USANewsGroup.com Market Intelligence Brief —

WHAT’S HAPPENING:

The infrastructure holding the global economy together is being stress-tested in real time:

- Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]

- The G7 issued formal guidance treating the quantum threat to current encryption as a ‘systemic concern’ [2]

- The FDA cleared a record 295 AI-powered medical devices in a single calendar year [3]

- The functional wellness category accelerating toward $179 billion as consumers reject legacy formats for precision delivery [4]

The common thread is structural replacement. Old systems are failing. New ones are being installed. This report profiles five companies positioned at the installation point.

THE ENCRYPTION UPGRADE — CSE: QSE / OTCQB: QSEGF

Quantum Secure Encryption Corp. (CSE: QSE) (OTCQB: QSEGF) builds the migration tools enterprises need to survive the quantum transition. The G7’s January 2026 guidance made it plain: current encryption is a systemic vulnerability, and organizations that wait will be caught exposed.

Earlier this month, QSE formalized its three-stage Enterprise Post-Quantum Migration Methodology, delivered through its Quantum Preparedness Assessment platform. The system provides a post-quantum compliancy dashboard with risk indicators mapped to compliance frameworks, guided data input workflows, and automated scoring. It integrates alongside existing cybersecurity architectures without wholesale system replacement.

The financial and infrastructure sectors are the primary targets. The methodology gives enterprises measurable indicators and visibility into where they stand, turning an abstract threat into a structured remediation plan.

Read this and more news for Quantum Secure Encryption Corp. at:

https://usanewsgroup.com/2024/04/26/the-currency-of-tomorrow-why-investing-in-cutting-edge-ai-recognition-tech-could-mean-big-money/

THE GOLD STANDARD — TSX: RUA,OTC:NZAUF / OTCQB: NZAUF

Rua Gold Inc. (TSX: RUA,OTC:NZAUF) (OTCQB: NZAUF) just uplisted to the Toronto Stock Exchange and closed an oversubscribed $25 million financing, giving the company ~C$38 million in available cash to drill across two gold projects in New Zealand.

The company’s recent outlook confirmed four drill rigs operating across the Reefton Goldfield, targeting resource expansion at Auld Creek and new discovery across the historic 2Moz past-producing district. RUA is targeting a Fast-Track mining permit referral in Q1 2026, with a regulatory decision expected in Q2. New Zealand just joined the international Minerals Security Partnership, aligning government policy with RUA’s development timeline.

The Reefton Goldfield carries gold-antimony mineralization. Antimony is classified as a critical mineral by multiple governments, adding a strategic dimension to the resource base. An updated NI 43-101 Technical Report is expected by month-end.

Read this and more news for Rua Gold Inc. at:

https://usanewsgroup.com/2025/04/02/others-found-1911-g-t-here-before-now-a-proven-11b-mining-team-is-back-to-finish-the-job/

THE DIAGNOSTIC SIGNAL — TSXV: VPT / OTCPK: VPTDF

VentriPoint Diagnostics (TSXV: VPT) (OTCPK: VPTDF) is commercializing AI-powered cardiac imaging that delivers MRI-grade heart chamber analysis from a standard ultrasound. The FDA cleared VMS+ 4.0 via 510(k) in February 2025, and the company has spent the last twelve months building the commercial infrastructure to scale it.

Recently, VentriPoint provided a corporate update confirming advancement across multiple fronts: U.S. go-to-market refinement, ongoing distributor alignment in Europe and the UK, integration discussions with ASCEND Cardiovascular, collaboration with the Ollie Hinkle Heart Foundation for system placements, and continued work with Lishman Global on China market entry. A shareholder videoconference is scheduled for later this month.

The 295 AI medical device clearances the FDA issued in 2025 confirm the regulatory environment is open. VentriPoint is building from that cleared position into clinical adoption.

Read this and more news for VentriPoint Diagnostics at:

https://usanewsgroup.com/2025/11/21/the-mri-grade-disruption-hiding-in-plain-sight-why-the-smart-money-is-watching-ventripoint

THE DELIVERY MECHANISM — CSE: MOOD / OTCPK: DOSEF

Doseology Sciences Inc. (CSE: MOOD) (OTCPK: DOSEF) is building precision oral delivery systems for the functional wellness category. The company appointed Larry Latowsky as Executive Chairman earlier this month. Latowsky previously served as President and CEO of Katz Group Canada, the parent of Rexall-Pharma Plus, IDA, and Guardian Drug stores, operating 1,500 pharmacy locations nationally before a ~C$3 billion acquisition by McKesson.

In late January, Doseology began pilot production of non-nicotine, caffeine-based energy pouches under its Feed That Brain brand. The pouch format delivers measured, portion-controlled energy without sugar, carbonation, or large-volume consumption. A direct-to-consumer launch is expected within weeks.

The $179 billion functional beverage rotation is real. Doseology is attacking it with a pharmacy-grade governance team and a delivery platform designed for precision, not intensity.

