Aided by rising demand for permanent magnets, the rare earths market entered 2025 on firmer footing, with prices and investor sentiment trending higher.

That early optimism, however, was quickly overtaken by mounting geopolitical risk as US-China trade tensions returned rare earths to the center of global supply chain concerns.

Through the first quarter, uncertainty around tariffs and the prospect of tighter Chinese controls weighed heavily on downstream industries and reinforced the strategic value of rare earths.

That risk crystallized in early April, when China issued Announcement 18, a sweeping export control regime covering a range of medium and heavy rare earths — including terbium, dysprosium, samarium and yttrium — as well as related oxides, alloys, compounds and permanent magnet technologies.

Framed by Beijing as a national security and nonproliferation measure, the policy added a new layer of regulatory friction to supply chains underpinning electric vehicles, defense systems, clean energy and advanced manufacturing.

The response was swift. In Washington, the Trump administration moved to reassess US critical minerals security, singling out rare earths as a strategic vulnerability.

“An overreliance on foreign critical minerals and their derivative products could jeopardize US defense capabilities, infrastructure development, and technological innovation,” the White House said, underscoring a shift from market-driven concern to national security imperative.

For Jon Hykawy, president and chief executive at Stormcrow Capital, the Trump administration’s rare earths ambitions and its understanding of the minerals markets was the most impactful trend of 2025, commenting, “By far the biggest impact was the implication from re-elected US President Donald Trump that rare earths and other critical materials, to be found in Ukraine or Greenland or Canada or wherever, are the most bigly important things, ever.’

The seasoned market analyst also questions the administration’s broader goals.

“Critical materials are, to me, what is necessary for ensuring that important projects can be completed,’ he said.

‘But President Trump has also decided that climate change is a scam, that electrified vehicles and wind power are terrible and coal and oil are where it’s at,’ Hykawy continued.

‘In that case, whether or not Trump has even the concept of a plan regarding what a rare earth actually is, and he isn’t using ‘rare earth’ as a catch-all phrase for ‘weird metal that I don’t know how to spell,’ then rare earths or lithium are not critical materials, as far as the USA should be concerned: if you don’t need ‘em, they ain’t critical.”

China’s rare earths chokehold exposes supply chain fault lines

By mid-year, the impact of China’s controls was being felt most acutely in the automotive sector. European suppliers warned of production shutdowns as licensing delays rippled through tightly integrated supply chains.

The Asian nation controls roughly 70 percent of global rare earths mine output, as well as 85 percent of refining capacity and about 90 percent of magnet manufacturing.

That concentration left markets highly exposed when Beijing escalated restrictions again in October, expanding export controls to cover a total of 12 rare earths and associated permanent magnets.

Although some measures were later paused through November 2026, earlier dual-use restrictions stayed in place, reinforcing the perception that rare earths are now a tool of geopolitical leverage.

“At its core, China has shown a greater willingness to use its dominance in critical minerals to advance its trade and geopolitical influence, potentially causing significant disruptions to global supply chains for industries like automotive, aerospace, defense, and electronics,” states a S&P Global Energy report.

Against that backdrop, efforts to diversify supply accelerated.

In the US, government support moved from rhetoric to capital. The Department of Defense committed US$400 million to MP Materials (NYSE:MP) to expand processing at Mountain Pass and build a second domestic magnet plant, securing a US-based source of permanent magnets for defense applications.

Days later, Apple (NASDAQ:AAPL) announced a US$500 million agreement with MP to supply recycled rare earth magnets for hundreds of millions of devices starting in 2027, tying supply chain security to sustainability.

As Hykawy explained, these developments are setting the stage for ex-China supply:

“We are at the beginning of producing, processing and utilizing rare earths in a supply chain entirely outside of China. There is absolutely nothing that prevents us from building that western supply chain except time and money. Rare earth deposits of all types, including ionic clays and their relatively inexpensive production of heavy rare earths, are readily available outside of China.”

He went on to note that there has been a misconception about the impacts of rare earths production, paired with a lack of investment and expertise that has prevented a faster buildout.

“It’s a media cliché that rare earth mining and processing is somehow much more destructive to the environment than other types of mining, but that’s also just plain wrong,” Hykawy added.

“Unfortunately, building that supply chain will take money and, especially, time, because we need the people who know how to do all of this, and there is no substitute for the time required to give them their required experience.”

Rare earths supply security and growing demand

As global demand for rare earths accelerates and supply chain risks heighten, experts believe the sector’s importance on the global stage will keep intensifying.

During a Benchmark Week presentation, Michael Finch of Benchmark Mineral Intelligence explained that rare earths have “become far more strategic in nature” over recent years, with applications spanning electric vehicles, consumer electronics, wind energy, robotics and modern military systems.

While permanent magnets remain a headline driver, non-magnetic uses now account for a larger share of total demand, underscoring the material’s broad industrial importance.

Demand projections for rare earths forecast robust growth, underpinned key segment expansion.

