Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.

These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are expected to become more pronounced amid aging mines and a lack of new operations.

Colin Hamilton, Teck Resources’ (TSX:TECK.A,TECK.B,NYSE:TECK) vice president of market research and economic analysis, spoke on changing copper market dynamics at the 2026 Prospectors & Developers Association of Canada (PDAC) convention.

In his talk, Hamilton highlighted China’s role as the world’s largest consumer of copper, and the country’s increasing influence on the global copper market.

China’s role in copper markets

There are few parts of the economy that copper doesn’t touch. It’s used in construction, manufacturing, the transmission of electricity and in many high-tech products like mobile phones and electric vehicles.

Copper is a fundamental commodity for the global economy, and demand for it is only going to grow in the coming years on a variety of factors.

The red metal is essential for changing dynamics in the global south, where a greater share of the population is moving to urban centers and upward economic mobility is driving demand for household appliances like air conditioners, refrigerators and washing machines.

Adding to this demand are emerging sectors like the energy transition, where wind and solar require greater copper inputs, as well as AI and the data centers that support it.

Hamilton told the PDAC audience that China, the world’s largest consumer of the red metal, sits at a confluence of demand generation.

The country is often considered the world’s factory for its manufacturing glut, it has a growing middle class, and its tech sector is booming. These factors are also driving significant growth in its electricity grid.

“A decade ago, China was more or less in parallel with the rest of the world,” Hamilton said. “China has surged ahead in terms of that electricity share, and it’s going to continue in a world where artificial intelligence is arguably the next geopolitical battleground.”

He explained that because of its manufacturing base, China’s energy grid has benefited from significant investment, a trend that is set to continue.

“China is planning to increase grid investment by 40 percent over the next five years. This is huge spending that is continuing to come through, and that will be copper-intensive spend,” Hamilton said.

China isn’t the only country that needs to expand its electrical grid. Hamilton also noted that Europe has an energy problem that it is solving, in the short term, by buying Chinese-produced solar technology, adding further copper demand to already constrained Chinese supply.

Smelting supply shortfalls

The biggest issue impacting copper markets and causing increased prices is a lack of supply.

This has led to a shortfall of copper concentrate supply for smelters to refine.

“To keep it in simple terms, we see a situation where smelting demand over 2025 is going to be 600,000 to 650,000 metric tons more than the available concentrate in the custom market,” Hamilton said. “That’s really what sets that raw material constraint. There’s just not enough copper supply to go around.”

The lack of supply in concentrates has pushed treatment and refining charges, which are typically paid by mining companies to smelters, down to zero. Hamilton said these historically low charges outline how acutely tight the market really is. He explained that it’s a trend that won’t moderate in the short term, as supply growth is failing to keep pace with refining capacity.

Hamilton noted that 10 years ago the expectation was that copper supply would be in the 20 million to 30 million metric ton per year range by 2026. In reality, supply is expected to be 23 million metric tons this year, closer to the lower end of the range.

“Not to say projects haven’t come online, but we have seen depletion of existing assets,” he said.

China’s copper supply strategy

In addition to being the leading consumer of copper, China is also leading in adding new supply to the market.

“Who has been successful at growing copper supply is China, not necessarily in the country, but a lot through investments, particularly in the Democratic Republic of the Congo,” Hamilton said.

Those investments have contributed to the DRC adding 2.5 million metric tons of annual supply over the last decade, as well as increases in Peruvian production from the Las Bambas and Toromocho operations, owned by China-based MMG and Chinalco, respectively.

This dominance by China has led the rest of the world to play catch-up. Hamilton pointed to Chile, the world’s top copper producer, noting that Chilean production has been flat for 20 years. While there is growth planned, he said it’s going to take some time and a change in mindset within the industry.

In the long term, Hamilton suggests China will take what is available from the concentrate market; however, he pointed out that fallout from the copper tariffs last year led US traders to buy up significant quantities of copper cathode.

“Now that material is not available for price formation yet,” he said. “It is locked in economically to the US. It will come back to the market at some point. So we have to be aware that is a little bit of an inventory overhang, but I do believe trading houses will slowly bleed this out into the market in a managed form.”

What comes next?

The market needs to adapt to changing times, Hamilton emphasized, in much the way copper smelters have in the face of difficult copper market conditions.

“Smelters have really pulled the levers they can pull as the whole economics of the value chain changes to maintain profitability. That’s good, that’s what we like to see, that healthy change in business model to changing market conditions,” Hamilton said.

Hamilton suggested that there needs to be some evolving perspectives within the industry, in which every part of the value chain works together, and they should be able to make money.

China, he points out, has focused on a commodity-first business model, in which it imports raw materials from wherever they are available and uses its domestic processing capacity to upgrade them.

Although growth in its domestic processing capacity has stalled, he suggested that its funding of processors outside the country is likely to increase.

“China started to dominate the copper exports of (semirefined products) and cable into the world. I do think that’s a trend that will continue, though it does mean there will probably be some trade barriers,” Hamilton said, noting the trend could also extend to finished products.

He went on to say that copper has delivered consistent premiums, spending nearly 50 percent of the time since 2000 in the 90th percentile of the cost curve.

“The industry has just been using the money, the free cash flow, to do dividends and buybacks and servicing debt, but we haven’t actually seen that capital allocation back towards growth,” Hamilton said.

While keeping shareholders happy is important, so too is growth of the business.

“Capital intensity is hugely important. Where companies have got mining projects wrong, in many cases, over the past decade has been blowing out in terms of capital intensity, so you have to look for smart solutions,” he said.

Hamilton noted that the easiest copper resources have already been developed, and the next ones will become increasingly more challenging. With prices reaching record highs, it should unlock some projects.

“At these copper price levels, if you’ve got a shovel-ready project, you can bring it to market pretty quickly. Those big greenfield projects are much harder,” he said.

Using capital efficiently will be critical as companies look to open these new assets. However, Hamilton believes that copper’s solid fundamentals, and new energy sectors, will drive industry growth.

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

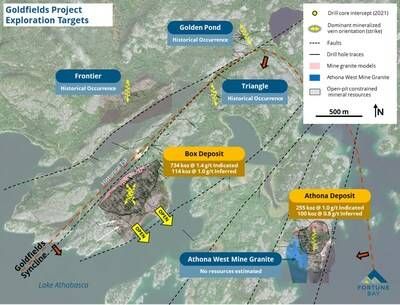

Brightstar Resources (BTR:AU) has announced Brightstar Secures US$120M Bond to Fund Goldfields Project

Brightstar Resources (BTR:AU) has announced Brightstar Secures US$120M Bond to Fund Goldfields Project