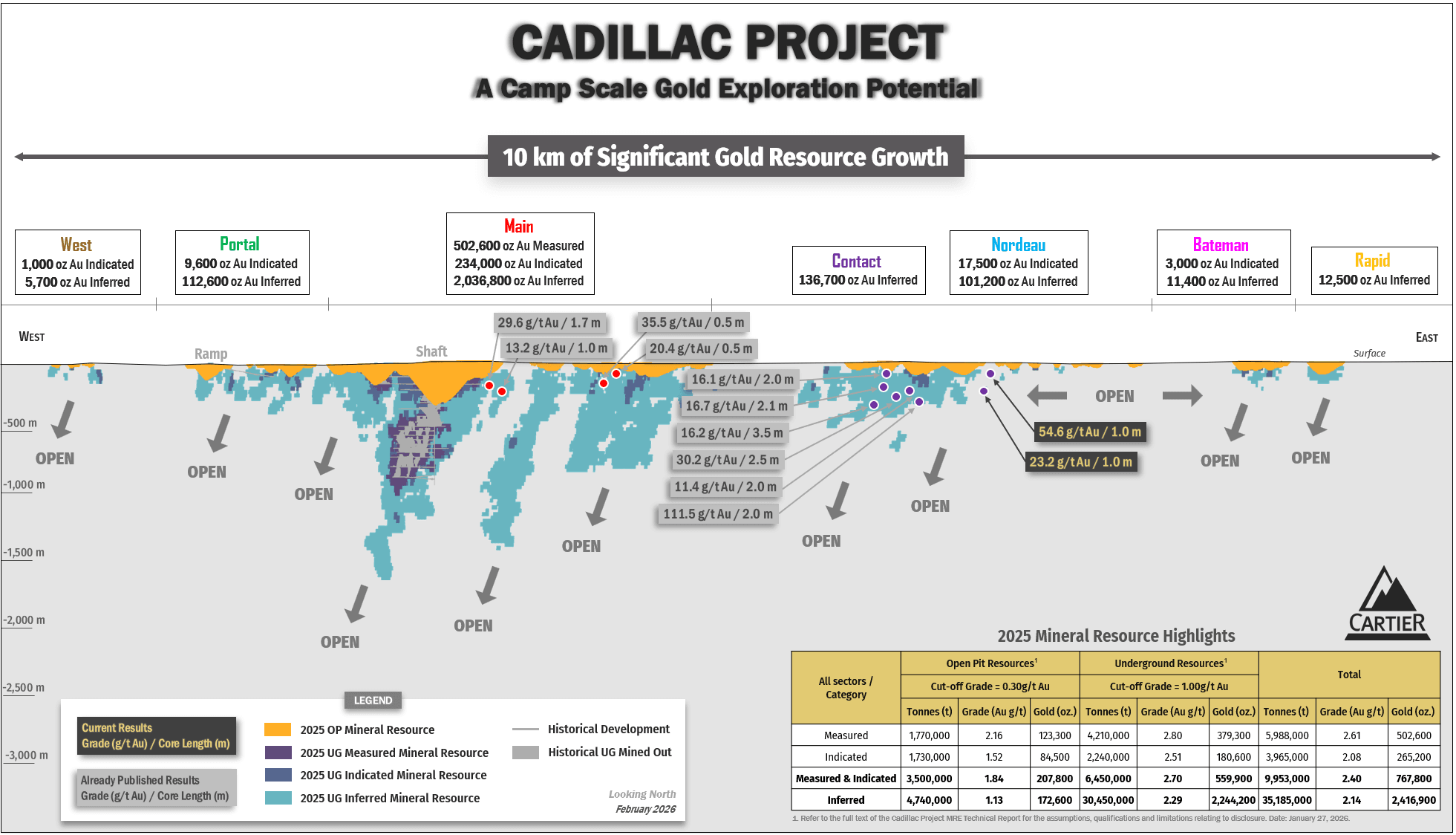

Figure 2: Location of the new drill results (regional longitudinal section)

Figure 3: Plan view, cross and long sections of the Contact Sector

Figure 4: Photos of the drill core from holes CA25-558 and CA25-559

Contact Sector

The Contact Sector is a highly prospective area featuring the North Contact Zone with inferred resources of 136,700 ounces (2.1 million tonnes at 2.0 g/t Au) and several newly defined high-priority drill targets.