According to Finch’s data an average 100 kW EV traction motor contains roughly five kilograms of neodymium-praseodymium and about one kilogram of dysprosium oxide, illustrating how electrification is fueling consumption.

Additionally, permanent magnet applications are projected to grow at an 8.5 percent compound annual rate through 2030, with magnetic and non-magnetic uses expected to reach parity over the next decade.

Military demand is also a significant driver.

“(There are) 418 kilograms of rare earths going into an F 35 type two fighter (jet), 2.6 metric tons going into a type 51 (naval) destroyer, and 4.6 metric tons going into a Virginia class submarine,” said Finch.

As stated, supply remains heavily concentrated in China which controls 91 percent of the overall supply chain, from mining to permanent magnets. Finch emphasized that this concentration creates a single-country risk, noting, “When a country owns so much of a supply chain, it’s easy to use it as a bargaining chip.”

The global rare earths supply chain is gradually diversifying. North America and Africa are emerging as key growth regions, with projects expected to significantly expand non-Chinese production in the coming decade.

Finch pointed to Africa, which could account for up to 7 percent of global supply after 2030, driven by low capital intensity and favorable mining costs. Despite this progress, he cautioned that complete self-sufficiency outside China remains a distant prospect, emphasizing the need for rapid investment and strategic coordination to secure supply.

Rare earths investment bolstered by government support

In addition to the Department of Defense’s MP Materials investment, the US government has established a price floor for NdPr oxide, the high-value rare earths ingredient inside permanent magnets.

During a fireside chat at Benchmark Week, Ryan Corbett, CFO of MP Materials, explained the impact of the price floor in support of the burgeoning US supply chain. He told the audience that the deal is “absolutely transformational,’ and pointed to China’s ability to control pricing by flooding or starving the market. “What good is it to invest billions of dollars if the second you turn your refinery on, prices go from US$170 to US$45?” said Corbett.

In October, the Trump administration announced another strategic investment aimed at reshoring critical supply chains through a US$1.4 billion public-private partnership with Vulcan Elements and ReElement Technologies.

Under the agreement, the Commerce Department will provide US$50 million in CHIPS Act incentives for neodymium-iron-boron magnet production in exchange for an equity stake, alongside up to US$700 million in conditional Defense Department loans to support facilities targeting up to 10,000 metric tons of annual output.

On the private investment side, Rare earths developer Pensana (LSE:PRE,OTCPL:PNSPF) secured a US$100 million strategic investment to advance its mine-to-magnet ambitions in the US, at the end of 2025.

Although the rare earths sector saw several multimillion-dollar deals in 2025, exploration capital remains scarce.

According to S&P Global’s Senior Principal Analyst, Mining Studies & Mine Economics, Paul Manalo the rare earths account for 1 percent of global exploration budgets, however, that number has improved in recent years.

“For the sixth consecutive year, budgets for rare earths were up reaching US$155 million in 2025; it’s the highest level since 2012,” Manalo said during the S&P Global Market Intelligence 2026 Corporate Exploration Strategies webinar.

Although exploration budgets are growing, the expert said 80 percent of that capital is being deployed in only four countries: Australia, Brazil, USA and Canada. “Just like in other minor metals, the juniors are the primary drivers for exploration of rare earths, with only a few majors dabbling in it,” Manalo told listeners, adding, “There are few rare earth mines outside of China, so most pending exploration is for late stage projects.”

The government funding and strategic stockpile proposal were acknowledged as a good starting point by Stormcrow Capital’s Hykawy, who also cautioned that they may not be as meaningful as markets anticipate.

“I give the efforts so far an ‘A’ for enthusiasm but a ‘C-‘ for effectiveness. From what I have seen, the powers-that-be are beavering away to create a supply chain that can provide what the world is demanding, today,” he said.

“Unfortunately, many of their efforts can’t bear fruit for 5 years or more, and none of these agencies seemed to think it worthwhile to try and evaluate what will be required in 5 or 10 years.”

More long-term foresight is needed.

“Technology giveth, but technology also taketh away, and while no one can be sure what the technology-driven need will be in 5 or 10 years, we should at least try to incorporate that into planning,” he said.

“If the wrong projects are being backed, the economics for that producer or processor in 5 or 10 years are not going to look good and money and time will have been completely wasted.”

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

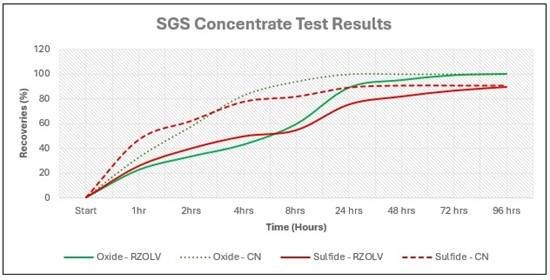

against conventional sodium cyanide under controlled bottle-roll leaching conditions.

against conventional sodium cyanide under controlled bottle-roll leaching conditions.