Best-to-date titanium–vanadium–iron drill results at Trapper Zone underscore Radar’s large-scale oxide system within the 160 km² Dykes River intrusive complex near tidewater in Labrador

Saga Metals Corp. (‘SAGA’ or the ‘Company’) (TSXV: SAGA,OTC:SAGMF) (OTCQB: SAGMF) (FSE: 20H), a North American exploration company focused on critical mineral discovery, is pleased to highlight a strengthened titanium thesis for its Radar Ti-V-Fe Project near the port of Cartwright, Labrador, following the Company’s best drill results to date from the Trapper Zone Phase 1 Mineral Resource Estimate (‘MRE’) drill program.

SAGA’s latest assays from the first two of eight completed MRE program drill holes at Trapper Zone demonstrate long, cumulative intervals of oxide mineralization with significant assay results of titanium dioxide (TiO₂), vanadium pentoxide (V₂O₅) and iron oxides (Fe₂O₃). This mineral assemblage is consistent with vanadiferous titanomagnetite (‘VTM’) and ilmenite mineralization that could potentially underpin multiple downstream titanium value chains and support an emerging strategic narrative: a need for resilient North American titanium supply.

SAGA believes Radar’s titanium-bearing oxide system is increasingly topical as Western governments and manufacturers focus on secure, defense-aligned supply chains for titanium metal inputs. In a January 2, 2026, MINING.com article citing Project Blue’s report ‘Metals and the Security of Nations’, titanium is characterized as a critical mineral for defense and aerospace, with supply-chain risk concentrated in titanium metal pathways (including aerospace-grade sponge capacity and certification) rather than in pigment markets. The vast majority – over 90% globally of mined titanium is processed into the pigment – a looming supply chain gap UK-headquartered market intelligence company Project Blue outlines in its report.

‘Titanium is essentially a defence metal – it can be up to 20% or more of the markets for total titanium consumption that goes into defence. An F 15 can be up to 40% in weight of titanium. There’s some serious volume going in these jet planes,’ Project Blue Founder and Director, Dr. Nils Backeberg told MINING.com in an interview.

Saga Metals Releases Best-to-Date Drill Results at the Radar Project Confirming Robust Titanium–Vanadium–Iron Oxide Mineralization at Trapper Zone — Assay Highlights:

- Hole R-0008: 269.36 m @ 6.57% TiO₂, 0.244% V₂O₅, 36.21% Fe₂O₃ (full hole)

- Hole R-0009: 296.47 m @ 7.46% TiO₂, 0.250% V₂O₅, 39.75% Fe₂O₃ (full hole)

- High-grade intervals within the broader intercepts, including 2 m @ 13.30% TiO₂ (core sample 1800528)

Michael Garagan, CGO & Director of Saga Metals, stated: ‘The results from the first two holes at the Trapper Zone are an outstanding success, and represent the best intercepts drilled on the Radar property to date.’

What’s Different About the Radar Ti-V-Fe Project: A District-Scale Oxide System Enclosing the Entire Dykes River Intrusive Complex Potentially Forming a New North American Titanium Narrative

