Co-Listing Expands U.S. Investor Access and Visibility in World’s Largest Aviation and Capital Markets

Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) (‘Syntholene’ or the ‘Company’) announces that its common shares have been approved for quotation and have commenced trading on the OTCQB Venture Market in the United States under the trading symbol SYNTF. The OTCQB co-listing is intended to broaden the Company’s U.S. investor audience and increase visibility within the world’s largest aviation fuel, capital markets, and energy infrastructure ecosystem.

The OTCQB Venture Market, operated by OTC Markets Group Inc., is a recognized public market in the United States designed for early-stage and developing companies that meet verified reporting and compliance standards. The Company’s primary listing remains on the TSX Venture Exchange under the symbol ESAF.

‘Establishing a U.S. trading presence on the OTCQB is a strategically important step for Syntholene,’ stated Syntholene CEO Dan Sutton. ‘The United States represents the largest aviation market globally and a core center of capital formation for energy and infrastructure investment. Providing U.S. investors with direct access to our shares aligns our capital markets strategy with the jurisdictions driving both demand growth and project financing for synthetic fuels. We view this co-listing as a natural extension of our TSX Venture Exchange and Frankfurt listings, as well as an important foundation for long-term engagement with U.S. institutional, strategic, and retail investors.’

Syntholene believes the OTCQB quotation enhances the Company’s visibility and accessibility in the United States at a time when policy support for sustainable aviation fuel and synthetic fuels is accelerating. U.S. federal and state initiatives, including tax credits, grant programs, and offtake support mechanisms under the Inflation Reduction Act and related Department of Energy and Department of Transportation programs, are driving increased investment into next-generation fuel production infrastructure.

About Syntholene

Syntholene is actively commercializing its novel Hybrid Thermal Production System for low-cost clean fuel synthesis. The target output is ultrapure synthetic jet fuel, manufactured at 70% lower cost than the nearest competing technology today. The company’s mission is to deliver the world’s first truly high-performance, low-cost, and carbon-neutral synthetic fuel at an industrial scale, unlocking the potential to produce clean synthetic fuel at lower cost than fossil fuels, for the first time.

Syntholene’s power-to-liquid strategy harnesses thermal energy to power proprietary integrations of hydrogen production and fuel synthesis. Syntholene has secured 20MW of dedicated energy to support the Company’s upcoming demonstration facility and commercial scale-up.

Founded by experienced operators across advanced energy infrastructure, nuclear technology, low-emissions steel refining, process engineering, and capital markets, Syntholene aims to be the first team to deliver a scalable modular production platform for cost-competitive synthetic fuel, thus accelerating the commercialization of carbon-neutral eFuels across global markets.

For further information, please contact:

Dan Sutton, CEO

comms@syntholene.com

www.syntholene.com

+1 608-305-4835

Investor Relations

KIN Communications Inc.

604-684-6730

ESAF@kincommunications.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of applicable securities laws. The use of any of the words ‘expect’, ‘anticipate’, ‘aims’, ‘continue’, ‘estimate’, ‘objective’, ‘may’, ‘will’, ‘project’, ‘should’, ‘believe’, ‘plans’, ‘intends’ and similar expressions are intended to identify forward-looking information or statements. All statements, other than statements of historical fact, including but not limited to statements regarding the development and intended benefits of the Company’s technology, commercial scalability, technical and economic viability, anticipated geothermal power availability, anticipated benefit of eFuel, and future commercial opportunities, are forward-looking statements.

The forward-looking statements and information are based on certain key expectations and assumptions made by the Company, including without limitation the assumption that the Company will be able to execute its business plan, that the eFuel will have its expected benefits, that there will be market adoption, and that the Company will be able to access financing as needed to fund its business plan. Although the Company believes that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information because the Company can give no assurance that they will prove to be correct. Since forward-looking statements and information address future events and conditions, by their very nature, they involve inherent risks and uncertainties.