The NCZ lies along an east-west trending, strongly sheared corridor (Héva Fault Zone), situated approximately 900 m north of the Cadillac Fault Zone, and occurs at the contact between the hanging wall mafic to intermediate volcanics (basalt to andesite) of Louvicourt Group and the footwall turbiditic sedimentary rocks (wacke-mudrock) of Cadillac Group. This lithological contact is a favorable horizon for hydrothermal fluid flow, likely related to synvolcanic gold deposition.

The NCZ, defined by at least three parallel gold-rich zones, are typically and primarily associated with a fine-grained and disseminated arsenopyrite-pyrrhotite mineralization, with a pervasive biotite-chlorite-carbonate alteration, all crosscut by late-stage smoky quartz vein and veinlet stockworks containing visible gold. Locally, accessory minerals such as sphalerite, galena and tourmaline are observed.

Milestones of 2025-2027 Exploration Program

100,000 m Drilling Program (Q3 2025 to Q2 2027)

The ambitious 600-hole drilling program will both expand known gold zones and test new shallow surface high-potential targets. The objective is to unlock the camp-scale, high-grade gold potential along the 15 km Cadillac Fault Zone. It is important to note that Cartier’s recent consolidation of this large land holding offers the unique opportunity in over 90 years for unrestricted exploration.

Environmental Baseline Studies & Economic Evaluation of Chimo mine tailings (Q3 2025 to Q3 2026)

The baseline studies will be divided into two distinct parts which include 1) environmental baseline desktop study and 2) preliminary environmental geochemical characterization. The initial baseline studies will provide a comprehensive understanding of the current environmental conditions and implement operations that minimize environmental impact while optimizing the economic potential of the project. These studies will be supplemented by an initial assessment of the economic potential of the past-producing Chimo mine tailings to determine whether a quantity of gold can be extracted economically.

Metallurgical Sampling and Testwork Program (Q4 2025 to Q1 2026)

The metallurgical testwork program includes defining of expected gold recovery rates and improving historical results from the Chimo deposit, as well as establishing metallurgical recovery data for the first-time for the East Chimo and West Nordeau satellite deposits, where no previous data exists. This comprehensive program will characterize the mineralized material, gold recovery potential and validate optimal grind size defining the most efficient and cost-effective flowsheet. The data generated will directly support optimized project development and have the potential to significantly reduce both capital and operating costs, while also improving the environmental footprint.

Preliminary Economic Assessment (2026)

Internal engineering studies have been initiated to validate a multitude of development scenarios that consider the updated MRE and current market environment. Following the selection of the most optimal scenario, a PEA will be completed which will also build upon the results of the metallurgical testwork program and the environmental baseline studies to unveil the updated development strategy and vision of the project.

