First Class Metals PLC (‘First Class Metals’, ‘FCM’ or the ‘Company’) the UK listed company focused on the discovery of economic metal deposits across its exploration properties in Ontario, Canada, is pleased to announce the successful completion of an option to purchase two properties with highly anomalous Rare Earth Elements (‘REE’) samples.

Highlights

- FCM expands its exploration portfolio to include Rare Earth Elements complementing its core gold exploration strategy in Ontario

- The option terms for both properties are highly favourable in year one, allowing FCM to assess REE potential with limited upfront financial exposure.

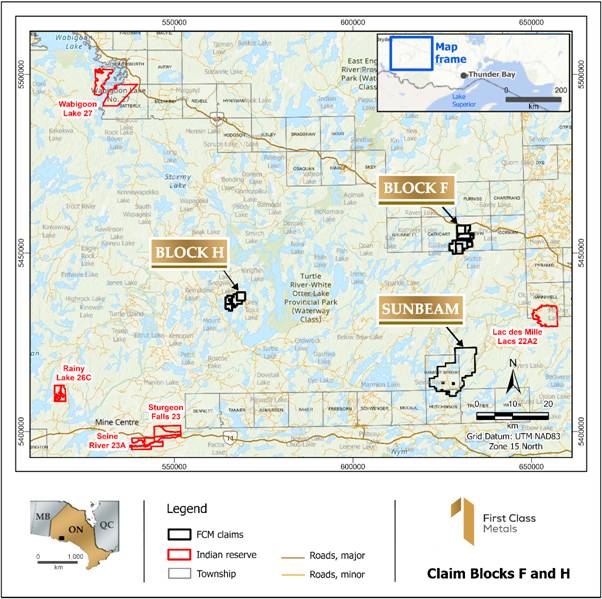

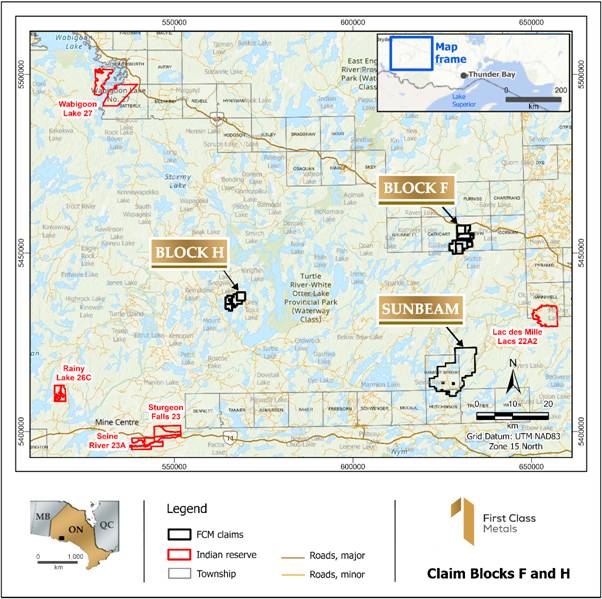

- The two optioned properties, Block H (~18km²) and Block F (~33km²), are located within one of the most anomalous REE regions identified in the Ontario province-wide lake sediment geochemical database.

- Initial exploration planned for Spring 2026 will focus on ground-truthing historic anomalies, validating assays, and refining geological controls on mineralisation.

- Both blocks are believed to lie within the traditional territory of Lac des Mille Lacs First Nation, with whom FCM already maintains a constructive working relationship.

- The Company intends to rename Block H and Block F via an online poll, enhancing stakeholder engagement and market visibility.

- Global REE supply remains highly concentrated, with China dominating both production and downstream processing, driving Western governments to prioritise secure, allied-source supply chains.

- Thorium-associated REE systems are increasingly attracting attention due to their potential to host light and heavy REE assemblages, which are essential for high-value permanent magnet applications.

Marc J. Sale CEO First Class Metals commented:

‘Gold remains the cornerstone of FCM’s exploration strategy and continues to underpin our approach to value accretion to FCM’s Ontario properties. However, against a backdrop of accelerating global demand for Rare Earth Elements, and a clear strategic shift by allied governments towards securing critical minerals, the opportunity presented by these two properties is particularly compelling. Their geochemical and geographic location allows FCM to gain meaningful exposure to this evolving sector while maintaining our gold-focused exploration strategy and Ontario focus.’