Actual results could differ materially from those currently anticipated due to a number of factors and risks, including, without limitation, Syntholene’s ability to meet production targets, realize projected economic benefits, overcome technical challenges, secure financing, maintain regulatory compliance, manage geopolitical risks, and successfully negotiate definitive terms. Syntholene does not undertake any obligation to update or revise these forward-looking statements, except as required by applicable securities laws.

Readers are advised to exercise caution and not to place undue reliance on these forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/282096

News Provided by TMX Newsfile via QuoteMedia

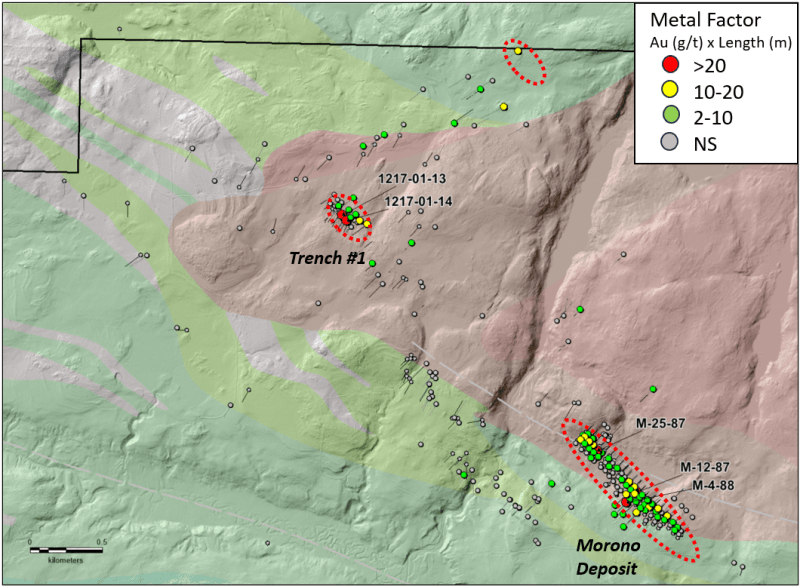

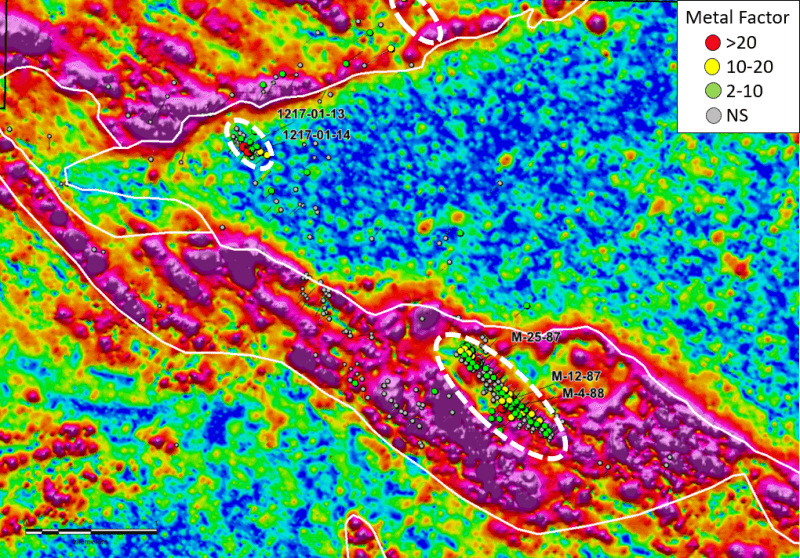

Location map of the Cleopatra Nickel property

Location map of the Cleopatra Nickel property

Rapid Critical Metals (RCM:AU) has announced Canada – High Grade Ga-Ge Sampling Confirms Historic Results

Rapid Critical Metals (RCM:AU) has announced Canada – High Grade Ga-Ge Sampling Confirms Historic Results