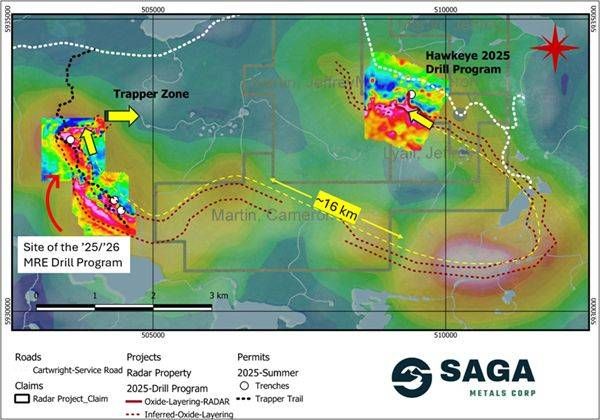

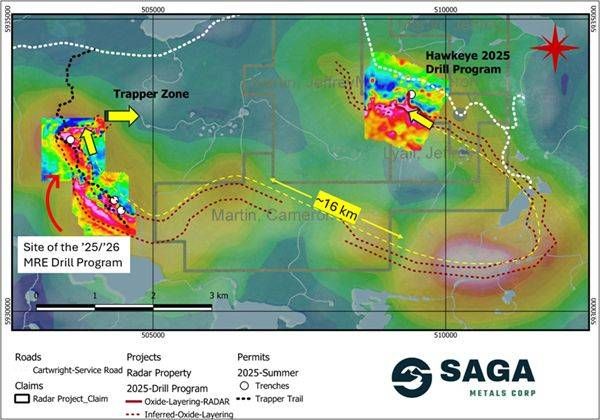

SAGA’s Radar Project is not a single isolated target. The Radar Property spans 24,175 hectares and hosts the entire Dykes River intrusive complex (~160 km²)—a property-scale position that is unique among Western explorers. Geological mapping, geophysics and trenching confirm oxide layering across more than 20 km of strike length and mineralization open for expansion. Drilling to date (4,250 m total) has confirmed a large mineralized layered mafic intrusion hosting VTM and ilmenite concentrations with strong titanium and vanadium grades. Drilling and geophysics validate a continuous 16+ km oxide layering trend stretching from the Hawkeye Zone to the Trapper Zone, coinciding with a strong arcuate regional magnetic-high anomaly.

Titanium Market Context: Defense and Aerospace Supply Chains Are Driving Urgency

This exploration progress is occurring against a strengthening macro backdrop for titanium as a defense and aerospace critical mineral, where supply-chain resilience—not just demand growth—has become a primary strategic driver. Titanium is deemed a critical metal by the U.S., EU and Canada and is essential for defense and aerospace applications due to its strength-to-weight ratio and corrosion resistance.

At the same time, the titanium market is structurally bifurcated: TiO₂ pigment dominates mined titanium flows, while defense and aerospace rely on titanium metal supply chains that are sensitive to geopolitics and processing constraints. Project Blue (as reported by MINING.com) notes that over 90% of mined titanium is processed into pigment, and that near-term vulnerability centers on aerospace-grade titanium sponge capacity and certification, rather than mineral availability alone. The same report highlights titanium supply-chain concentration risks, stating Russia remains a leading source of aerospace-grade titanium and that China’s share of global titanium metals has increased sharply in recent years.

Titanium market growth tailwinds

Third-party market research distributed via openPR (DataM Intelligence) forecasts the global titanium market could grow from US$30.34 billion (2024) to US$52.52 billion by 2032 (CAGR 7.10%), citing demand drivers including aerospace, defense, automotive, and renewable energy; the same release indicates Asia-Pacific leads with 45% share. openPR.com

‘SAGA’s recent assays are truly exceptional, delivering long intervals of high-grade titanium, vanadium, and iron oxide mineralization—highlighting the immense potential of this district-scale oxide system. At Saga Metals, we’re committed to advancing Radar as a strategic source of titanium right here in Labrador, bolstering resilient, domestic supply chains to meet these urgent national security needs,’ stated Mike Stier, CEO & Director of Saga Metals.

Next steps at the Radar Project:

SAGA expects to receive additional assay results next week, with remaining results shortly thereafter, and plans to mobilize crews by mid-January to initiate the 2026 phase of the Trapper Zone MRE drill program.

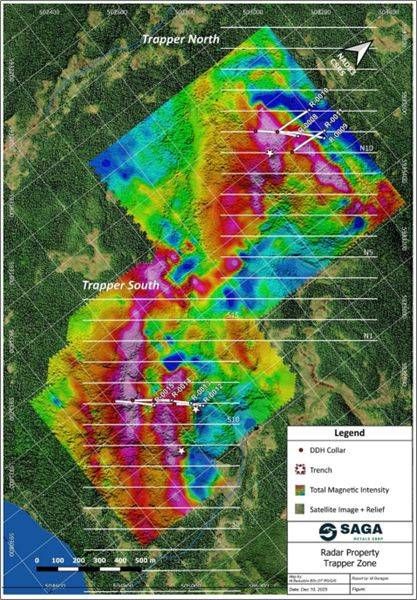

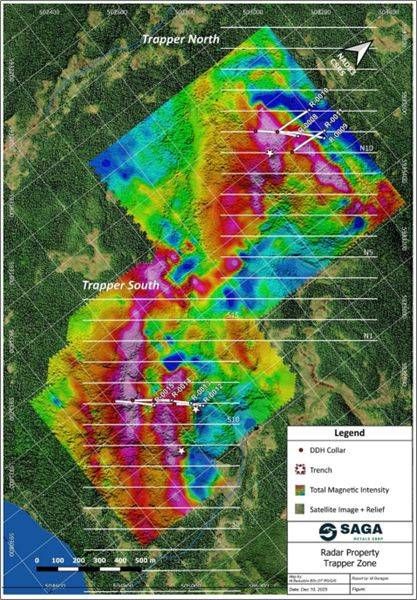

Figure 1: Location of the Fall 2025 phase of drilling at Trapper Zone, showing the TMI of the 2025 Trapper Zone ground magnetic survey as well as the grid for the MRE drill program to be completed in 2026.