Option Terms

First Class Metals has entered into option agreements to acquire a 100% interest in both Block F and Block H (each subject to a production royalty). The options are structured over a three-year period and provide the Company with the ability to evaluate the properties with limited upfront financial commitment.

Block F

To exercise the option over Block F, the Company must make total cash payments of CAD $73,500 and issue CAD $60,000 in ordinary shares of the Company (‘Shares’) to the optionors over three years. Cash payments comprise CAD $9,500 payable within 30 working days of signing the agreement (the ‘Effective Date’), CAD $10,000 payable on the first anniversary of the Effective Date, CAD $16,000 on the second anniversary, and CAD $38,000 on the third anniversary. The share consideration of CAD $60,000 is payable on the first anniversary of the Effective Date.

|

Due Date

|

Share Payments

|

Cash Payment (CAD)

|

|

Within 30 working days of signing the Agreement

|

Nil

|

$9,500

|

|

On the 1st anniversary of the Effective Date

|

$60,000 in shares

|

$10,000

|

|

On the 2nd anniversary of the Effective Date

|

Nil

|

$16,000

|

|

On the 3rd anniversary of the Effective Date

|

Nil

|

$38,000

|

|

Total

|

$60,000 in shares

|

$73,500

|

Block H

To exercise the option over Block H, the Company must make total cash payments of CAD $67,600 and issue CAD $30,000 in Shares to the optionors over three years. Cash payments comprise CAD $5,600 payable within 30 working days of signing the agreement, CAD $8,000 payable on the first anniversary of the Effective Date, CAD $16,000 on the second anniversary, and CAD $38,000 on the third anniversary. The share consideration of CAD $30,000 is payable on the first anniversary of the effective date.

|

Due Date

|

Share Payments

|

Cash Payment (CAD)

|

|

Within 30 working days of signing the Agreement

|

Nil

|

$5,600

|

|

On the 1st anniversary of the Effective Date

|

$30,000 in shares

|

$8,000

|

|

On the 2nd anniversary of the Effective Date

|

Nil

|

$16,000

|

|

On the 3rd anniversary of the Effective Date

|

Nil

|

$38,000

|

|

Total

|

$30,000 in shares

|

$67,600

|

Macro Context – Rare Earth Elements

Rare Earth Elements (‘REE’) are widely recognised as strategically critical commodities, forming essential inputs for electric vehicles, renewable energy technologies, defence applications, semiconductors and high-performance permanent magnets. Global demand for REE is forecast to grow materially.

As a result, REE continue to attract increasing attention from governments and industry seeking to secure long-term supply.

Canada has formally identified REE as priority critical minerals and is positioning itself as a key allied jurisdiction capable of supporting secure, transparent and responsible supply chains. Federal and provincial initiatives are focused on encouraging domestic exploration and development, particularly in established mining regions with strong infrastructure and regulatory frameworks such as Ontario.

Thorium-associated REE systems, including those linked to batholithic and pegmatitic environments, are increasingly viewed as prospective exploration targets. FCM’s entry into REE exploration in northwest Ontario aligns with this national strategic focus, while complementing the Company’s core gold exploration activities within a Tier-1 mining jurisdiction.

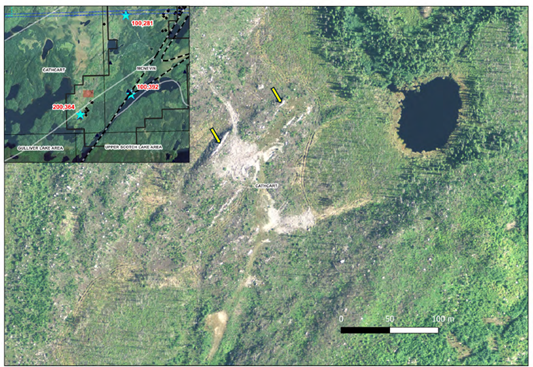

The two claim blocks are located in the Atikokan area of northwest Ontario in relative proximity to the Sunbeam property, see Figure 1. Access to both blocks is excellent whilst forestry track on the properties allows internal access.