Read this and more news for Doseology Sciences Inc. at:

https://usanewsgroup.com/2025/12/19/what-comes-after-cigarettes-vapes-and-energy-drinks/

THE TERRITORIAL PLAY — CSE: GGR / OTCQB: GGRFF

Golden Goose Resources Corp. (CSE: GGR) (OTCQB: GGRFF) just expanded its investor access by listing on the OTCQB Venture Market under the symbol GGRFF. DTC eligibility is pending.

The company controls three exploration-stage gold projects across two jurisdictions: the Gran Esperanza Project (~44,000 hectares, Río Negro, Argentina), the Goldfire Project (4,680 hectares, Windfall Camp, Quebec, near Gold Fields’ Windfall deposit), and the El Quemado Project (46 mining concessions, ~58,000 hectares, Salta Province, Argentina).

With gold above $5,500, junior explorers with defined land packages in proven districts are the leverage play on the commodity cycle. The OTCQB listing gives U.S. investors a direct line.

Read this and more news for Golden Goose Resources Corp. at:

https://usanewsgroup.com/2026/01/28/two-gold-projects-two-major-neighbors-what-does-this-junior-know-that-the-market-doesnt/

CONTACT:

USA News Group

info@usanewsgroup.com

(604) 265-2873

DISCLAIMER:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (MIQ). This article is being distributed for Baystreet.ca Media Corp. (BAY), who has been paid a fee for an advertising contract with Rua Gold Inc. (a fee for a three month contract subject to the terms and conditions of the agreement from the company direct) and Ventripoint Diagnostics Ltd. This article is also being distributed for Maynard Communications (MAY), who has been paid a fee for an advertising campaign for Doseology Sciences Inc. and Golden Goose Resources Corp. MIQ has been paid a fee for QSE – Quantum Secure Encryption Corp. advertising and digital media from the company directly. MIQ has not been paid a fee for Doseology Sciences Inc., Rua Gold Inc., Ventripoint Diagnostics Ltd., or Golden Goose Resources Corp. advertising or digital media, but the owner/operators of MIQ also co-owns BAY, and expects to be paid a fee from MAY. There may be 3rd parties who may have shares of these companies and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled companies. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ/BAY owns shares of QSE – Quantum Secure Encryption Corp. (purchased via private placement), Doseology Sciences Inc. (purchased via private placement), Ventripoint Diagnostics Ltd., and Golden Goose Resources Corp. (purchased in the open market). They do not currently own shares of Rua Gold Inc. but reserve the right to buy and sell, and will buy and sell shares of all mentioned companies at any time without further notice. All material disseminated by MIQ has been approved by the mentioned companies. Technical information relating to Rua Gold Inc. has been reviewed and approved by Simon Henderson, CP, AUSIMM, a Qualified Person who is the COO of the company and therefore not independent. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful: investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES:

[1] J.P. Morgan Global Research, ‘Gold price predictions,’ February 2026 – https://www.jpmorgan.com/insights/global-research/commodities/gold-prices

[2] The Quantum Insider, ‘January 2026 Quantum Recap,’ February 2, 2026 – https://thequantuminsider.com/2026/02/02/january-2026-quantum-recap-quantum-moves-deeper-into-policy-and-manufacturing/

[3] Innolitics, ‘2025 Year in Review: AI/ML Medical Device 510(k) Clearances,’ December 28, 2025 – https://innolitics.com/articles/year-in-review-ai-ml-medical-device-k-clearances/

[4] GlobeNewsWire / Equity-Insider.com, ‘Functional Wellness Stocks Explode as $179 Billion Beverage Market Ditches Sugar for Science,’ January 29, 2026 – https://www.globenewswire.com/news-release/2026/01/29/3228948/0/en/Functional-Wellness-Stocks-Explode-as-179-Billion-Beverage-Market-Ditches-Sugar-for-Science.html

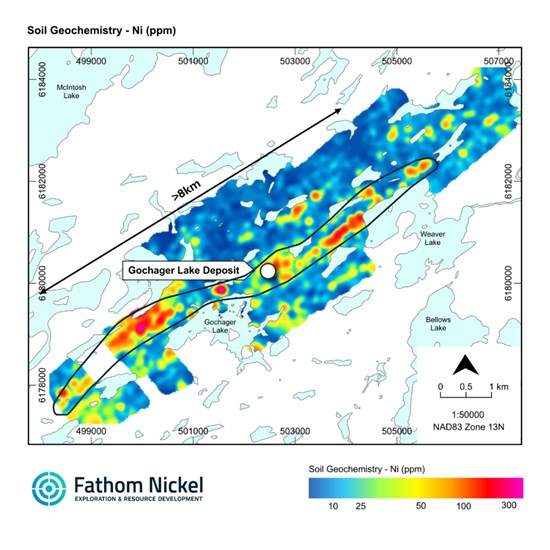

XRF Analyzer (‘pXRF’) to provide real-time lithogeochemical, multi-element data on surface rock chip samples and rock grab samples collected in the field. The Vanta

XRF Analyzer (‘pXRF’) to provide real-time lithogeochemical, multi-element data on surface rock chip samples and rock grab samples collected in the field. The Vanta