About the Radar Ti-V-Fe Property:

The Radar Property spans 24,175 hectares and hosts the entire Dykes River intrusive complex (~160 km²), a unique position among Western explorers. Geological mapping, geophysics, and trenching have already confirmed oxide layering across more than 20 km of strike length, with mineralization open for expansion.

Vanadiferous titanomagnetite (‘VTM’) mineralization at Radar is comparable to global Fe–Ti–V systems such as Panzhihua (China), Bushveld (South Africa), and Tellnes (Norway), positioning the Project as a potential strategic future supplier of titanium, vanadium, and iron to North American markets.

Figure 2: Radar Project’s prospective oxide layering zone validated over ~16 km strike length through Fall 2025 drilling, as shown on a compilation of historical airborne geophysics as well as ground-based geophysics in the Hawkeye and Trapper zones completed by SAGA in the 2024/2025 field programs. SAGA has demonstrated the reliability of the regional airborne magnetic surveys after ground-truthing and drilling in the 2024 and 2025 field programs.

Qualified Person

Paul J. McGuigan, P. Geo., is an Independent Qualified Person as defined under National Instrument 43-101 and has reviewed and approved the technical information disclosed in this news release.

Technical Information

Samples were cut by Company personnel at SAGA’s core facility in Cartwright, Labrador. Diamond drill core was sawed and then sampled in maximum 2 m intervals. Drill hole core diameter utilized was NQ.

Core samples have been prepared and analyzed at IGS laboratory facility in Montreal, Quebec. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. The Company utilizes a rigorous, industry-standard QA/QC program.

Note: Market data is sourced from https://www.openpr.com/news/4334101/titanium-market-to-reach-usd-52-52-billion-by-2032-strong-7-10 and has not been independently verified by SAGA. Mining.com released an article on January 2, 2026 referenced in this press release and is sourced from: https://www.mining.com/us-must-ramp-up-titanium-capacity-to-avoid-squeeze-project-blue-founder-says/

About Saga Metals Corp.

Saga Metals Corp. is a North American mining company focused on the exploration and discovery of a diversified suite of critical minerals that support the North American transition to supply security. The Radar Ti-V-Fe Project comprises 24,175 hectares and entirely encloses the Dykes River intrusive complex, mapped at 160 km² on the surface near Cartwright, Labrador. Exploration to date, including a total of 4,250 m of drilling, has confirmed a large and mineralized layered mafic intrusion hosting vanadiferous titanomagnetite (VTM) and ilmenite mineralization with strong grades of titanium and vanadium.

The Double Mer Uranium Project, also in Labrador, covers 25,600 hectares and features uranium radiometrics that highlight an 18km east-west trend, with a confirmed 14km section producing samples as high as 0.428% U3O8. Uranium uranophane was identified in several areas of highest radiometric response (2024 Double Mer Technical Report).

Additionally, SAGA owns the Legacy Lithium Property in Quebec’s Eeyou Istchee James Bay region. This project, developed in partnership with Rio Tinto, has been expanded through the acquisition of the Amirault Lithium Project. Together, these properties cover 65,849 hectares and share significant geological continuity with other major players in the area, including Rio Tinto, Winsome Resources, Azimut Exploration, and Loyal Metals.

With a portfolio spanning key commodities critical to the clean energy future, SAGA is strategically positioned to play an essential role in critical mineral security.

On Behalf of the Board of Directors

Mike Stier, Chief Executive Officer

For more information, contact:

Rob Guzman, Investor Relations

Saga Metals Corp.

Tel: +1 (844) 724-2638

Email: rob@sagametals.com

www.sagametals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Disclaimer

This news release contains forward-looking statements within the meaning of applicable securities laws that are not historical facts. Forward-looking statements are often identified by terms such as ‘will’, ‘may’, ‘should’, ‘anticipates’, ‘expects’, ‘believes’, and similar expressions or the negative of these words or other comparable terminology. All statements other than statements of historical fact, included in this release are forward-looking statements that involve risks and uncertainties. In particular, this news release contains forward-looking information pertaining to the Company’s Radar Project. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, environmental risks, limitations on insurance coverage, inherent risks and uncertainties involved in the mineral exploration and development industry, particularly given the early-stage nature of the Company’s assets, and the risks detailed in the Company’s continuous disclosure filings with securities regulations from time to time, available under its SEDAR+ profile at www.sedarplus.ca. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements only as expressly required by applicable law.

Photos accompanying this announcement are available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e21bb951-27c0-4b42-8a84-30fb2b2317f1

https://www.globenewswire.com/NewsRoom/AttachmentNg/46a5c706-d557-4027-bbbe-ec9278c19754