Figure 1 showing the locations of Blocks F and H with relevant topographic information, note access as well as proximity to the Sunbeam property.

The decision to acquire the two blocks from a local prospector was based on the historic (Ontario Geological Survey) lake sediment programmes. To date no groundwork has been conducted by FCM. However, PowerMax Minerals (CSE:PMAX) who also acquired blocks in the area from the same vendor have conducted an initial prospecting programme.

The Company has initiated a detailed data review of all available material in advance of a prospecting orientated field programme.

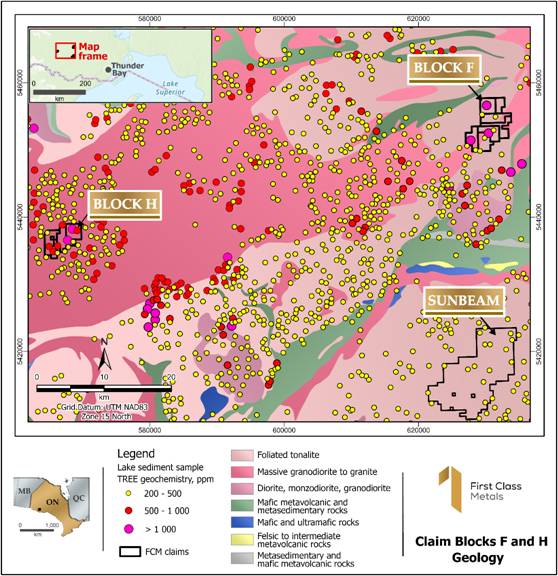

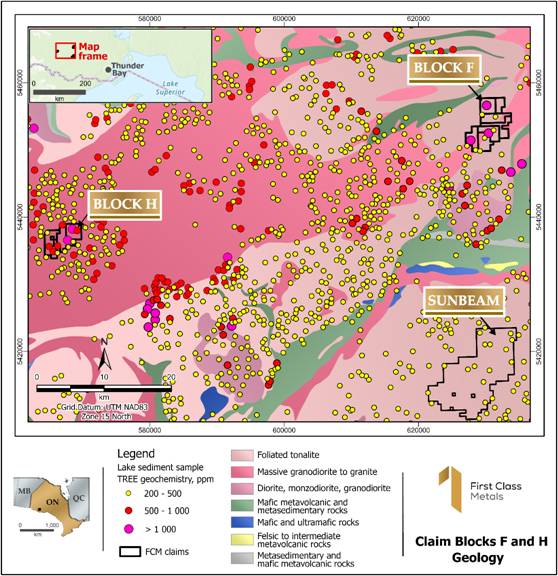

The White Otter Batholith, north of Atikokan, Ontario represents one of the most anomalous REE areas in the province-wide 48,367 samples lake sediment database. There are 26 samples in the database with partial total REE>500ppm of which 9 (35%) are in the White Otter area, a number of which as covered by the newly optioned FCM claim blocks, see Figure 2.

Figure 2 location of blocks H & F relative to the assays from the province-wide lake sediments survey.