Table 2: Drill hole collar coordinates from Contact Sector

| Hole Number |

UTM Easting (m) |

UTM Northing (m) |

Elevation (m) |

Azimuth (°) |

Dip (°) |

Hole Length (m) |

| CA25-545 |

335648 |

5320072 |

361 |

196 |

-45 |

120 |

| CA25-547 |

335648 |

5320072 |

361 |

155 |

-67 |

162 |

| CA25-552 |

335719 |

5320054 |

359 |

221 |

-45 |

120 |

| CA25-553 |

335719 |

5320054 |

359 |

159 |

-48 |

120 |

| CA25-554 |

335719 |

5320054 |

359 |

181 |

-76 |

145 |

| CA25-557 |

336287 |

5319982 |

362 |

222 |

-58 |

177 |

| CA25-558 |

336287 |

5319982 |

362 |

156 |

-83 |

261 |

| CA25-559 |

336365 |

5320013 |

363 |

174 |

-70 |

240 |

| CA25-560 |

336365 |

5320013 |

363 |

157 |

-45 |

180 |

Table 3: Drill hole detailed assay results from Contact Sector

| Hole Number |

From (m) |

To (m) |

Core Length* (m) |

Au (g/t) Uncut |

Vertical Depth (m) |

Zone |

| CA25-545 |

71.0 |

90.6 |

19.6 |

0.7 |

≈50 |

NC3 |

| Including |

71.0 |

72.0 |

1.0 |

1.0 |

| Including |

72.0 |

73.0 |

1.0 |

2.2 |

| Including |

74.0 |

75.0 |

1.0 |

2.4 |

| Including |

85.0 |

86.0 |

1.0 |

4.1 |

| Including |

86.0 |

87.0 |

1.0 |

1.3 |

| Including |

89.5 |

90.6 |

1.0 |

1.1 |

| CA25-547 |

105.8 |

119.0 |

13.2 |

1.2 |

≈100 |

NC3 |

| Including |

105.8 |

106.7 |

0.9 |

2.8 |

| Including |

106.7 |

108.0 |

1.3 |

1.7 |

| Including |

110.0 |

111.0 |

1.0 |

5.6 |

| Including |

112.0 |

113.0 |

1.0 |

1.5 |

| Including |

116.0 |

116.5 |

0.5 |

1.7 |

| And |

131.0 |

131.7 |

0.7 |

5.1 |

≈120 |

| CA25-552 |

35.3 |

37.0 |

1.7 |

3.2 |

≈25 |

NC1 |

| Including |

35.3 |

36.0 |

0.7 |

1.6 |

| Including |

36.0 |

37.0 |

1.0 |

4.3 |

| And |

77.5 |

88.0 |

10.5 |

1.0 |

≈60 |

NC3 |

| Including |

77.5 |

78.5 |

1.0 |

2.2 |

| Including |

80.0 |

80.5 |

0.5 |

6.0 |

| Including |

81.5 |

82.5 |

1.0 |

1.7 |

| Including |

83.5 |

84.0 |

0.5 |

1.0 |

| Including |

87.0 |

88.0 |

1.0 |

1.0 |

| CA25-553 |

32.9 |

33.4 |

0.5 |

1.4 |

≈25 |

NC2 |

| And |

66.8 |

67.3 |

0.5 |

1.3 |

≈50 |

NC3 |

| And |

80.7 |

81.8 |

1.1 |

4.2 |

≈60 |

| CA25-554 |

100.5 |

116.0 |

15.5 |

1.5 |

≈100 |

NC3 |

| Including |

100.5 |

101.2 |

0.7 |

3.6 |

| Including |

101.2 |

102.0 |

0.8 |

2.4 |

| Including |

102.0 |

103.0 |

1.0 |

2.0 |

| Including |

104.0 |

105.0 |

1.0 |

2.2 |

| Including |

105.0 |

106.0 |

1.0 |

3.8 |

| Including |

107.0 |

108.0 |

1.0 |

2.4 |

| Including |

113.0 |

114.0 |

1.0 |

1.3 |

| Including |

115.0 |

116.0 |

1.0 |

3.5 |

| And |

120.0 |

121.0 |

1.0 |

1.3 |

≈115 |

| CA25-557 |

34.0 |

35.0 |

1.0 |

2.8 |

≈30 |

NC1 |

| And |

105.1 |

105.6 |

0.5 |

7.5* |

≈90 |

NC3 |

| And |

112.0 |

113.0 |

1.0 |

1.0 |

≈95 |

| And |

131.0 |

132.0 |

1.0 |

1.9 |

≈110 |

| CA25-558 |

148.0 |

149.0 |

1.0 |

1.7 |

≈150 |

NC2 |

| And |

188.0 |

194.0 |

6.0 |

4.4 |

≈190 |

NC3 |

| Including |

188.0 |

189.0 |

1.0 |

1.9 |

| Including |

189.0 |

190.0 |

1.0 |

1.0 |

| Including |

193.0 |

194.0 |

1.0 |

23.2 |

| CA25-559 |

128.5 |

129.5 |

1.0 |

54.6* |

≈120 |

NC1 |

| Including |

128.5 |

129.0 |

0.5 |

24.1* |

| Including |

129.0 |

129.5 |

0.5 |

85.1* |

| CA25-560 |

147.0 |

148.0 |

1.0 |

3.2 |

≈100 |

NC3 |

* Occurrences of visible gold (VG) have been noted in the drill core at various intervals. ** Based on the observed intercept angles within the drill core, true thicknesses are estimated to represent approximately 50-75% of the reported core length intervals.