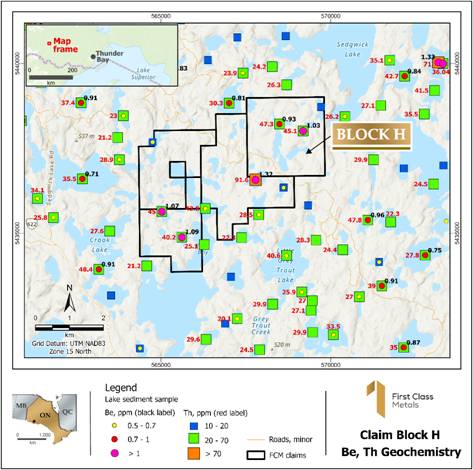

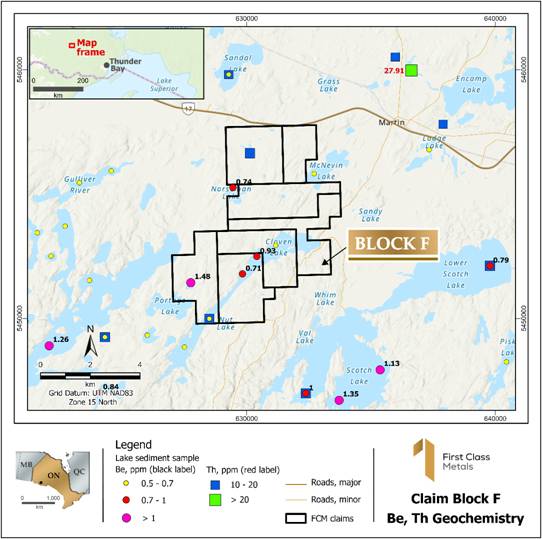

The White Otter batholith is a Thorium (Th) high. Anomalous REE’s in lake sediments in the area are often associated with elevated Th.

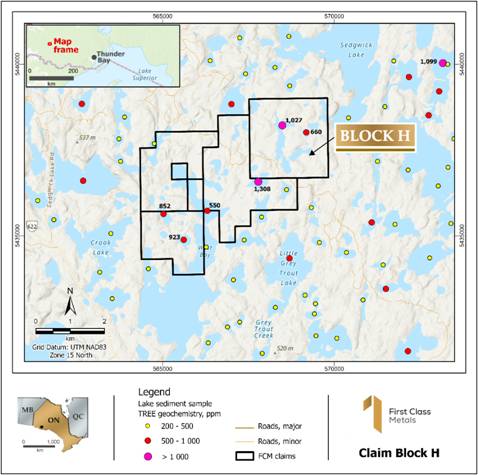

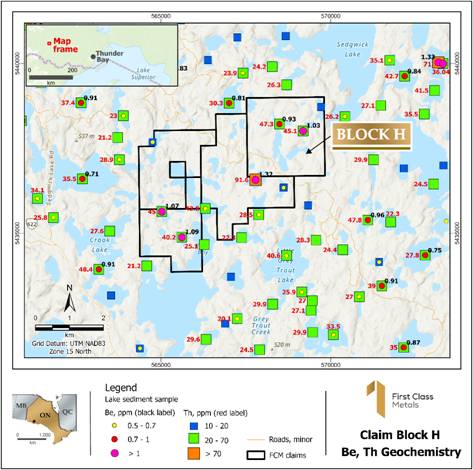

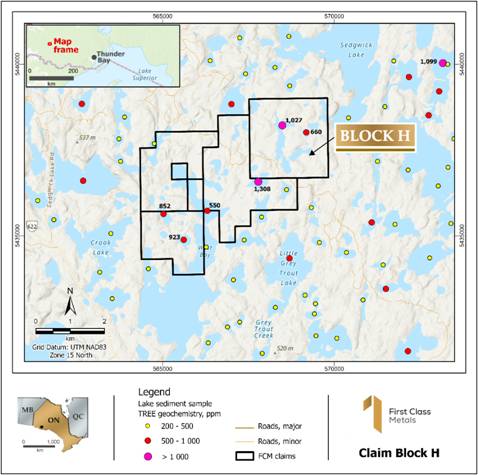

Figure 3 Block H, 81 cells, (4 multi cells) 1,712 Ha. Note the available access tracks

REE anomalies occur within and around the eastern margin of the batholith within a 5km radius. It is possible that the White Otter batholith is a source for REE pegmatites or related mineralization in the area. Block H is in the core of the White Otter REE element anomaly, see Figures 2,3 and 4.

Figure 4 Block H showing the anomalous Be and Th lake sediment samples

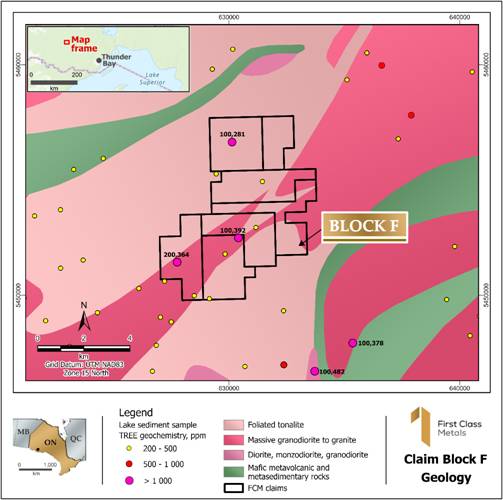

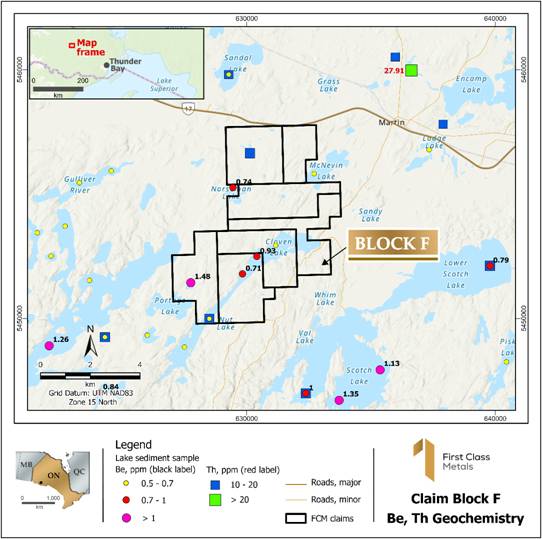

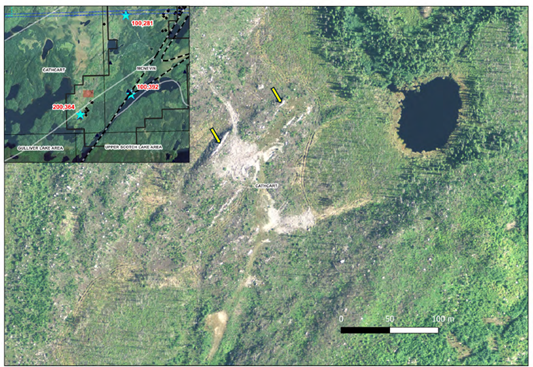

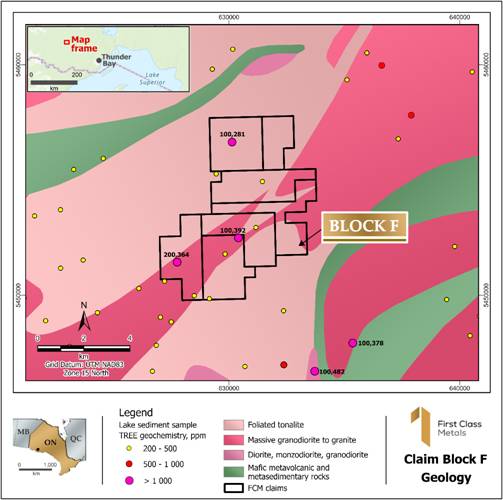

Block F sits astride what is interpreted as a major geological regional fault. This fault is emphasised by the topography and the anomalous lake sediment results further highlight this prospective feature. Satellite imagery of the area also shows possible pegmatite dykes. See Figures 3-5

Figure 5 Block F, 7 multicell claims, 158 cells, area 3,332Ha, note the northeast orientation of anomalous assays, possibly related to a major regional fault within the White Otter Batholith

Figure 6 Block F showing the anomalous Be and Th lake sediment samples

Figure 7 showing Block F with possible pegmatites close to overlimit anomalies- examples arrowed

FCM is now engaged in a interrogation of other historic data to compile a ground target list for the Spring exploration programme.

Qualified Person

The technical disclosures contained in this announcement have been drafted in line with the Canadian Institute of Mining, Metallurgy and Petroleum standards and guidelines and approved by Marc J. Sale, who has more than 30 years in the gold exploration industry and is considered a Qualified person owing to his status as a Fellow of the Australian Institute of Mining and Metallurgy.