Quality Assurance and Quality Control (QA/QC) Program

The drill core from the Cadillac Project is NQ-size and, upon receipt from the drill rig, is described and sampled by Cartier geologists. Core is sawn in half, with one half labelled, bagged and submitted for analysis and the other half retained and stored at Cartier’s coreshack facilities located in Val-d’Or, Quebec, for future reference and verification. As part of Quality Assurance and Quality Control (QA/QC) program, Cartier inserts blank samples and certified reference materials (standards) at regular intervals into the sample stream prior to shipment to monitor laboratory performance and analytical accuracy.

Drill core samples are sent to MSALABS’s analytical laboratory located in Val-d’Or, Quebec, for preparation and gold analysis. The entire sample is dried and crushed (70% passing a 2-millimeter sieve). The analysis for gold is performed on an approximately 500 g aliquot using Chrysos Photon Assay technology, which uses high-energy X-ray excitation with gamma detection to quickly and non-destructively measure gold content.

technology, which uses high-energy X-ray excitation with gamma detection to quickly and non-destructively measure gold content.

Alternatively, samples are submitted to Activation Laboratories Ltd. (‘Actlabs’), located in either Val-d’Or or Ste-Germaine-Boulé, both in Quebec, for preparation and gold analysis. The entire sample is dried, crushed (90% passing a 2-millimetre sieve) and 250 g is pulverized (90% passing a 0.07-millimetre sieve). The analysis for gold is conducted using a 50 g fire assay fusion with atomic absorption spectroscopy (AAS) finish, with a detection limit up to 10,000 ppb. Samples exceeding this threshold are reanalyzed by fire assay with a gravimetric finish to determine high-grade values accurately.

Both MSALABS and Actlabs are ISO/IEC 17025 accredited for gold assays and implement industry-standard QA/QC protocols. Their internal quality control programs include the use of blanks, duplicates, and certified reference materials at set intervals, with established acceptance criteria to ensure data integrity and analytical precision.

Qualified Person

The scientific and technical content of this press release has been prepared, reviewed and approved by Mr. Ronan Déroff, P.Geo., M.Sc., Vice President Exploration, who is a ″Qualified Person″ as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (″ NI 43-101 ″).

About Cadillac Project

The Cadillac Project, covering 14,000 hectares along a 15-kilometre stretch of the Cadillac Fault, is one of the largest consolidated land packages in the Val-d’Or mining camp. Cartier’s flagship asset integrates the historic Chimo Mine and East Cadillac projects, creating a dominant position in a gold mining district. With excellent road access, year-round infrastructure and nearby milling capacity, the project is ideally positioned for rapid advancement and value creation.

The Cadillac property contains total gold resource of 767,800 ounces in the measured and indicated category (10.0 Mt at 2.4 g/t Au) and 2,416,900 ounces in the inferred category (35.2 Mt at 2.1 g/t Au) across all the sectors. Please see the ″ NI 43-101 Technical Report and Mineral Resource Estimate on the Cadillac Project, Val-d’Or, Abitibi, Quebec, Canada. Pierre-Luc Richard, P.Geo. of PLR Resources Inc., Stephen Coates, P.Eng. of Evomine Consulting Inc. and Florent Baril, P.Eng. of Bumigeme Inc. ″, effective January 27, 2026.

About Cartier Resources Inc.

Cartier Resources Inc., founded in 2006 and headquartered in Val-d’Or (Quebec) is a gold exploration company focused on building shareholder value through discovery and development in one of Canada’s most prolific mining camps. The Company combines strong technical expertise and a track record of successful exploration to advance its flagship Cadillac Project. Cartier’s strategy is clear: unlock the full potential of one of the largest undeveloped gold landholdings in Quebec.

For further information, contact:

Philippe Cloutier, P. Geo.

President and CEO

Telephone: 819-856-0512

philippe.cloutier@ressourcescartier.com

www.ressourcescartier.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/96974a1b-a4b1-4998-b693-c7861a904fd3

https://www.globenewswire.com/NewsRoom/AttachmentNg/6a3dd0d6-8fb1-45fb-ae5a-7f3122c27921

https://www.globenewswire.com/NewsRoom/AttachmentNg/3070290b-fb85-4fb5-81ba-27a456d7df6e

https://www.globenewswire.com/NewsRoom/AttachmentNg/5eb6ca50-70f9-404f-a175-bc3d373be04a

technology, which uses high-energy X-ray excitation with gamma detection to quickly and non-destructively measure gold content.

technology, which uses high-energy X-ray excitation with gamma detection to quickly and non-destructively measure gold content.