For Further Information:

Engage with us by asking questions, watching video summaries, and seeing what other shareholders have to say. Navigate to our Interactive Investor hub here: https://firstclassmetalsplc.com

For further information, please contact:

James Knowles, Executive Chair

Email: JamesK@Firstclassmetalsplc.com

Tel: 07488 362641

Marc J Sale, CEO and Executive Director

Email: MarcS@Firstclassmetalsplc.com

Tel: 07711 093532

AlbR Capital Limited (Financial Adviser)

David Coffman/Dan Harris

Website: www.albrcapital.com

Tel: (0)20 7469 0930

Axis Capital Markets (Broker)

Lewis Jones

Website: Axcap247.com

Tel: (0)203 026 0449

First Class Metals PLC – Background

First Class Metals listed on the LSE in July 2022 and is focused on metals exploration in Ontario, Canada which has a robust and thriving junior mineral exploration sector. In particular, the Hemlo ‘camp’ near Marathon, Ontario is a proven world class address for gold exploration, featuring the Hemlo gold deposit previously operated by Barrick Mining (>23M oz gold produced), with the past producing Geco and Winston Lake base metal deposits also situated in the region.

FCM currently holds 100% ownership of seven claim blocks covering over 250km² in northwest Ontario. A further three blocks are under option and cover an additional 30km2.FCM is focussed on exploring for gold but has base metals and critical metals mineralisation. FCM is maintaining a joint venture with GT Resources on the West Pickle Lake Property, a drill-proven ultra-high-grade Ni-Cu project.

The flagship properties, North Hemlo and Sunbeam, are gold focussed. North Hemlo has a significant discovery in the Dead Otter trend which is a discontinuous 3.5km gold anomalous trend with a 19.6g/t Au peak grab sample. This sampling being the highest known assay from a grab sample ever recorded on the North Limb of Hemlo.

In October 2022 FCM completed the option to purchase the historical high-grade past-producing Sunbeam gold mine near Atikokan, Ontario, ~15 km southeast of Agnico Eagle’s Hammond Reef gold deposit (3.3 Moz of open pit probable gold reserves).

FCM acquired the Zigzag Project near Armstrong, Ontario in March 2023. The property features Li-Ta-bearing pegmatites in the same belt as Green Technology Metals’ Seymour Lake Project, which contains a Mineral Resource estimate of 9.9 Mt @ 1.04% Li2O. Zigzag was successfully drilled prior to Christmas 2023.

The Kerrs Gold property, acquired under option by First Class Metals in April 2024, is located in northeastern Ontario within the Abitibi Greenstone Belt, one of the world’s most prolific gold-producing regions. The project holds a historical inferred resource of approximately 386,000 ounces of gold, underscoring its potential as a meaningful addition to FCM’s expanding gold portfolio. Kerrs Gold complements the Company’s exploration strategy and provides exposure to a well-established mining district. FCM is currently reviewing plans to advance the project and further unlock its value.

The significant potential of the properties for precious, base and battery metals relates to ‘nearology’, since all properties lie in the same districts as known deposits (Hemlo, Hammond Reef, Seymour Lake), and either contain known showings, geochemical or geophysical anomalies, or favourable structures along strike from known showings (e.g. the Esa project, with an inferred Hemlo-style shear along strike from known gold occurrences).

For further information see the Company’s presentation on the web site:

www.firstclassmetalsplc.com

Forward Looking Statements

Certain statements in this announcement may contain forward-looking statements which are based on the Company’s expectations, intentions and projections regarding its future performance, anticipated events or trends and other matters that are not historical facts. Such forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements sometimes use words such as ‘aim’, ‘anticipate’, ‘target’, ‘expect’, ‘estimate’, ‘intend’, ‘plan’, ‘goal’, ‘believe’, or other words of similar meaning. These statements are not guarantees of statements. Given these risks future performance and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking and uncertainties, prospective investors are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date of such statements and, except as required by applicable law, the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Source

This post appeared first on investingnews.com

Brightstar Resources (BTR:AU) has announced Mining Approvals Received for Lady Shenton Mine in Menzies

Brightstar Resources (BTR:AU) has announced Mining Approvals Received for Lady Shenton Mine in Menzies